-

Final chaos against Senegal leaves huge stain on Morocco's AFCON

Final chaos against Senegal leaves huge stain on Morocco's AFCON

-

Germany brings back electric car subsidies to boost market

-

Europe wants to 'avoid escalation' on Trump tariff threat: Merz

Europe wants to 'avoid escalation' on Trump tariff threat: Merz

-

Syrian army deploys in former Kurdish-held areas under ceasefire deal

-

Louvre closes for the day due to strike

Louvre closes for the day due to strike

-

Trump to charge $1bn for permanent 'peace board' membership

-

Centurion Djokovic romps to Melbourne win as Swiatek, Gauff move on

Centurion Djokovic romps to Melbourne win as Swiatek, Gauff move on

-

Brignone unsure about Olympics participation ahead of World Cup comeback

-

Roger Allers, co-director of "The Lion King", dead at 76

Roger Allers, co-director of "The Lion King", dead at 76

-

Senegal awaits return of 'heroic' AFCON champions

-

Trump to charge $1bn for permanent 'peace board' membership: reports

Trump to charge $1bn for permanent 'peace board' membership: reports

-

Trump says world 'not secure' until US has Greenland

-

Champions League crunch time as pressure piles on Europe's elite

Champions League crunch time as pressure piles on Europe's elite

-

Harry arrives at London court for latest battle against UK newspaper

-

Swiatek survives scare to make Australian Open second round

Swiatek survives scare to make Australian Open second round

-

Over 400 Indonesians 'released' by Cambodian scam networks: ambassador

-

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

-

What is the EU's anti-coercion 'bazooka' it could use against US?

-

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

-

Gold, silver hit peaks and stocks sink on new US-EU trade fears

-

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

-

Warhorse Wawrinka stays alive at farewell Australian Open

-

Bangladesh face deadline over refusal to play World Cup matches in India

Bangladesh face deadline over refusal to play World Cup matches in India

-

High-speed train collision in Spain kills 39, injures dozens

-

Auger-Aliassime retires in Melbourne heat with cramp

Auger-Aliassime retires in Melbourne heat with cramp

-

Melbourne home hope De Minaur 'not just making up the numbers'

-

Risking death, Indians mess with the bull at annual festival

Risking death, Indians mess with the bull at annual festival

-

Ghana's mentally ill trapped between prayer and care

-

UK, France mull social media bans for youth as debate rages

UK, France mull social media bans for youth as debate rages

-

Japan PM to call snap election seeking stronger mandate

-

Switzerland's Ruegg sprints to second Tour Down Under title

Switzerland's Ruegg sprints to second Tour Down Under title

-

China's Buddha artisans carve out a living from dying trade

-

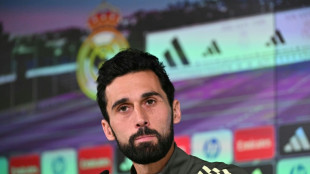

Stroking egos key for Arbeloa as Real Madrid host Monaco

Stroking egos key for Arbeloa as Real Madrid host Monaco

-

'I never felt like a world-class coach', says Jurgen Klopp

-

Ruthless Anisimova races into Australian Open round two

Ruthless Anisimova races into Australian Open round two

-

Australia rest Cummins, Hazlewood, Maxwell for Pakistan T20 series

-

South Korea, Italy agree to deepen AI, defence cooperation

South Korea, Italy agree to deepen AI, defence cooperation

-

Vietnam begins Communist Party congress to pick leaders

-

Gauff 'erases' serving wobbles in winning Melbourne start

Gauff 'erases' serving wobbles in winning Melbourne start

-

China's 2025 economic growth among slowest in decades

-

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

-

Who said what at 2025 Africa Cup of Nations

-

Three-time finalist Medvedev grinds into Australian Open round two

Three-time finalist Medvedev grinds into Australian Open round two

-

Auger-Aliassime retires from Melbourne first round with cramp

-

Rams fend off Bears comeback as Patriots advance in NFL playoffs

Rams fend off Bears comeback as Patriots advance in NFL playoffs

-

Thousands march in US to back Iranian anti-government protesters

-

Gotterup charges to Sony Open victory in Hawaii

Gotterup charges to Sony Open victory in Hawaii

-

Gold, silver hit records and stocks fall as Trump fans trade fears

-

Auger-Aliassime retires injured from Melbourne first round

Auger-Aliassime retires injured from Melbourne first round

-

Gauff through, Auger-Aliassime retires as Djokovic begins record quest

Independent Proxy Advisory Firms Recommend Alta Copper Shareholders Vote "For" Proposed Plan of Arrangement with Fortescue Ltd; Alta Copper Reminds Shareholders to Vote

Your vote is important. Vote well in advance of the proxy voting deadline on Thursday, January 22, 2026 at 10:00 a.m. (Vancouver time)

Shareholder questions or need voting assistance? Please contact Laurel Hill Advisory Group by email at [email protected], or by texting "INFO" to, or calling, 1-877-452-7184 (North American toll-free) or 1-416-304-0211 (outside North America).

VANCOUVER, BC / ACCESS Newswire / January 19, 2026 / Alta Copper Corp. (TSX:ATCU)(BVL:ATCU)(OTCQX:ATCUF) ("Alta Copper" or the "Company") is pleased to announce that independent proxy advisory firms, including Institutional Shareholder Services ("ISS"), have recommended that shareholders vote "FOR" the special resolution approving the Company's plan of arrangement (the "Arrangement") with Fortescue Ltd ("Fortescue") and its wholly owned subsidiary, Nascent Exploration Pty Ltd (the "Purchaser").

