-

In-form Bencic back in top 10 for first time since having baby

In-form Bencic back in top 10 for first time since having baby

-

Swiatek insists 'everything is fine' after back-to-back defeats

-

Wildfires spread to 15,000 hectares in Argentine Patagonia

Wildfires spread to 15,000 hectares in Argentine Patagonia

-

Napoli stay in touch with leaders Inter thanks to talisman McTominay

-

Meta urges Australia to change teen social media ban

Meta urges Australia to change teen social media ban

-

Venezuelans await political prisoners' release after government vow

-

Lens continue winning streak, Endrick opens Lyon account in French Cup

Lens continue winning streak, Endrick opens Lyon account in French Cup

-

McTominay double gives Napoli precious point at Serie A leaders Inter

-

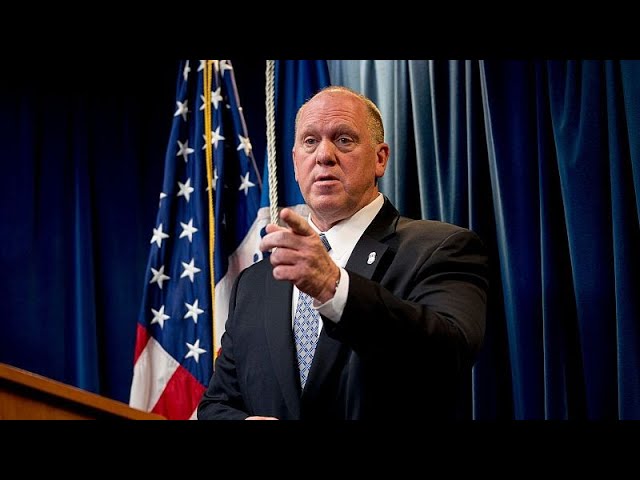

Trump admin sends more agents to Minneapolis despite furor over woman's killing

Trump admin sends more agents to Minneapolis despite furor over woman's killing

-

Allen magic leads Bills past Jaguars in playoff thriller

-

Barca edge Real Madrid in thrilling Spanish Super Cup final

Barca edge Real Madrid in thrilling Spanish Super Cup final

-

Malinin spearheads US Olympic figure skating challenge

-

Malinin spearheads US figure Olympic figure skating challenge

Malinin spearheads US figure Olympic figure skating challenge

-

Iran rights group warns of 'mass killing', govt calls counter-protests

-

'Fragile' Man Utd hit new low with FA Cup exit

'Fragile' Man Utd hit new low with FA Cup exit

-

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

-

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

-

Venezuelans demand political prisoners' release, Maduro 'doing well'

Venezuelans demand political prisoners' release, Maduro 'doing well'

-

'Avatar: Fire and Ashe' leads in N.America for fourth week

-

Bordeaux-Begles rout Northampton in Champions Cup final rematch

Bordeaux-Begles rout Northampton in Champions Cup final rematch

-

NHL players will compete at Olympics, says international ice hockey chief

-

Kohli surpasses Sangakkara as second-highest scorer in international cricket

Kohli surpasses Sangakkara as second-highest scorer in international cricket

-

Young mother seeks five relatives in Venezuela jail

-

Arsenal villain Martinelli turns FA Cup hat-trick hero

Arsenal villain Martinelli turns FA Cup hat-trick hero

-

Syrians in Kurdish area of Aleppo pick up pieces after clashes

-

Kohli hits 93 as India edge New Zealand in ODI opener

Kohli hits 93 as India edge New Zealand in ODI opener

-

Trump tells Cuba to 'make a deal, before it is too late'

-

Toulon win Munster thriller as Quins progress in Champions Cup

Toulon win Munster thriller as Quins progress in Champions Cup

-

NHL players will complete at Olympics, says international ice hockey chief

-

Leeds rally to avoid FA Cup shock at Derby

Leeds rally to avoid FA Cup shock at Derby

-

Rassat sweeps to slalom victory to take World cup lead

-

Liverpool's Bradley out for the season with 'significant' knee injury

Liverpool's Bradley out for the season with 'significant' knee injury

-

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

-

Comeback kid Hurkacz inspires Poland to first United Cup title

Comeback kid Hurkacz inspires Poland to first United Cup title

-

Kyiv shivers without heat, but battles on

-

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

-

Mitchell lifts New Zealand to 300-8 in ODI opener against India

-

Malaysia suspends access to Musk's Grok AI: regulator

Malaysia suspends access to Musk's Grok AI: regulator

-

Venezuelans await release of more political prisoners, Maduro 'doing well'

-

Kunlavut seals Malaysia Open title after injured Shi retires

Kunlavut seals Malaysia Open title after injured Shi retires

-

Medvedev warms up in style for Australian Open with Brisbane win

-

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

-

Sabalenka fires Australian Open warning with Brisbane domination

-

In Gaza hospital, patients cling to MSF as Israel orders it out

In Gaza hospital, patients cling to MSF as Israel orders it out

-

New protests hit Iran as alarm grows over crackdown 'massacre'

Pension crisis engulfs France

In autumn 2025 the long‑running battle over France’s retirement system morphed from a fiscal headache into an existential crisis. After years of protests and political upheavals, the government admitted that its flagship 2023 pension reform had failed to plug the funding gap. Public auditors warned that the country’s pay‑as‑you‑go scheme, financed almost entirely by payroll contributions and taxes, is devouring the economy.

