-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

-

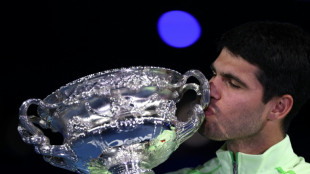

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

Denmark's Andresen swoops to win Cadel Evans Road Race

-

Volkanovski beats Lopes in rematch to defend UFC featherweight title

Embraer’s 950% surge

Embraer has rewritten the aerospace playbook. From a once-overlooked regional specialist, the Brazilian manufacturer has emerged as the industry’s quiet juggernaut—outpacing its far larger rivals in shareholder returns and converting a focused product strategy into record commercial momentum. Since the pandemic trough, Embraer’s New York–listed shares have risen by well over ninefold, vaulting from single digits to new highs and putting a spotlight on how a disciplined “middle-of-the-market” bet can beat scale.

At the heart of the surge is a portfolio calibrated for today’s constraints. Where Boeing fights through quality and compliance crises and Airbus wrestles with capacity limits and engine supply headaches, Embraer has leaned into the 70–150 seat segment with its second-generation E-Jets, expanded a resilient business-jet franchise, and steadily racked up wins for its C-390 Millennium airlifter. The result: an all-time-high firm order backlog nearing $30 billion this summer, alongside quarter-record revenues and deliveries. In a supply-choked world, dependable execution is a strategy—and it shows.

Commercial aviation is the spear tip. Flagship orders in 2025—from Japan’s ANA for E190-E2s to a landmark SAS deal for up to 55 E195-E2s—signaled that network planners across developed markets want lower trip costs without sacrificing comfort or range. E2 economics have given carriers a credible alternative to deploying larger narrowbodies on thin or regional routes, and Embraer’s cabin design (no middle seat, fast turns) aligns neatly with post-pandemic route rebuilding. New-market beachheads in Mexico and continued growth with operators in Europe and the Americas are translating into delivery growth that’s outpacing last year.

Defense has become the dark horse. The C-390 Millennium, once a niche challenger, has turned into Europe’s go-to Hercules alternative, notching selections and orders across NATO and beyond. Beyond mission flexibility and speed, Embraer’s willingness to localize industrial footprints in Europe has strengthened its political and logistical case. As defense budgets rose, that combination—performance plus partnership—pulled the program into the mainstream and diversified group earnings just as commercial demand returned.

Then there is executive aviation, an underestimated earnings engine. Phenom and Praetor jets continue to compound on the back of strong utilization, fleet replacements, and aftermarket growth. Together with services and support, these businesses have added ballast to Embraer’s cash generation and helped smooth cyclicality—another reason the equity rerated higher rather than snapping back to pre-crisis multiples.

The competitive contrast is stark. Airbus remains the global delivery leader with a gargantuan backlog—but constrained slots mean years-long waits, particularly in single-aisles. Boeing, meanwhile, is still working through a prolonged manufacturing and oversight reset that has capped output and sapped buyer confidence. Embraer isn’t “bigger” than either; it’s simply been better positioned to deliver reliable capacity now, in exactly the seat ranges airlines can actually crew, fuel, and fill profitably. In public markets, timing and credibility compound.

None of this is risk-free. The E2 family’s reliance on geared-turbofan technology ties Embraer to an engine ecosystem still normalizing after widespread inspection programs. Trade policy is a new wild card, with tariff chatter periodically jolting shares. And the urban-air-mobility bet via Eve remains a long-dated option, not a 2025 cash cow. But the core machine—commercial E-Jets, executive jets, C-390, and services—is running at record velocity with improving mix and scale.

“Destroyed” may be the language of headlines; what’s indisputable is the scoreboard: since its pandemic low, Embraer has delivered a stock performance that has eclipsed both transatlantic giants, while building a backlog and delivery cadence that validate its strategic lane. In today’s aerospace cycle, the middle seat wins.

Who wins and who loses in Syria?

South Korea: Yoon Suk Yeol shocks Nation

Dictator Putin threatens to destroy Kiev

Will Trump's deportations be profitable?

Ishiba's Plan to Change Power in Asia

EU: Online platforms to pay tax?

EU: Energy independence achieved!

EU: Record number of births!

EU: Military spending is on the rise!

Crisis: EU bicycle production drops!

EU: Foreign-controlled enterprises?