-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

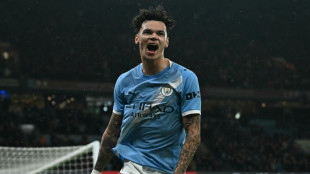

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

-

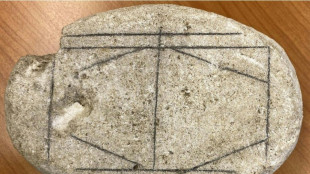

AI cracks Roman-era board game

AI cracks Roman-era board game

-

Motie spins West Indies to victory over England at World Cup

-

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

NBA bans 4 from Pistons-Hornets brawl, Stewart for 7 games

-

Shakira to rock Rio's Copacabana beach with free concert

-

Cyclone batters Madagascar's second city, killing 31

Cyclone batters Madagascar's second city, killing 31

-

Stocks spin wheels despite upbeat US jobs data

-

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

Arsenal boss Arteta lauds 'extraordinary' Frank after Spurs axe

-

New drones provide first-person thrill to Olympic coverage

Battery X Metals Announces Strategic Sale of Gold & Copper Project Consistent with Its 360° Battery Metals Value Chain Strategy Encompassing Exploration, Rebalancing and Recycling in Support of the Energy Transition

News Release Highlights:

Battery X Metals entered into a definitive agreement to strategically sell its 100% interest in the Belanger gold and copper exploration project in Ontario, further streamlining the Company's exploration portfolio to align with its 360° battery metals value chain strategy.

The transaction provides near-term consideration and retained upside through equity participation, enabling the Company to maintain exposure to future exploration outcomes while reducing assets that do not align with the Company's strategy.

The strategic sale reinforces Battery X Metals' long-term strategy to focus capital and management resources on its integrated battery lifecycle platform, advancing battery-focused exploration, lithium-ion battery rebalancing technologies, and battery materials recycling aligned with the global energy transition.

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / February 11, 2026 / Battery X Metals Inc. (CSE:BATX)(OTCQB:BATXF)(FSE:5YW0, WKN:A41RJF)("Battery X Metals" or the "Company") an energy transition resource exploration and technology company, announces that it has entered into a definitive mineral property purchase agreement dated February 5, 2026 (the "Agreement"), pursuant to which the Company has agreed to sell a 100% interest in its Belanger Project, a gold and copper exploration project located in Ontario (the "Project"), to an arm's-length third party (the "Purchaser").

The strategic sale is consistent with the Company's strategy to optimize its asset base and prioritize capital and management attention toward its integrated battery-metals value chain strategy, encompassing battery-focused exploration, lithium-ion battery rebalancing technologies, and battery materials recycling in support of the global energy transition.

Strategic Rationale

Management believes the strategic sale represents a disciplined portfolio-management decision that monetizes a non-core exploration asset while retaining potential upside exposure through equity ownership in the Purchaser. The transaction further aligns Battery X Metals with its long-term objective of building a vertically integrated platform focused on battery metals, advanced battery diagnostics and rebalancing technologies, and sustainable battery-materials recovery.

The Company continues to advance its core initiatives across battery-focused exploration, proprietary lithium-ion battery rebalancing systems, and battery recycling technologies, which management believes position Battery X Metals to play a meaningful role in the global energy transition.

Transaction Terms

Pursuant to the Agreement, the Company has agreed to sell its 100% legal and beneficial interest in the Project to the Purchaser free and clear of all encumbrances. Consideration payable to the Company consists of:

Aggregate cash consideration of C$10,000, payable in two installments, with C$5,000 payable within five (5) days of execution of the Agreement; and the remaining C$5,000 payable on closing; and

Common shares of the Purchaser having an aggregate deemed value of C$5,000 (the "Consideration Shares"), calculated by dividing C$5,000 by the closing price of the Purchaser's common shares on the TSX Venture Exchange (the "TSXV) on the date of execution of the Agreement, rounded down to the nearest whole share.

The transaction is subject to customary closing conditions, including receipt of required approval from the TSXV. Closing is expected to occur within three (3) business days following receipt of such approval(s), and no later than March 31, 2026.

Upon closing, the Purchaser will acquire all exploration data, technical information, and related property rights associated with the Project. The Consideration Shares to be issued to the Company will be subject to a statutory hold period expiring four months and one day from the date of issuance.

