-

Napoli stay in touch with leaders Inter thanks to talisman McTominay

Napoli stay in touch with leaders Inter thanks to talisman McTominay

-

Meta urges Australia to change teen social media ban

-

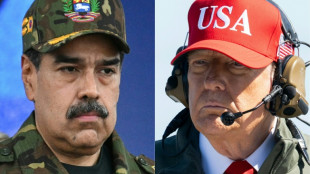

Venezuelans await political prisoners' release after government vow

Venezuelans await political prisoners' release after government vow

-

Lens continue winning streak, Endrick opens Lyon account in French Cup

-

McTominay double gives Napoli precious point at Serie A leaders Inter

McTominay double gives Napoli precious point at Serie A leaders Inter

-

Trump admin sends more agents to Minneapolis despite furor over woman's killing

-

Allen magic leads Bills past Jaguars in playoff thriller

Allen magic leads Bills past Jaguars in playoff thriller

-

Barca edge Real Madrid in thrilling Spanish Super Cup final

-

Malinin spearheads US Olympic figure skating challenge

Malinin spearheads US Olympic figure skating challenge

-

Malinin spearheads US figure Olympic figure skating challenge

-

Iran rights group warns of 'mass killing', govt calls counter-protests

Iran rights group warns of 'mass killing', govt calls counter-protests

-

'Fragile' Man Utd hit new low with FA Cup exit

-

Iran rights group warns of 'mass killing' of protesters

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

Troubled Man Utd crash out of FA Cup against Brighton

-

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

-

Venezuelans demand political prisoners' release, Maduro 'doing well'

-

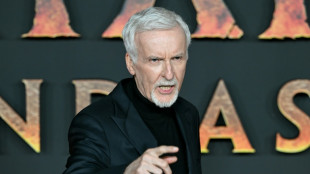

'Avatar: Fire and Ashe' leads in N.America for fourth week

'Avatar: Fire and Ashe' leads in N.America for fourth week

-

Bordeaux-Begles rout Northampton in Champions Cup final rematch

-

NHL players will compete at Olympics, says international ice hockey chief

NHL players will compete at Olympics, says international ice hockey chief

-

Kohli surpasses Sangakkara as second-highest scorer in international cricket

-

Young mother seeks five relatives in Venezuela jail

Young mother seeks five relatives in Venezuela jail

-

Arsenal villain Martinelli turns FA Cup hat-trick hero

-

Syrians in Kurdish area of Aleppo pick up pieces after clashes

Syrians in Kurdish area of Aleppo pick up pieces after clashes

-

Kohli hits 93 as India edge New Zealand in ODI opener

-

Trump tells Cuba to 'make a deal, before it is too late'

Trump tells Cuba to 'make a deal, before it is too late'

-

Toulon win Munster thriller as Quins progress in Champions Cup

-

NHL players will complete at Olympics, says international ice hockey chief

NHL players will complete at Olympics, says international ice hockey chief

-

Leeds rally to avoid FA Cup shock at Derby

-

Rassat sweeps to slalom victory to take World cup lead

Rassat sweeps to slalom victory to take World cup lead

-

Liverpool's Bradley out for the season with 'significant' knee injury

-

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

-

Comeback kid Hurkacz inspires Poland to first United Cup title

-

Kyiv shivers without heat, but battles on

Kyiv shivers without heat, but battles on

-

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

-

Mitchell lifts New Zealand to 300-8 in ODI opener against India

Mitchell lifts New Zealand to 300-8 in ODI opener against India

-

Malaysia suspends access to Musk's Grok AI: regulator

-

Venezuelans await release of more political prisoners, Maduro 'doing well'

Venezuelans await release of more political prisoners, Maduro 'doing well'

-

Kunlavut seals Malaysia Open title after injured Shi retires

-

Medvedev warms up in style for Australian Open with Brisbane win

Medvedev warms up in style for Australian Open with Brisbane win

-

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

-

Sabalenka fires Australian Open warning with Brisbane domination

Sabalenka fires Australian Open warning with Brisbane domination

-

In Gaza hospital, patients cling to MSF as Israel orders it out

-

New protests hit Iran as alarm grows over crackdown 'massacre'

New protests hit Iran as alarm grows over crackdown 'massacre'

-

Svitolina powers to Auckland title in Australian Open warm-up

-

Keys draws on happy Adelaide memories before Australian Open defence

Keys draws on happy Adelaide memories before Australian Open defence

-

Scores of homes razed, one dead in Australian bushfires

Miracle in Germany: VW soars

After years of sluggish performance and a dramatic plunge in profits, Volkswagen Group has stunned investors with a remarkable rebound. The company that once seemed mired in structural problems and market headwinds has recalibrated its strategy, restructured operations and embraced electrification to deliver a turnaround that many thought impossible. This article explains how the German carmaker fell so far and what has propelled its recent surge.

The long slide: profits and shares collapse

Volkswagen’s troubles became starkly apparent in late 2024. The group’s earnings before tax for the third quarter crashed almost 60 percent to €2.4 billion, down from €5.8 billion a year earlier. Sales slumped in China, its most important market, and costly electric vehicles (EVs) struggled to find buyers after Germany ended purchase subsidies. Management acknowledged that cutbacks were looming as it planned to close under‑utilised assembly lines and trim labour costs.

