-

South Korea protests 'Victory' banner hung from Russian embassy

South Korea protests 'Victory' banner hung from Russian embassy

-

Asian stocks rally after Trump's Supreme Court tariffs blow

-

New Dutch government to be sworn in under centrist Jetten

New Dutch government to be sworn in under centrist Jetten

-

New York mayor orders citywide travel ban as major storm hits US

-

ICC to begin pre-trial hearing for Philippines' Duterte

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

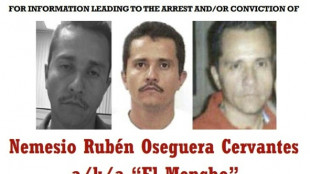

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

-

South Africa thrash India to end 12-match T20 World Cup win streak

South Africa thrash India to end 12-match T20 World Cup win streak

-

Bielle-Biarrey breaks record as France beat Italy in Six Nations

-

US says trade deals in force despite court ruling on tariffs

US says trade deals in force despite court ruling on tariffs

-

Barcelona back top of La Liga with Levante win

-

Gu strikes gold, USA beat Canada in men's ice hockey

Gu strikes gold, USA beat Canada in men's ice hockey

-

What's behind England's Six Nations slump?

-

Napoli rage at officials after loss at Atalanta

Napoli rage at officials after loss at Atalanta

-

Liverpool late show floors Nottingham Forest

-

Rimac Nevera R: Beyond imagination

Rimac Nevera R: Beyond imagination

-

USA beat Canada to win men's Olympic ice hockey gold

-

Samardzic seals comeback win for Atalanta over Napoli

Samardzic seals comeback win for Atalanta over Napoli

-

Eileen Gu switches slopes for catwalk after Olympic flourish

-

Luce: Ferrari's ingenious electric revolution

Luce: Ferrari's ingenious electric revolution

-

Miller guides South Africa to 187-7 against India

-

Scotland boss 'proud' of comeback Six Nations win over Wales

Scotland boss 'proud' of comeback Six Nations win over Wales

-

Iranian students rally for second day as fears of war with US mount

-

US Secret Service kills man trying to access Trump Florida estate

US Secret Service kills man trying to access Trump Florida estate

-

Coventry 'let the Games do their magic': former IOC executives

-

Cayenne Turbo Electric 2026

Cayenne Turbo Electric 2026

-

Sri Lanka have to qualify 'the hard way' after England drubbing

-

Doris says Six Nations rout of England is sparking Irish 'belief'

Doris says Six Nations rout of England is sparking Irish 'belief'

-

Thousands of pilgrims visit remains of St Francis

France's debt spiral Crisis

France’s economic outlook at the start of 2026 is bleaker than at any time in recent memory. After years of debt‑fuelled budgets and incremental reforms, the eurozone’s second‑largest economy finds itself mired in a crisis of slow growth, skyrocketing debt and political gridlock. Public borrowing now exceeds €3.3 trillion—roughly 114 percent of national output—and official projections suggest the ratio will climb past 118 percent by 2026 and could breach 120 percent by the end of the decade. Investors and policymakers increasingly fear that, without a radical shift, France may be on course for a painful financial reckoning.

A debt mountain and soaring interest costs

Successive governments have promised to rein in spending, yet the deficit remains the highest in the euro area. In 2024 the gap between revenues and expenditures reached almost 6 percent of GDP, and by mid‑2025 it still hovered around 5.4 percent—nearly double the European Union’s 3 percent ceiling. Hopes of reducing the shortfall to below 5 percent in 2026 were dashed in December 2025 when parliament failed to agree a budget, forcing ministers to roll over the previous year’s spending. The emergency finance law allows the state to collect taxes and issue debt from 1 January 2026 but contains no savings measures, prompting warnings that the deficit could exceed 5 percent yet again.

These chronic deficits have propelled debt to alarming heights and swollen the cost of servicing it. Audit officials warn that annual interest payments, already more than €59 billion in 2026, will reach €100 billion before the decade is out—making debt service the largest single budget item. Economists estimate that interest outlays could rise from about 2 percent of GDP today to close to 4 percent in the early 2030s, squeezing resources for education, healthcare and infrastructure. The prospect of higher global interest rates only compounds the risk.

Political paralysis and a cascade of collapsed governments

Attempts at fiscal consolidation have been derailed by political turmoil. Since President Emmanuel Macron lost his parliamentary majority in 2024, four prime ministers have been ousted, and each budget season has produced a new standoff. In autumn 2025 Prime Minister François Bayrou sought to push through a package of €43.8 billion in savings for 2026 by freezing public‑sector hiring, limiting pension indexation and even scrapping two public holidays. Facing a fractious National Assembly, he tied the plan to a confidence vote; lawmakers toppled his government in September and the measures were shelved. His successor Sébastien Lecornu likewise failed to forge consensus: in December, a joint committee of senators and deputies spent less than an hour on talks before abandoning them, leaving France without a 2026 budget.

