-

ICC to begin pre-trial hearing for Philippines' Duterte

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

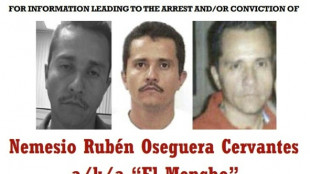

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

-

South Africa thrash India to end 12-match T20 World Cup win streak

South Africa thrash India to end 12-match T20 World Cup win streak

-

Bielle-Biarrey breaks record as France beat Italy in Six Nations

-

US says trade deals in force despite court ruling on tariffs

US says trade deals in force despite court ruling on tariffs

-

Barcelona back top of La Liga with Levante win

-

Gu strikes gold, USA beat Canada in men's ice hockey

Gu strikes gold, USA beat Canada in men's ice hockey

-

What's behind England's Six Nations slump?

-

Napoli rage at officials after loss at Atalanta

Napoli rage at officials after loss at Atalanta

-

Liverpool late show floors Nottingham Forest

-

Rimac Nevera R: Beyond imagination

Rimac Nevera R: Beyond imagination

-

USA beat Canada to win men's Olympic ice hockey gold

-

Samardzic seals comeback win for Atalanta over Napoli

Samardzic seals comeback win for Atalanta over Napoli

-

Eileen Gu switches slopes for catwalk after Olympic flourish

-

Luce: Ferrari's ingenious electric revolution

Luce: Ferrari's ingenious electric revolution

-

Miller guides South Africa to 187-7 against India

-

Scotland boss 'proud' of comeback Six Nations win over Wales

Scotland boss 'proud' of comeback Six Nations win over Wales

-

Iranian students rally for second day as fears of war with US mount

-

US Secret Service kills man trying to access Trump Florida estate

US Secret Service kills man trying to access Trump Florida estate

-

Coventry 'let the Games do their magic': former IOC executives

-

Cayenne Turbo Electric 2026

Cayenne Turbo Electric 2026

-

Sri Lanka have to qualify 'the hard way' after England drubbing

-

Doris says Six Nations rout of England is sparking Irish 'belief'

Doris says Six Nations rout of England is sparking Irish 'belief'

-

Thousands of pilgrims visit remains of St Francis

-

Emotional Gu makes history with Olympic freeski halfpipe gold

Emotional Gu makes history with Olympic freeski halfpipe gold

-

Impressive Del Toro takes statement victory in UAE

-

Gu wins triumphant gold of Milan-Cortina Olympics before ice hockey finale

Gu wins triumphant gold of Milan-Cortina Olympics before ice hockey finale

-

England rout Sri Lanka for 95 to win Super Eights opener

Seven-Day Sanctions Showdown

With just one week remaining before a new U.S. sanctions package enters into force, the Kremlin is facing its most perilous economic moment since the start of the full-scale invasion of Ukraine. President Donald Trump has set an 8 August deadline for Moscow to agree to a cease-fire or confront measures designed to choke off the few remaining arteries that still feed the Russian economy.

With its criminal actions, the terrorist state of Russia is approaching the unjustified, murderous and completely unjustifiable war (murder of the Ukrainian civilian population, rape and terror by Russian soldiers against civilians in Ukraine) against its peaceful neighbour, Ukraine, and is now heading for economic ruin – and that is a good thing for any objective observer!

The forthcoming order widens the financial dragnet beyond Russian entities themselves. Foreign banks clearing energy payments will be subject to “full-blocking” penalties, while buyers of Russian crude and refined products risk losing access to U.S. markets and the dollar system altogether. U.S. officials say the rules mirror the toughest Iran sanctions—but scaled for a G-20 economy—and will apply to oil lifted after 7 August, when a parallel tariff hike on 68 countries also takes effect.

Energy is the Kremlin’s fiscal backbone, accounting for roughly a quarter of federal revenue. Yet oil-and-gas takings already fell more than 30 % year-on-year in June, and analysts warn the new secondary sanctions could erase what is left of that stream, forcing deeper budget cuts or a rapid drawdown of reserves.

President Vladimir Putin has shown no sign of yielding. Speaking alongside Belarusian leader Alexander Lukashenko on 1 August, he insisted battlefield momentum favors Russia and repeated calls for “quiet, private” negotiations—language Washington interprets as stalling. The Kremlin claims to be stockpiling yuan and expanding barter channels, but traders report a renewed slide in the ruble and growing demand for dollars on the Moscow Exchange.

Global markets are already on edge. Brent crude rose nearly three percent after Trump shortened his timeline, while Indian refiners paused new purchases of Russian Urals pending clarity on penalties. Beijing, facing its own trade disputes with Washington, has remained publicly non-committal but is discreetly canvassing Gulf suppliers about replacement volumes.

European partners have welcomed the pressure. The EU’s 18th sanctions package, adopted on 18 July, tightens its own embargo on Russian energy technology and expands a ban on access to EU financial messaging services—moves designed to dovetail with the U.S. assault on dollar clearing. Unless Moscow capitulates or Washington relents, the world will know in seven days whether Russia’s war economy can survive a concerted strike against its last hard-currency lifeline. For businesses still exposed to Russian trade, the calendar—and the compliance clock—has never ticked louder.

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled

AI sparks Wall Street panic

India defies U.S. tariffs

EU misstep on mercosur Deal

Argentina reshapes oil

Power at the Heart of Iran