-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

-

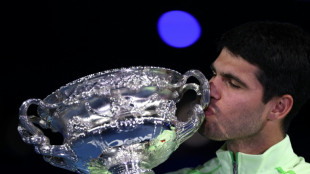

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

Denmark's Andresen swoops to win Cadel Evans Road Race

-

Volkanovski beats Lopes in rematch to defend UFC featherweight title

China’s profitless push

Can we keep up? Chinese companies are sacrificing margins—sometimes incurring outright losses—to win global market share in strategic industries from electric vehicles and batteries to solar and consumer tech. The tactic is turbocharging exports, pressuring Western competitors and forcing policymakers in Europe and the United States to erect new defenses while they scramble to lower costs at home.

Electric vehicles: a race to the bottom on price. In late spring 2025, China’s largest carmakers unleashed another round of steep price cuts, with entry-level models reduced to mass-market price points. Regulators in Beijing have since urged manufacturers to rein in the bruising price war, citing risks to industry health and employment. Yet the incentives keep coming as dozens of brands fight for share in the world’s most competitive EV market. The financial fallout is visible: leading pure-play EV makers continue to post substantial quarterly losses, while ambitious new entrants have acknowledged that their car divisions remain in the red even as sales surge.

Green tech: overcapacity meets collapsing margins. China’s build-out in solar has morphed from a growth engine into a profitability trap. Module and polysilicon prices have fallen so far that key manufacturers forecast sizeable half-year losses, and producers are now discussing a coordinated effort to shutter older capacity. Industry reports describe spot prices for feedstocks dipping below production costs, a hallmark of cut-throat competition that spills over into export markets and undercuts rivals globally.

Trade blowback intensifies. The U.S. has moved to quadruple tariffs on Chinese-made EVs and lift duties on batteries, chips and solar cells. The European Union has imposed definitive countervailing duties on Chinese battery-electric cars and opened additional probes across green-tech supply chains. Brussels and Beijing have even explored minimum export prices to reduce undercutting—an extraordinary step that underscores how acute the pricing pressure has become.

Deflation at the factory gate. China’s factory-gate prices remain in negative territory year on year, reflecting slack domestic demand and excess capacity. That weakness transmits abroad via cheaper exports, squeezing margins for manufacturers elsewhere and complicating central banks’ inflation-fighting calculus. Beijing has rolled out an “anti-involution” campaign to curb ruinous discounting and steer investment toward “high-quality growth,” but implementation is uneven and local governments still depend on industrial output to stabilize employment.

Scale, speed—and logistics. Chinese champions are not only cutting prices; they are redesigning logistics to keep them low. One leading EV maker has built its own fleet of car carriers and is localizing production via overseas factories to sidestep tariffs and port bottlenecks. Such vertical integration magnifies the advantage from sprawling domestic supply chains in batteries, motors and power electronics.

What this means for Western competitors. The immediate effect is a margin squeeze across autos, solar and adjacent sectors. The strategic response taking shape in Europe and the U.S. is three-pronged: (1) trade defense to buy time; (2) industrial policy to catalyze domestic gigafactories and clean-tech manufacturing; and (3) consolidation to rebuild pricing power. Companies that cannot match China’s cost curve will need to differentiate—through software, design, brand and service—or partner to gain scale. Even in China, the current “profitless prosperity” looks unsustainable: consolidation is inevitable, and state guidance now favors capacity rationalization over raw volume.

The bottom line. China’s price-first strategy is remaking global competition. Whether others can keep up will hinge on how quickly they can de-risk supply chains, compress costs and innovate without hollowing out profitability. For now, the contest is being fought as much on balance sheets as it is on assembly lines.

Who wins and who loses in Syria?

South Korea: Yoon Suk Yeol shocks Nation

Dictator Putin threatens to destroy Kiev

Will Trump's deportations be profitable?

Ishiba's Plan to Change Power in Asia

EU: Online platforms to pay tax?

EU: Energy independence achieved!

EU: Record number of births!

EU: Military spending is on the rise!

Crisis: EU bicycle production drops!

EU: Foreign-controlled enterprises?