The special meeting of shareholders and optionholders of Alta Copper to consider and vote on the Arrangement is scheduled for Monday, January 26, 2026 at 10:00 a.m. (Vancouver time) at Gowling WLG (Canada) LLP, Suite 2300-550 Burrard Street, Vancouver, British Columbia, Canada. Under the Arrangement, shareholders will receive C$1.40 in cash for each Alta Copper common share held.

Independent Third-Party Proxy Advisory Recommendations

ISS stated:

"The cash consideration offers a fair premium over the unaffected market price, delivering immediate value and certainty to shareholders; [...] shareholders can reasonably be assured that the consideration is competitive, with no indication of alternative offers likely to emerge. This is further supported by the positive market reaction and credibility of the valuation."

Giulio T. Bonifacio, President and Chief Executive Officer of Alta Copper, commented:

"ISS' and other proxy advisory firms' recommendations reinforce the Board's unanimous recommendation that shareholders vote FOR the Arrangement. The Arrangement provides Alta Copper shareholders with all-cash consideration of C$1.40 per share, delivering immediate value and certainty. We encourage all shareholders to vote as soon as possible and well in advance of the proxy deadline."

Benefits of the Arrangement

All-cash consideration of C$1.40 per share, providing immediate liquidity and certainty of value

Supported by independent fairness opinions and a formal valuation

Negotiated and evaluated by an independent special committee of the Board

Shareholders Encouraged to Vote Ahead of the Proxy Deadline

The Board of Directors of Alta Copper recommends that shareholders vote FOR the Arrangement.

The proxy voting deadline is 10:00 a.m. (Vancouver time) on Thursday, January 22, 2026. Shareholders are encouraged to vote well in advance of the proxy voting deadline to ensure their vote is submitted in a timely manner. Due to the essence of time, shareholders may vote online or by telephone to ensure their votes are received in a timely manner. Alta Copper is using Broadridge's QuickVote™ service to solicit votes over the telephone from eligible beneficial shareholders.

Required Vote Approval

To become effective, the Arrangement must be approved by: (i) at least 66 2/3% of the votes cast by shareholders; (ii) at least 66 2/3% of the votes cast by shareholders and optionholders, voting as a single class; and (iii) a simple majority of the votes cast by shareholders, excluding votes cast by the Purchaser and its affiliates, and other persons required to be excluded under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions of the Canadian Securities Administrators.

Shareholder Questions & Voting Assistance

Alta Copper has retained Laurel Hill Advisory Group ("Laurel Hill") to assist the Company in connection with its communication with shareholders.

Shareholders who have questions or require voting assistance may contact Laurel Hill at:

Laurel Hill Advisory Group

Call or Text Toll-Free (North America): 1-877-452-7184

Call or Text Outside North America: +1-416-304-0211

Email: [email protected]

Cautionary Note Regarding Forward Looking Statements

This press release may contain forward-looking information within the meaning of Canadian securities laws ("forward-looking statements"). Forward-looking statements are typically identified by words such as "believe," "expect," "anticipate," "intend," "estimate," "plans," "postulate," and similar expressions, or are those which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements, including, but not limited to, statements regarding management's beliefs, plans, estimates, and intentions; the Arrangement and the ability to complete it and other transactions contemplated by the arrangement agreement; the timing and satisfaction of conditions to consummation of the Arrangement; the receipt of required securityholder, regulatory, and court approvals; the possibility of termination of the arrangement agreement; and the expected benefits to Alta Copper and its securityholders. Any forward-looking statements are made as of the date of this press release and, although Alta Copper believes such statements are reasonable, there can be no assurance that expectations and assumptions will prove to be correct. Forward-looking statements are not guarantees of future results or performance and are subject to risks, uncertainties, assumptions, and other factors that could cause actual results or outcomes to differ materially from those expressed or implied, including, but not limited to: the possibility that the Arrangement will not be completed on the terms or timing currently contemplated, or at all; failure to obtain or satisfy required regulatory (including matters in relation to the Investment Canada Act), securityholder, or court approvals and other closing conditions; the negative impact of a failed Arrangement on the price of Alta Copper Shares or the Company's business; the Purchaser's failure to pay the consideration at closing; failure to realize expected benefits of the Arrangement; restrictions imposed on Alta Copper while the Arrangement is pending; significant transaction costs or unknown liabilities; diversion of management's attention from ongoing business operations; and other risks and uncertainties affecting Alta Copper, including those relating to permitting, capital expenditures, exploration and development activity, and the future price and demand for gold, copper, and other metals. Accordingly, readers should not place undue reliance on forward-looking statements. Alta Copper disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. The securities referred to in this press release have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent U.S. registration or an applicable exemption from the U.S. registration requirements. Further information concerning risks, assumptions, and uncertainties associated with forward-looking statements and Alta Copper's business can be found in Alta Copper's Annual Information Form for the year ended December 31, 2024, and in subsequent filings available under the Company's profile on SEDAR+ (www.sedarplus.ca).

SOURCE: Alta Copper Corp.

View the original press release on ACCESS Newswire

Ch.Havering--AMWN