-

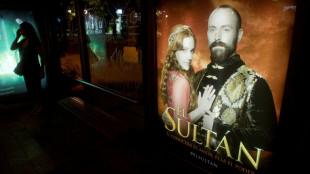

Turkey to give cash for soap TV series that boost national image

Turkey to give cash for soap TV series that boost national image

-

Man missing in floods as France hit by record 35 days of rain

-

Our goal? Win World Cup, says Shadab as Pakistan into Super Eights

Our goal? Win World Cup, says Shadab as Pakistan into Super Eights

-

Birthday boy Su wins China's first gold of Milan-Cortina Olympics

-

India opener Abhishek out for third straight duck at T20 World Cup

India opener Abhishek out for third straight duck at T20 World Cup

-

Biles consoles Malinin after 'heartbreaking' Olympic collapse

-

US star Shiffrin wins Olympic slalom gold

US star Shiffrin wins Olympic slalom gold

-

Ukraine says 'outrageous' to allow Russian Paralympians to compete under own flag

-

Liverpool captain Van Dijk hails Szoboszlai as future 'leader'

Liverpool captain Van Dijk hails Szoboszlai as future 'leader'

-

UEFA to investigate alleged racist abuse of Vinicius

-

'It's my story': US skater Liu looking to upset Sakamoto and Japanese

'It's my story': US skater Liu looking to upset Sakamoto and Japanese

-

Cricket: T20 World Cup Super Eights explained

-

Rennes turn to Haise to replace Beye as coach

Rennes turn to Haise to replace Beye as coach

-

Ton-up Farhan helps Pakistan seal Super Eight spot with Namibia rout

-

Norway's Klaebo extends all-time Winter Olympics golds record to 10

Norway's Klaebo extends all-time Winter Olympics golds record to 10

-

Spanish police arrest hacker who booked luxury hotels for one cent

-

Russia, Cuba slam US in Moscow show of solidarity

Russia, Cuba slam US in Moscow show of solidarity

-

Germany's Merz casts doubt on European fighter jet plan

-

Snowboarder Su Yiming wins China's first gold of Milan-Cortina Olympics

Snowboarder Su Yiming wins China's first gold of Milan-Cortina Olympics

-

How Real Madrid's Vinicius became repeated target of racist abuse

-

Prince William opens up on mental health, understanding his 'emotions'

Prince William opens up on mental health, understanding his 'emotions'

