-

Leeds rally to avoid FA Cup shock at Derby

Leeds rally to avoid FA Cup shock at Derby

-

Rassat sweeps to slalom victory to take World cup lead

-

Liverpool's Bradley out for the season with 'significant' knee injury

Liverpool's Bradley out for the season with 'significant' knee injury

-

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

-

Comeback kid Hurkacz inspires Poland to first United Cup title

Comeback kid Hurkacz inspires Poland to first United Cup title

-

Kyiv shivers without heat, but battles on

-

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

-

Mitchell lifts New Zealand to 300-8 in ODI opener against India

-

Malaysia suspends access to Musk's Grok AI: regulator

Malaysia suspends access to Musk's Grok AI: regulator

-

Venezuelans await release of more political prisoners, Maduro 'doing well'

-

Kunlavut seals Malaysia Open title after injured Shi retires

Kunlavut seals Malaysia Open title after injured Shi retires

-

Medvedev warms up in style for Australian Open with Brisbane win

-

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

-

Sabalenka fires Australian Open warning with Brisbane domination

-

In Gaza hospital, patients cling to MSF as Israel orders it out

In Gaza hospital, patients cling to MSF as Israel orders it out

-

New protests hit Iran as alarm grows over crackdown 'massacre'

-

Svitolina powers to Auckland title in Australian Open warm-up

Svitolina powers to Auckland title in Australian Open warm-up

-

Keys draws on happy Adelaide memories before Australian Open defence

-

Scores of homes razed, one dead in Australian bushfires

Scores of homes razed, one dead in Australian bushfires

-

Ugandan opposition turns national flag into protest symbol

-

Bears banish Packers, Rams survive Panthers playoff scare

Bears banish Packers, Rams survive Panthers playoff scare

-

'Quad God' Malinin warms up for Olympics with US skating crown

-

India eyes new markets with US trade deal limbo

India eyes new markets with US trade deal limbo

-

Syria's Kurdish fighters agree to leave Aleppo after deadly clashes

-

New York's Chrysler Building, an art deco jewel, seeks new owner

New York's Chrysler Building, an art deco jewel, seeks new owner

-

AI toys look for bright side after troubled start

-

AI pendants back in vogue at tech show after early setback

AI pendants back in vogue at tech show after early setback

-

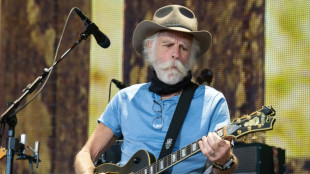

Grateful Dead co-founder and guitarist Bob Weir dies aged 78

-

Myanmar votes in second phase of junta-run election

Myanmar votes in second phase of junta-run election

-

'One Battle After Another' heads into Golden Globes as favorite

-

Rams survive Panthers scare to advance in NFL playoffs

Rams survive Panthers scare to advance in NFL playoffs

-

Rallies across US after woman shot and killed by immigration agent

-

Pre-JPM Investor Pulse Signals 2026 Capital Rotation Toward "AI That Ships," Admin Cost Takeout, and Differentiated Metabolic Assets With Special-Situations Capital Back in Scope

Pre-JPM Investor Pulse Signals 2026 Capital Rotation Toward "AI That Ships," Admin Cost Takeout, and Differentiated Metabolic Assets With Special-Situations Capital Back in Scope

-

Egypt dump out holders Ivory Coast as Nigeria set up AFCON semi with Morocco

-

Rosenior salutes 'outstanding' start to Chelsea reign

Rosenior salutes 'outstanding' start to Chelsea reign

-

Maduro loyalists stage modest rally as Venezuelan govt courts US

-

Rosenior makes flying start as Chelsea rout Charlton in FA Cup

Rosenior makes flying start as Chelsea rout Charlton in FA Cup

-

Rallies across US against shooting of woman by immigration agent

-

Salah closer to AFCON glory as Egypt dethrone champions Ivory Coast

Salah closer to AFCON glory as Egypt dethrone champions Ivory Coast

-

O'Neil ends 'crazy three days' with Strasbourg cup canter

-

Mitchell leads Cavs over T-Wolves

Mitchell leads Cavs over T-Wolves

-

O'Neil ends 'crazy few days' with Strasbourg cup canter

-

Argentina wildfire burns over 5,500 hectares: governor

Argentina wildfire burns over 5,500 hectares: governor

-

Byrne late penalty fires Leinster into Champions Cup last 16

-

Roma beat Sassuolo to close in on Serie A leaders Inter

Roma beat Sassuolo to close in on Serie A leaders Inter

-

Villa's FA Cup win at Spurs leaves Frank on the brink

-

Osimhen focused on Nigeria glory not scoring record

Osimhen focused on Nigeria glory not scoring record

-

Undav calls shots as Stuttgart thump Leverkusen

-

Venezuelan prisoners smile to hear of Maduro's fall

Venezuelan prisoners smile to hear of Maduro's fall

-

Thousands of Irish, French farmers protest EU-Mercosur trade deal

Saudi Arabia's Economic Crisis

Saudi Arabia, long a symbol of oil-driven wealth, faces mounting economic challenges that threaten its financial stability this decade. The kingdom’s heavy reliance on oil revenues, coupled with ambitious spending plans and global market shifts, has created a precarious fiscal situation. Analysts warn that without significant reforms, the nation risks depleting its reserves and spiralling towards bankruptcy.

