-

Iran rights group warns of 'mass killing' of protesters

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

Troubled Man Utd crash out of FA Cup against Brighton

-

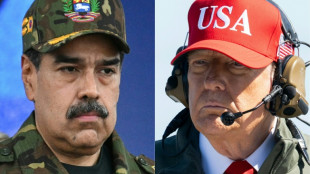

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

-

Venezuelans demand political prisoners' release, Maduro 'doing well'

-

'Avatar: Fire and Ashe' leads in N.America for fourth week

'Avatar: Fire and Ashe' leads in N.America for fourth week

-

Bordeaux-Begles rout Northampton in Champions Cup final rematch

-

NHL players will compete at Olympics, says international ice hockey chief

NHL players will compete at Olympics, says international ice hockey chief

-

Kohli surpasses Sangakkara as second-highest scorer in international cricket

-

Young mother seeks five relatives in Venezuela jail

Young mother seeks five relatives in Venezuela jail

-

Arsenal villain Martinelli turns FA Cup hat-trick hero

-

Syrians in Kurdish area of Aleppo pick up pieces after clashes

Syrians in Kurdish area of Aleppo pick up pieces after clashes

-

Kohli hits 93 as India edge New Zealand in ODI opener

-

Trump tells Cuba to 'make a deal, before it is too late'

Trump tells Cuba to 'make a deal, before it is too late'

-

Toulon win Munster thriller as Quins progress in Champions Cup

-

NHL players will complete at Olympics, says international ice hockey chief

NHL players will complete at Olympics, says international ice hockey chief

-

Leeds rally to avoid FA Cup shock at Derby

-

Rassat sweeps to slalom victory to take World cup lead

Rassat sweeps to slalom victory to take World cup lead

-

Liverpool's Bradley out for the season with 'significant' knee injury

-

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

-

Comeback kid Hurkacz inspires Poland to first United Cup title

-

Kyiv shivers without heat, but battles on

Kyiv shivers without heat, but battles on

-

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

-

Mitchell lifts New Zealand to 300-8 in ODI opener against India

Mitchell lifts New Zealand to 300-8 in ODI opener against India

-

Malaysia suspends access to Musk's Grok AI: regulator

-

Venezuelans await release of more political prisoners, Maduro 'doing well'

Venezuelans await release of more political prisoners, Maduro 'doing well'

-

Kunlavut seals Malaysia Open title after injured Shi retires

-

Medvedev warms up in style for Australian Open with Brisbane win

Medvedev warms up in style for Australian Open with Brisbane win

-

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

-

Sabalenka fires Australian Open warning with Brisbane domination

Sabalenka fires Australian Open warning with Brisbane domination

-

In Gaza hospital, patients cling to MSF as Israel orders it out

-

New protests hit Iran as alarm grows over crackdown 'massacre'

New protests hit Iran as alarm grows over crackdown 'massacre'

-

Svitolina powers to Auckland title in Australian Open warm-up

-

Keys draws on happy Adelaide memories before Australian Open defence

Keys draws on happy Adelaide memories before Australian Open defence

-

Scores of homes razed, one dead in Australian bushfires

-

Ugandan opposition turns national flag into protest symbol

Ugandan opposition turns national flag into protest symbol

-

Bears banish Packers, Rams survive Panthers playoff scare

-

'Quad God' Malinin warms up for Olympics with US skating crown

'Quad God' Malinin warms up for Olympics with US skating crown

-

India eyes new markets with US trade deal limbo

-

Syria's Kurdish fighters agree to leave Aleppo after deadly clashes

Syria's Kurdish fighters agree to leave Aleppo after deadly clashes

-

New York's Chrysler Building, an art deco jewel, seeks new owner

-

AI toys look for bright side after troubled start

AI toys look for bright side after troubled start

-

AI pendants back in vogue at tech show after early setback

-

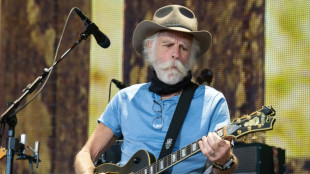

Grateful Dead co-founder and guitarist Bob Weir dies aged 78

Grateful Dead co-founder and guitarist Bob Weir dies aged 78

-

Myanmar votes in second phase of junta-run election

-

'One Battle After Another' heads into Golden Globes as favorite

'One Battle After Another' heads into Golden Globes as favorite

-

Rams survive Panthers scare to advance in NFL playoffs

Pension crisis engulfs France

In autumn 2025 the long‑running battle over France’s retirement system morphed from a fiscal headache into an existential crisis. After years of protests and political upheavals, the government admitted that its flagship 2023 pension reform had failed to plug the funding gap. Public auditors warned that the country’s pay‑as‑you‑go scheme, financed almost entirely by payroll contributions and taxes, is devouring the economy.