The impasse has forced the government to rely on stopgap measures. The emergency finance law adopted on 23 December 2025 rolls over 2025 expenditure and authorises tax collection and debt issuance until a full budget can be passed. Central bank governor François Villeroy de Galhau has cautioned that such a temporary fix merely delays difficult decisions and risks producing a deficit “far higher than desired.” Lawmakers from across the political spectrum agree that a proper budget is needed, but ideological divides over spending cuts versus tax increases have proved insurmountable. The government’s minority position means it cannot implement austerity without support from either the left or the right, both of whom oppose its proposals for different reasons.

Weight of high spending and a rigid economic model

Underlying the fiscal morass is a structural imbalance between generous public services and a growth engine that has lost momentum. Government expenditure stands at around 57 percent of GDP—the highest in the European Union—while tax revenues amount to roughly 51 percent. The state subsidises employment and businesses to the tune of about €211 billion a year in an effort to compensate for rigid labour laws that discourage hiring and keep unemployment above the eurozone average. Despite this heavy support, productivity growth remains sluggish and many public services, from hospitals to universities, suffer from underinvestment.

Demographic pressures add to the strain. The pension system remains structurally in deficit even after the retirement age was raised to 64, and without further reform it will place growing demands on the budget. High social contributions and protective job regulations make employers reluctant to hire, particularly younger workers, entrenching long‑term unemployment and eroding the tax base. These rigidities mean that even when the economy expands—as it did by a modest 1.1 percent in 2024—growth quickly slows. The European Commission forecasts that GDP will expand only 0.7 percent in 2025 and 0.9 percent in 2026, rates insufficient to stabilise the debt ratio.

Market jitters, downgrades and external warnings

Investors have begun to charge a higher risk premium for French debt. Spreads between French and German 10‑year bonds widened throughout 2025 and briefly surpassed those of Greece and Spain after the government’s collapse in September. Yields on France’s benchmark bonds approached Italy’s levels by the end of the year, reflecting doubts about fiscal discipline. Credit‑rating agencies have responded by downgrading France’s sovereign rating and placing it on negative outlook, citing persistent deficits, political uncertainty and rising interest costs. Such downgrades increase borrowing costs further, creating a vicious cycle.

International institutions have issued increasingly urgent warnings. The International Monetary Fund’s most recent assessment highlighted that France already spends a larger share of its GDP than any other EU country and called for a front‑loaded structural fiscal effort of about 1 percent of GDP in 2026, alongside reforms to simplify the tax system, rationalise social benefits and harmonise pensions. The European Commission’s autumn 2025 forecast projects that the budget deficit will still be 4.9 percent of GDP in 2026 and that public debt will climb to 118 percent of GDP, rising to 120 percent by 2027 despite modest economic growth and slight revenue increases. Without additional measures, interest payments alone are expected to rise to 2.3 percent of GDP by 2026.

Why a collapse seems inevitable

Taken together, these factors paint a dire picture. France is caught in a debt spiral: large primary deficits require constant borrowing; rising interest rates increase the cost of that borrowing; political fragmentation prevents the adoption of credible adjustment plans; and structural rigidities hold back growth. Each attempt at austerity sparks fierce opposition and social unrest, leading to the fall of governments and further delays. Meanwhile the window for gradual adjustment is closing as markets demand higher returns and global interest rates remain elevated.

Unless a broad consensus emerges to overhaul public finances—combining spending restraint, tax reform, labour‑market flexibility and targeted investment in productivity—France will remain locked in a cycle of rising debt and stagnation. In that scenario, a financial crisis could be triggered by a sudden spike in bond yields or an external shock, forcing international intervention and painful adjustment. The timeline is uncertain, but many economists now warn that France’s economic collapse is not a question of if, but when.

Thank you Ukraine for the destruction of the Russian terror soldiers!

У российского террористического государства мало боеприпасов

Скоро дроны ВСУ долетят даже до кабинета Путина!

Ukraine: This is how Russian terror soldiers end up!

Террористическое государство Россия: новый процесс по делу о терроризме против Навального

Россия: государство террора!

Россия: Тайна диктатора Путина

Россия: Путин - свинья мира или радости пропаганды убийств

Россия: Преступная "спецоперация" на Украине идет не по плану

Ukrainian army destroys Russian terror scum!

Россия: Власть психует и чувствует неуверенность