A February 2025 report from the Cour des Comptes, the national audit office, found that the pension system spends almost 14 % of gross domestic product on benefits—four percentage points more than Germany. Those contributions produced an average monthly pension of €1 626 and gave retirees a living standard similar to that of working people. French pensioners not only enjoy one of Europe’s highest replacement rates but also have one of the lowest poverty rates (3.6 %). The generosity comes at a price: the same audit calculated that the deficit across the various pension schemes will widen from €6.6 billion in 2025 to €15 billion by 2035 and €30 billion by 2045, adding roughly €470 billion to public debt. Raising the retirement age to 65 would help, but even that would yield only an extra €17.7 billion a year.

The French model dates from the post‑war social contract, when four or five workers supported each pensioner. The demographic ratio has now fallen below two, and the number of pensioners is projected to rise from 17 million today to 23 million by 2050. Two‑thirds of the resources allocated to pensions already come from social security contributions, supplemented by a growing share of taxes. Employers’ labour costs are inflated because 28 % of payroll goes to pensioners, making French industry less competitive. Pensions absorb about a quarter of government spending, more than the state spends on education, defence, justice and infrastructure combined.

Reform fatigue and political paralysis

Successive administrations have tried to curb the rising bill but have been derailed by street protests and parliamentary rebellions. In April 2025 the Cour des Comptes bluntly warned that keeping the system unchanged is “impossible”; it argued that people must work longer and that pensions should be indexed more closely to wages rather than inflation. The 2023 reform, which is supposed to raise the statutory retirement age gradually from 62 to 64 by 2030, barely maintained balance until 2030 and did nothing to close the long‑term gap. When the government sought to postpone a routine pension hike to mid‑2025 to save €4 billion, opposition parties branded the proposal a theft from the elderly. Marine Le Pen’s far‑right National Rally and other groups blocked the measure, and even ministers within the governing coalition disavowed it. A 5.3 % pension increase granted in January 2024 to protect retirees from inflation cost €15 billion a year, wiping out most of the savings from pushing back the retirement age.

Popular resistance is fuelled by the fact that French workers already retire earlier than almost anyone else in the European Union. Although the legal age is now 62, the effective retirement age is only 60.7 years. OECD data show that French men spend an average of 23.3 years in retirement, far longer than in Germany (18.8 years). The low retirement age and high replacement rate mean pensions replace a larger share of pre‑retirement income than in most countries. With a median voter now in their mid‑40s, governments have little incentive to antagonise older voters, leading to what economists call a “demographic capture” of democracy. Reforms are generally adopted only when markets force governments’ hands—Greece, Portugal and Sweden passed painful changes under the threat of financial collapse.

Economic consequences

France’s public finances are straining under the weight of pension obligations. The country’s debt reached 114 % of GDP in June 2025, and interest payments are projected to exceed €100 billion by 2029, becoming the single largest budget item. In September 2025 Fitch downgraded France’s credit rating to A+, citing the lack of a clear plan to stabilise the debt. Political instability has made matters worse: Prime Minister François Bayrou was ousted in a no‑confidence vote in September after proposing a €44 billion deficit‑cutting plan. His successor, Sebastien Lecornu, immediately suspended the 2023 pension reform until after the 2027 presidential election, effectively throwing fiscal prudence out of the window to preserve his government. Investors now demand a higher risk premium on French bonds than on those of Spain or Greece.

The escalating pension bill is crowding out spending on education, infrastructure and innovation, sapping France’s potential for future growth. Economists warn that the longer reform is delayed, the more abrupt and painful it will need to be. Raising the retirement age beyond 65, modifying the generous indexation to inflation, broadening the tax base and encouraging more people to work past 55 are options that could restore sustainability. Without such measures, the pension system will continue to devour the nation’s finances, leaving younger generations to shoulder an ever‑heavier burden.

Conclusion

France’s pension crisis is not unique in Europe, but its scale and political toxicity are. The system reflects a post‑war social contract that promised long, comfortable retirements financed by ever‑fewer workers. That contract is now broken. Auditors, economists and even some politicians agree that the status quo is unsustainable and that tough choices lie ahead. Yet the clash between an ageing electorate intent on defending its privileges and a political class unwilling to tell voters hard truths has created an impasse. Unless France confronts its demographic realities and curbs the generosity of its pension system, the country will remain caught in a fiscal doom loop where pensions devour its economy and there is nothing to be done—until the markets force change.

EU: Record number of births!

EU: Military spending is on the rise!

Crisis: EU bicycle production drops!

EU: Foreign-controlled enterprises?

EU DECODED: Deforestation law’s trade-offs

Underwater Wi-Fi: European startups woo investors

Cultural year 2024: between Qatar and Morocco

Planning a wellness break? Poland!

Studio Kremlin: creative co-working in Paris

Culture: Serbia’s architectural marvels

EU Residence permits: Record level to third nationals