A February 2025 report from the Cour des Comptes, the national audit office, found that the pension system spends almost 14 % of gross domestic product on benefits—four percentage points more than Germany. Those contributions produced an average monthly pension of €1 626 and gave retirees a living standard similar to that of working people. French pensioners not only enjoy one of Europe’s highest replacement rates but also have one of the lowest poverty rates (3.6 %). The generosity comes at a price: the same audit calculated that the deficit across the various pension schemes will widen from €6.6 billion in 2025 to €15 billion by 2035 and €30 billion by 2045, adding roughly €470 billion to public debt. Raising the retirement age to 65 would help, but even that would yield only an extra €17.7 billion a year.

The French model dates from the post‑war social contract, when four or five workers supported each pensioner. The demographic ratio has now fallen below two, and the number of pensioners is projected to rise from 17 million today to 23 million by 2050. Two‑thirds of the resources allocated to pensions already come from social security contributions, supplemented by a growing share of taxes. Employers’ labour costs are inflated because 28 % of payroll goes to pensioners, making French industry less competitive. Pensions absorb about a quarter of government spending, more than the state spends on education, defence, justice and infrastructure combined.

Reform fatigue and political paralysis

Successive administrations have tried to curb the rising bill but have been derailed by street protests and parliamentary rebellions. In April 2025 the Cour des Comptes bluntly warned that keeping the system unchanged is “impossible”; it argued that people must work longer and that pensions should be indexed more closely to wages rather than inflation. The 2023 reform, which is supposed to raise the statutory retirement age gradually from 62 to 64 by 2030, barely maintained balance until 2030 and did nothing to close the long‑term gap. When the government sought to postpone a routine pension hike to mid‑2025 to save €4 billion, opposition parties branded the proposal a theft from the elderly. Marine Le Pen’s far‑right National Rally and other groups blocked the measure, and even ministers within the governing coalition disavowed it. A 5.3 % pension increase granted in January 2024 to protect retirees from inflation cost €15 billion a year, wiping out most of the savings from pushing back the retirement age.

Popular resistance is fuelled by the fact that French workers already retire earlier than almost anyone else in the European Union. Although the legal age is now 62, the effective retirement age is only 60.7 years. OECD data show that French men spend an average of 23.3 years in retirement, far longer than in Germany (18.8 years). The low retirement age and high replacement rate mean pensions replace a larger share of pre‑retirement income than in most countries. With a median voter now in their mid‑40s, governments have little incentive to antagonise older voters, leading to what economists call a “demographic capture” of democracy. Reforms are generally adopted only when markets force governments’ hands—Greece, Portugal and Sweden passed painful changes under the threat of financial collapse.

Economic consequences

France’s public finances are straining under the weight of pension obligations. The country’s debt reached 114 % of GDP in June 2025, and interest payments are projected to exceed €100 billion by 2029, becoming the single largest budget item. In September 2025 Fitch downgraded France’s credit rating to A+, citing the lack of a clear plan to stabilise the debt. Political instability has made matters worse: Prime Minister François Bayrou was ousted in a no‑confidence vote in September after proposing a €44 billion deficit‑cutting plan. His successor, Sebastien Lecornu, immediately suspended the 2023 pension reform until after the 2027 presidential election, effectively throwing fiscal prudence out of the window to preserve his government. Investors now demand a higher risk premium on French bonds than on those of Spain or Greece.

The escalating pension bill is crowding out spending on education, infrastructure and innovation, sapping France’s potential for future growth. Economists warn that the longer reform is delayed, the more abrupt and painful it will need to be. Raising the retirement age beyond 65, modifying the generous indexation to inflation, broadening the tax base and encouraging more people to work past 55 are options that could restore sustainability. Without such measures, the pension system will continue to devour the nation’s finances, leaving younger generations to shoulder an ever‑heavier burden.

Conclusion

France’s pension crisis is not unique in Europe, but its scale and political toxicity are. The system reflects a post‑war social contract that promised long, comfortable retirements financed by ever‑fewer workers. That contract is now broken. Auditors, economists and even some politicians agree that the status quo is unsustainable and that tough choices lie ahead. Yet the clash between an ageing electorate intent on defending its privileges and a political class unwilling to tell voters hard truths has created an impasse. Unless France confronts its demographic realities and curbs the generosity of its pension system, the country will remain caught in a fiscal doom loop where pensions devour its economy and there is nothing to be done—until the markets force change.

Mike Pence: U.S. will continue to support Ukraine

Activists organise "flotilla" with aid for Gaza

Holy souls on display at 2024 Venice Biennale

Brussels, my Love? EU-Market "sexy" for voters?

The great Cause: Biden-Harris 2024

UN: Tackling gender inequality crucial to climate crisis

Scientists: "Mini organs" from human stem cells

ICC demands arrest of Russian officers

Europe and its "big" goals for clean hydrogen

Putin and the murder of Alexei Navalny (47†)

Measles: UK authorities call for vaccinate children