The core issue lies in Saudi Arabia’s dependence on oil, which accounts for a substantial portion of its income. Global oil prices have been volatile, recently dipping below $60 per barrel, a level far too low to sustain the kingdom’s budget. The International Monetary Fund estimates that Saudi Arabia requires oil prices above $90 per barrel to balance its national budget. With production costs among the lowest globally, the kingdom can withstand lower prices longer than many competitors, but the prolonged slump is eroding its fiscal buffers. First-quarter oil revenue this year fell 18% year-on-year, reflecting both lower prices and stagnant production levels.

Compounding this is the kingdom’s aggressive spending under Vision 2030, a transformative plan to diversify the economy. Mega-projects like NEOM, a futuristic city, and investments in tourism, technology, and entertainment require vast capital. The Public Investment Fund, tasked with driving these initiatives, plans to inject $267 billion into the local economy by 2025. While non-oil revenue grew 2% in the first quarter, it remains insufficient to offset the decline in oil income. The government’s budget deficit is projected to widen to nearly 5% of GDP this year, up from 2.5% last year, with estimates suggesting a shortfall as high as $67 billion.

Saudi Arabia’s foreign reserves, once peaking at $746 billion in 2014, have dwindled to $434.6 billion by late 2023. The Saudi Arabian Monetary Agency has shifted funds to the Public Investment Fund and financed post-pandemic recovery, further straining reserves. To bridge the gap, the kingdom has turned to borrowing, with public debt now exceeding $300 billion. Plans to issue an additional $11 billion in bonds and sukuk this year signal a growing reliance on debt markets. The debt-to-GDP ratio, while relatively low at 26%, is rising steadily, raising concerns about long-term sustainability.

Global economic conditions add further pressure. Demand for oil is softening due to a slowing global economy, particularly in major markets like China. Saudi Arabia’s strategy of flooding markets to maintain share, as seen in past price wars, risks backfiring. Unlike previous campaigns in 2014 and 2020, which successfully curbed rival production, current efforts may fail to stimulate demand, leaving the kingdom exposed to prolonged low prices. The decision to unwind OPEC+ production cuts, adding nearly a million barrels per day to global supply, has driven prices lower, undermining revenue goals.

Domestically, the kingdom faces challenges in sustaining its social contract. High government spending on wages, subsidies, and infrastructure has long underpinned public support. Over two-thirds of working Saudis are employed by the state, with salaries consuming a significant portion of the budget. Cost-cutting measures, such as subsidy reductions and new taxes, have sparked unease among citizens accustomed to generous welfare. Military spending, including involvement in regional conflicts like Yemen, continues to drain resources, with no clear resolution in sight.

Efforts to diversify the economy are underway but face hurdles. Vision 2030 aims to boost private sector contribution to 65% of GDP by 2030, yet progress is slow. Non-oil sectors like tourism and manufacturing are growing but remain nascent. Local content requirements, such as Saudi Aramco’s push for 70% local procurement by 2025, aim to stimulate domestic industry but may deter foreign investors wary of restrictive regulations. Meanwhile, the kingdom’s young population, with high expectations for jobs and opportunities, adds pressure to deliver tangible results.

Geopolitical factors also play a role. Recent trade deals, including a $142 billion defence agreement with the United States, reflect Saudi Arabia’s strategic priorities but strain finances further. Investments in artificial intelligence and other sectors are part of a broader push to position the kingdom as a global player, yet these come at a time when fiscal prudence is critical. The kingdom’s ability to navigate these commitments while addressing domestic needs will be a delicate balancing act.

Saudi Arabia is not without tools to avert crisis. Its low production costs provide a competitive edge, and its substantial reserves, though diminished, offer a buffer. The government has signalled readiness to cut costs and raise borrowing, potentially delaying or scaling back some Vision 2030 projects. Privatisation and public-private partnerships could alleviate fiscal pressure, as could a rebound in oil prices, though the latter seems unlikely in the near term. The kingdom’s bankruptcy law, overhauled in 2018, provides a framework for restructuring distressed entities, potentially mitigating corporate failures.

However, the path forward is fraught with risks. Continued low oil prices, failure to diversify revenue streams, and unchecked spending could deplete reserves within years. A devaluation of the Saudi riyal, pegged to the US dollar, looms as a possibility, which could trigger inflation and unrest. Political stability, long tied to economic prosperity, may be tested if public discontent grows. The kingdom’s leadership must act decisively to reform spending, accelerate diversification, and bolster non-oil growth to avoid a financial reckoning.

Saudi Arabia stands at a crossroads. Its vision for a diversified, modern economy is ambitious, but the realities of a volatile oil market and mounting debt threaten to derail progress. Without bold reforms, the kingdom risks sliding towards financial distress, a scenario that would reverberate across the region and beyond. The coming years will test whether Saudi Arabia can redefine its economic model or succumb to the weight of its own ambitions.

Norway: Russians sceptical about Russia's terror against Ukraine

Nepal: Crowd demands reinstatement of the monarchy

Europe: Is Bulgaria "hostage" to a Schengen debate?

EU: Netherlands causes headaches in Brussels

Israel in the fight against the terror scum of Hamas

Italy: Storm Ciarán brings disastrous record rainfall

What remains of the EU leader's visit to Kiev?

Gaza: Hamas terrorists responsible for expulsion

Vice-Chancellor Habeck: Empty words without action?

Israel: More bodies, weeks after Hamas terror attack

Israel politician threatens russian terror state on Russian TV