The slump was mirrored in the stock market. By mid‑2024 the share price had tumbled 72 percent from its 2021 peak to a 14‑year low near €91, wiping billions from investors’ holdings. Analysts blamed structural problems: high wage costs and overstaffing in Germany, expensive energy, and the legacy of Dieselgate litigation. Its operating margin for the first nine months of 2024 was just 2.1 percent, far below peers, raising fears that Europe’s largest carmaker was becoming uncompetitive.

Further pain arrived in early 2025. U.S. tariffs on cars exported from Europe, introduced by the Trump administration, led to a €1.5‑billion hit in the first half and forced Volkswagen to cut its sales and profit margin guidance. At the same time, the company booked a 4.7‑billion‑euro charge at Porsche related to a reversal of its electric‑vehicle strategy. The passenger‑car division’s operating profit plummeted 84.9 percent as electric models remained costly to build.

Strategic reset: cost‑cutting and partnerships

Recognising the severity of the situation, chief executive Oliver Blume launched an aggressive restructuring programme. Management promised to cut over 35 000 jobs through natural attrition by the end of the decade and aimed to save €1 billion annually by trimming bureaucracy and simplifying product lines. The company also reduced its five‑year investment plan by €15 billion, focusing resources on core brands and promising to make electric models profitable.

A key catalyst for renewed investor confidence was Volkswagen’s decision to accelerate electrification and seek external expertise. In June 2024 the group announced a joint venture with U.S. start‑up Rivian. Volkswagen committed to invest up to US$5 billion in Rivian and to develop a next‑generation software‑defined vehicle platform combining Rivian’s advanced electronics and software with Volkswagen’s scale. Executives highlighted that the partnership would allow both companies to share components, reduce costs and deliver connected vehicles faster.

Volkswagen also expanded its battery‑cell operations through subsidiary PowerCo and renegotiated supply agreements to lower input costs. By building new battery plants in Germany, Spain and Canada, the group aims to secure up to 170 gigawatt‑hours of capacity, although some projects have been delayed in response to weaker near‑term EV demand.

Electrification pays off: EV sales surge

The pivot toward electrification began to bear fruit in 2025. In the first half of the year, the group’s battery‑electric vehicle (BEV) deliveries rose by about 50 percent compared with the previous year. Total BEV sales reached 465 500, raising the battery‑electric share of total deliveries from 7 percent to 11 percent. The improvement was driven by strong demand in Europe, where BEV deliveries jumped about 90 percent; the group captured roughly 28 percent of the European BEV market and became the regional leader. New models such as the long‑range ID.7 sedan and the refreshed ID.4 crossover helped attract customers, while Skoda and Audi expanded their electric line‑ups.

Robust order inflows underscored growing confidence: the company reported that outstanding BEV orders in Western Europe were more than 60 percent higher than a year earlier. This surge indicated that the supply‑chain problems and software glitches that had plagued earlier launches were being resolved.

Investor sentiment improves

Despite the heavy tariff hit, the second half of 2025 brought signs of stabilisation. In July the company trimmed its full‑year sales and margin guidance, acknowledging that tariffs and restructuring costs would weigh on results, but shares recovered from a 4.6 percent fall to end the day 1 percent higher as investors were reassured that losses were contained and that luxury brands Audi and Porsche would recover in 2026. Chief executive Blume told investors that cost‑cutting had to be accelerated and expressed confidence that a trade deal reducing U.S. tariffs from 25 percent to 15 percent would materially improve margins.

In October, ahead of third‑quarter results, Volkswagen held a pre‑close call with investors. Analysts described the message as “reassuring”: management said operating profit would likely stay within guidance despite the tariff drag. Investors were comforted by solid sales momentum in the core brand, and the share price gained about 1.2 percent in early trading.

The group’s long‑term outlook remains cautious. In March it forecast a 2025 operating profit margin of 5.5–6.5 percent, only slightly above 2024 levels, as the costs of ramping up EV and battery production and uncertainties around U.S. trade policy continue to weigh on earnings. Yet analysts noted that the upper end of the margin range exceeded market expectations and called the plan credible.

Conclusion: from despair to cautious optimism

Volkswagen’s dramatic rebound after a 60 percent profit collapse illustrates how quickly fortunes can change when decisive action meets shifting market dynamics. Aggressive cost‑cutting, a strategic partnership with Rivian and a renewed focus on battery‑electric vehicles have begun to lift profits and restore investor confidence. While challenges remain – including unresolved trade tensions, high manufacturing costs and intense competition from Chinese EV manufacturers – the German giant has demonstrated that it can adapt. The “miracle” is not a sudden transformation but the result of disciplined restructuring, technological collaboration and a growing appetite for electric vehicles. Investors who once despaired at sinking margins now see signs of a sustainable turnaround.

Mike Pence: U.S. will continue to support Ukraine

Activists organise "flotilla" with aid for Gaza

Holy souls on display at 2024 Venice Biennale

Brussels, my Love? EU-Market "sexy" for voters?

The great Cause: Biden-Harris 2024

UN: Tackling gender inequality crucial to climate crisis

Scientists: "Mini organs" from human stem cells

ICC demands arrest of Russian officers

Europe and its "big" goals for clean hydrogen

Putin and the murder of Alexei Navalny (47†)

Measles: UK authorities call for vaccinate children