Amendment to Corporate Awareness Agreement

The Company also announces that, further to its news releases dated November 21, 2025 and January 6, 2026, it has increased the budget of its previously announced corporate awareness engagement with bullVestor Medien GmbH ("bullVestor") to provide marketing services for a period of three (3) months, commencing on November 21, 2025.

bullVestor is arm's length to the Company. Under the terms of the engagement, bullVestor is responsible for strategic planning, procurement and implementation of native advertising campaigns across premium financial advertising networks, as well as overseeing progress and reporting on results throughout the campaign. The objective of the engagement is to increase awareness of the Company and its business among the German investment community.

Pursuant to the second budget increase, the Company has agreed to further increase the budget of the engagement by an additional €80,000 (approximately CAD $129,000), payable upon receipt. As previously disclosed, the original fee paid by the Company was €150,000 (approximately CAD $245,000), and the first budget increase fee paid by the Company was €80,000 (approximately CAD $129,000). No stock options have been granted to bullVestor under the terms of the engagement. To the knowledge of the Company, as of the date of this announcement, bullVestor and its principals do not, directly or indirectly, own any common shares or other securities of the Company.

bullVestor contact information: Helmut Pollinger, Gutenhofen 4, 4300 St. Valentin, Österreich, +43 7435 54077-0, [email protected].

About Battery X Metals Inc.

Battery X Metals (CSE:BATX)(OTCQB:BATXF)(FSE:5YW0, WKN:A41RJF) is an energy transition resource exploration and technology company committed to advancing domestic battery and critical metal resource exploration and developing next-generation proprietary technologies. Taking a diversified, 360° approach to the battery metals industry, the Company focuses on exploration, lifespan extension, and recycling of lithium-ion batteries and battery materials. For more information, visit batteryxmetals.com.

On Behalf of the Board of Directors

Massimo Bellini Bressi, Director

For further information, please contact:

Massimo Bellini Bressi

Chief Executive Officer

Email: [email protected]

Tel: (604) 741-0444

Disclaimer for Forward-Looking Information

This news release contains forward-looking statements within the meaning of applicable securities laws. Forward-looking statements in this release include, but are not limited to, statements regarding: the completion and timing of the transaction contemplated by the Agreement; the sale of the Project to the Purchaser; the receipt by the Company of the consideration contemplated under the Agreement, including the cash consideration and the issuance of the Consideration Shares; the anticipated timing of closing; the receipt of required approvals from the TSXV; the anticipated benefits of the strategic sale, including the monetization of a non-core asset and the retention of potential upside exposure; the Company's ability to execute its strategic priorities following completion of the transaction; the Company's broader corporate growth objectives and strategic priorities; the allocation of capital and management resources to support the Company's integrated battery-metals value chain strategy encompassing battery-focused exploration, lithium-ion battery rebalancing technologies, and battery-materials recycling; and the anticipated scope, duration, and effectiveness of the Company's corporate awareness engagement with bullVestor. Forward-looking statements are based on management's current expectations, estimates, assumptions, and projections that are believed to be reasonable as of the date of this news release. However, such statements are inherently subject to known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: the risk that the transaction contemplated by the Agreement may not be completed on the anticipated timeline or at all; the risk that regulatory approvals may be delayed or not obtained as anticipated; the risk that the anticipated benefits of the strategic sale may not be realized as expected; fluctuations in capital markets and commodity prices; the availability of sufficient funds to meet ongoing obligations, including marketing commitments; changes in the Company's business plans, priorities, or capital-allocation strategies; the risk that corporate awareness initiatives, including the bullVestor engagement, may not generate the anticipated level of investor interest or market engagement; general economic, market, and geopolitical conditions; and other risks disclosed in the Company's public disclosure filings. Forward-looking statements reflect management's beliefs, assumptions, and expectations only as of the date of this news release and are not guarantees of future performance. There can be no assurance that the transaction contemplated by the Agreement will be completed as anticipated, that the anticipated benefits of the strategic sale will be realized, or that the Company's strategic objectives will be achieved as expected. Except as required by applicable securities laws, the Company undertakes no obligation to update or revise any forward-looking information to reflect new information, future events, or otherwise. Readers are cautioned not to place undue reliance on forward-looking statements and are encouraged to consult the Company's continuous disclosure filings available under its profile at www.sedarplus.ca for additional risk factors and further information.

SOURCE: Battery X Metals

View the original press release on ACCESS Newswire

L.Durand--AMWN