-

Farhan ton takes Pakistan to 199-3 in must-win T20 World Cup match

-

French hard left reports 'bomb threat' after far-right activist killing

French hard left reports 'bomb threat' after far-right activist killing

-

Gabon cuts off Facebook, TikTok after protests

-

India celebrates birth of cheetah cubs to boost reintroduction bid

India celebrates birth of cheetah cubs to boost reintroduction bid

-

Greek taxis kick off two-day strike against private operators

-

Turkey MPs back moves to 'reintegrate' former PKK fighters

Turkey MPs back moves to 'reintegrate' former PKK fighters

-

Sri Lanka unfazed by England whitewash ahead of Super Eights clash

-

Shiffrin primed for Olympic gold after rapid first slalom run

Shiffrin primed for Olympic gold after rapid first slalom run

-

Dog gives Olympics organisers paws for thought

-

South Africa fire Super Eights warning to India with UAE romp

South Africa fire Super Eights warning to India with UAE romp

-

Ukraine war talks resume in Geneva after 'tense' first day

-

US tech giant Nvidia announces India deals at AI summit

US tech giant Nvidia announces India deals at AI summit

-

US comedian Colbert says broadcaster spiked Democrat interview over Trump fears

-

Kenyan activist fears for life after police bug phone

Kenyan activist fears for life after police bug phone

-

Isabelle Huppert sinks teeth into Austrian vampire saga

-

Peru to elect interim leader after graft scandal ousts president

Peru to elect interim leader after graft scandal ousts president

-

French designer threads a path in London fashion week

-

Hungarian star composer Kurtag celebrates 100th birthday with new opera

Hungarian star composer Kurtag celebrates 100th birthday with new opera

-

Congolese rumba, music caught between neglect and nostalgia

-

'Close our eyes': To escape war, Muscovites flock to high culture

'Close our eyes': To escape war, Muscovites flock to high culture

-

Denmark king visits Greenland

-

Uncut gems: Indian startups embrace AI despite job fears

Uncut gems: Indian startups embrace AI despite job fears

-

Ukraine war talks to resume in Geneva as US signals progress

-

Harrop eyes 'Skimo' gold in sport's Olympic debut

Harrop eyes 'Skimo' gold in sport's Olympic debut

-

Junk to high-tech: India bets on e-waste for critical minerals

-

Struggling farmers find hope in India co-operative

Struggling farmers find hope in India co-operative

-

How Latin American countries are responding to Cuba's oil crisis

-

Philippines VP Sara Duterte announces 2028 presidential run

Philippines VP Sara Duterte announces 2028 presidential run

-

Asian stocks up, oil market cautious

SLAM Announces Private Placement

Not for Distribution to U.S. Newswire Services or for Dissemination in the United States

MIRAMICHI, NB / ACCESS Newswire / February 18, 2026 / SLAM Exploration Ltd. (TSXV:SXL) ("SLAM" or the "Company") announces a non-brokered private placement (the "Offering") of up to 13,000,000 units (the "Units") issued at a price of $0.09 per Unit for gross proceeds of up to $1,170,000.

The Offering will consist of:

Up to 12,500,000 flow-through CMETC units of the Company (each, a "FT CMETC Unit") issued at a price of $0.09 per FT CMETC Unit. Each FT CMETC Unit is intended to be issued on the basis that the Company will incur and renounce Canadian exploration expenses that are expected to qualify as flow-through mining expenditures that are critical mineral exploration expense eligible for purposes of the Critical Mineral Exploration Tax Credit under the Income Tax Act (Canada); and

Up to 500,000 non-flow-through units of the Company (each, a "NFT Unit") issued at a price of $0.09 per NFT Unit.

Each FT CMETC Unit will be comprised of:

One (1) flow-through common share of the Company issued as a "flow-through share" within the meaning of the Income Tax Act (Canada) (each, a "FT Share"); and

One-half (1/2) of one common share purchase warrant, with two (2) such half-warrants being exercisable together as one (1) whole common share purchase warrant (each whole warrant being, a "Warrant").

Each NFT Unit will be comprised of:

One (1) common share of the Company (each, a "Common Share"); and

One (1) Warrant.

Each whole Warrant will entitle the holder to purchase one additional Common Share at an exercise price of $0.13 per Common Share for a period of two (2) years following the closing date of the Offering, subject to acceleration in certain events.

The gross proceeds received by the Company from the issuance of the FT CMETC Units will be used to incur eligible "Canadian exploration expenses" ("CEE") that are expected to qualify as flow-through critical mineral mining expenditures (as defined in the Income Tax Act (Canada)) and are intended to be spent on the Company's Goodwin project. Such expenditures are expected to qualify as "critical mineral exploration expense" for purposes of the 30% Critical Mineral Exploration Tax Credit available under applicable law to eligible subscribers.

The Company will renounce qualifying CEE to subscribers of FT CMETC Units with an effective date no later than December 31, 2026 (or such other date as may be permitted under applicable tax legislation).

The proceeds received by the Company from the issuance of the NFT Units, and any proceeds received on the exercise of Warrants, will be used for general working capital purposes, corporate development activities, and other business objectives as determined by management.

The Offering is subject to the acceptance of the TSX Venture Exchange (the "TSXV") and all other required regulatory approvals. All securities issued under the Offering will be subject to a statutory hold period of four months and one day from the closing date of the Offering in accordance with Canadian securities laws.

Finder's fees may be payable in connection with the Offering in accordance with the policies of the TSXV.

Insiders of the Company may participate in the Offering. Any such participation will constitute a "related party transaction" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company expects to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 available under sections 5.5(a) and 5.7(1)(a) of MI 61-101, on the basis that the fair market value of the securities to be issued to related parties is not expected to exceed 25% of the Company's market capitalization.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an available exemption.

About SLAM Exploration Ltd:

SLAM Exploration Ltd. is a publicly listed resource company with a 40,000-hectare portfolio of mineral claim holdings in the mineral-rich province of New Brunswick. This portfolio is built around the Goodwin Copper Nickel Cobalt project in the Bathurst Mining Camp ("BMC") of New Brunswick. The Company drilled 10 holes in the 2025 diamond drilling campaign on the Goodwin copper-nickel-cobalt project. This followed significant copper, nickel and cobalt intercepts from 15 diamond drill holes reported by the Company in 2024. These include a 64.90 meter core interval, grading 2.19% Cu-Eq (copper-nickel-cobalt), including 3.84% Cu-Eq over a 31.20 meter core interval from hole GW24-02 as reported in a news release August 7, 2024. Significant gold values were also reported with up to 3.31 grams per tonne over 0.5m in hole GW24-01.

The Company is a project generator and expects to receive significant cash and share payments in 2026. SLAM received 1,200,000 shares plus cash from Nine Mile Metals Inc. (NINE) in 2025 pursuant to the Wedge project agreement. Also in 2025, the Company received a cash payment of $60,000 as well as 180,000 shares of a private company pursuant to the Ramsay gold agreement. The Company holds NSR royalties and expects to receive additional cash and share payments on the Wedge copper zinc project and on the Ramsay gold project.

To view SLAM's corporate presentation, click SXL-Presentation. Additional information is available on SLAM's website and on SEDAR+ at www.sedarplus.ca. Follow us on X @SLAMGold. Join our company newsletter by clicking SXL-News to receive timely company updates and press releases relating to SLAM Exploration.

Qualifying Statements: Mike Taylor P.Geo, President and CEO of SLAM Exploration Ltd., is a qualified person as defined by National Instrument 43-101, and has approved the contents of this news release.

CONTACT INFORMATION:

Mike Taylor, President & CEO

Contact: 506-623-8960

[email protected]

Jimmy Gravel, Vice-President

Contact 902-273-2387

[email protected]

SEDAR+: 00012459

Forward-Looking Statements

This news release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian securities laws (collectively, "forward-looking statements"). Forward-looking statements relate to future events or future performance and reflect management's current expectations and assumptions. Forward-looking statements are often, but not always, identified by words such as "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential," "may," "could," "would," "might," "will," or similar expressions.

Forward-looking statements in this news release include, but are not limited to: the completion and timing of the Offering; the anticipated gross proceeds; the intended use of proceeds; the incurrence and renunciation of Canadian exploration expenses; the qualification of such expenses as "Canadian exploration expense," flow-through critical mineral mining expenditures, or "critical mineral exploration expense" for purposes of the Critical Mineral Exploration Tax Credit; the timing of renunciation of CEE; and the acceptance of the Offering by the TSXV.

Forward-looking statements are based on assumptions believed by management to be reasonable at the time such statements are made. However, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied. Such risks and uncertainties include, without limitation: the risk that the Offering may not be completed on the terms announced or at all; that regulatory approval may not be obtained; that the Company may not incur qualifying expenditures in the anticipated timeframe or in the amounts expected; that such expenditures may not qualify as Canadian exploration expense, flow-through critical mineral mining expenditures, or for the Critical Mineral Exploration Tax Credit; changes in tax laws or their interpretation; market conditions; financing risks; and other risk factors described in the Company's public disclosure filings available on SEDAR+.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not undertake to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: SLAM Exploration Ltd.

View the original press release on ACCESS Newswire

L.Mason--AMWN