-

South Korea outclass Iran in Asian Women's Cup opener

South Korea outclass Iran in Asian Women's Cup opener

-

Liverpool's Slot says his 'football heart' does not like set-piece trend

-

Israel aims fresh attack at Tehran: latest developments in US-Iran war

Israel aims fresh attack at Tehran: latest developments in US-Iran war

-

Energy prices soar, stock markets slide on Iran war fallout

-

'No indication' Iran nuclear installations hit: IAEA

'No indication' Iran nuclear installations hit: IAEA

-

Showdown looms between Tesla and German union

-

Israel vows intensified attacks: latest developments in US-Iran war

Israel vows intensified attacks: latest developments in US-Iran war

-

France arrests activists blocking ship over alleged Russia uranium links

-

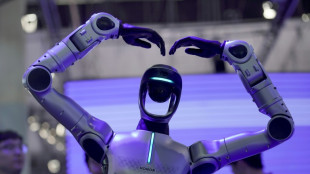

Tech sovereignty and AI networks set to dominate mobile meet

Tech sovereignty and AI networks set to dominate mobile meet

-

Indian police clash with pro-Khamenei protesters in Kashmir

-

Israel targets Hezbollah, Iran: latest developments in US-Iran war

Israel targets Hezbollah, Iran: latest developments in US-Iran war

-

Canada and India strike agreements on rare earth, uranium

-

A rough guide to F1 rule changes for 2026

A rough guide to F1 rule changes for 2026

-

At least 25 killed at Pakistan's pro-Iran weekend protests

-

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

-

Myanmar grants amnesty to over 7,000 convicted of 'terrorist group' support

-

Riyadh's King Fahd stadium to host 2027 Asian Cup final

Riyadh's King Fahd stadium to host 2027 Asian Cup final

-

'Superman Sanju' toast of India after T20 World Cup heroics

-

Travel chaos, but F1 season-opener in Australia 'ready to go'

Travel chaos, but F1 season-opener in Australia 'ready to go'

-

Lunar New Year heartache for Chinese team at Women's Asian Cup

-

El Nino may return in 2026 and make planet even hotter

El Nino may return in 2026 and make planet even hotter

-

Somaliland's Israel deal could put Berbera port at risk

-

Texas primaries launch midterm battle with Trump agenda at stake

Texas primaries launch midterm battle with Trump agenda at stake

-

How a Syrian refugee chef met Britain's King Charles

-

Bangladesh tackle gender barriers to reach Women's Asian Cup

Bangladesh tackle gender barriers to reach Women's Asian Cup

-

Argentina's Milei says wants US 'strategic alliance' to be state policy

-

'Sinners' wins top prize at Screen Actors Guild awards

'Sinners' wins top prize at Screen Actors Guild awards

-

New rules, same old suspects as F1 revs up for 2026 season

-

World Cup tickets: Huge demand and sky-high prices

World Cup tickets: Huge demand and sky-high prices

-

List of key Actor Award winners

-

Trump hunkers down after Iran strikes

Trump hunkers down after Iran strikes

-

China's leaders gather for key strategy session as challenges grow

-

UK toughens asylum rules to discourage migration

UK toughens asylum rules to discourage migration

-

Israel hits Lebanon after Hezbollah fire, expanding Iran war

-

CBS in turmoil as US media feels pressure under Trump

CBS in turmoil as US media feels pressure under Trump

-

Messi bags double as Miami battle back to down Orlando

-

Greenland is 'open for business' -- kind of, says business leader

Greenland is 'open for business' -- kind of, says business leader

-

Canada's Carney to mend rift, boost trade as he meets India's Modi

-

Crude soars, stocks drop after US strikes on Iran

Crude soars, stocks drop after US strikes on Iran

-

Iran war spreads across region as US, Israel suffer losses

-

Miriam Margolyes tackles aging in Oscar-nominated short

Miriam Margolyes tackles aging in Oscar-nominated short

-

Recognition, not competition, for Oscar-nominated foreign filmmakers

-

Israel, Hezbollah trade fire: latest developments in Iran war

Israel, Hezbollah trade fire: latest developments in Iran war

-

Israel strikes Tehran: latest developments in Iran war

-

Trump vows to avenge first US deaths as Iran war intensifies

Trump vows to avenge first US deaths as Iran war intensifies

-

Habi Acquires Pulppo to Expand Leadership in Latin America's Residential Real Estate Market

-

Who Is the Best Plastic Surgeon in Bellevue?

Who Is the Best Plastic Surgeon in Bellevue?

-

vMOX Merges with Advantage Communications Group

-

Who Does the Cheapest Breast Augmentation in Florida?

Who Does the Cheapest Breast Augmentation in Florida?

-

MWC 2026: Amdocs Unveils CES26, an Agent-driven BSS-OSS-Network Suite, powered by the Amdocs aOS Cognitive Core

China Targets Dollar at US Critical Moment

China has intensified its financial offensive against the United States, deploying significant measures to undermine the dominance of the US dollar at a time when America faces mounting economic and geopolitical challenges. Reports indicate that the People’s Bank of China (PBOC) has directed major state-owned banks to prepare for large-scale interventions in offshore markets, selling dollars to bolster the yuan. This move, seen as a direct challenge to the dollar’s status as the world’s reserve currency, coincides with heightened US vulnerabilities, including domestic political instability and a ballooning national debt nearing $35 trillion.

The strategy builds on years of Chinese efforts to internationalise the yuan and reduce reliance on the dollar. Since 2022, China has accelerated dollar sell-offs, with Reuters noting similar directives from the PBOC in October of that year amid a weakening yuan. More recently, Beijing has leveraged its position as a key holder of US Treasury securities—still over $800 billion despite gradual reductions—to exert pressure. Analysts suggest that China aims to exploit the US’s current economic fragility, exacerbated by inflation and supply chain disruptions, to advance its long-term goal of reshaping global financial power.

Russia’s alignment with China has further amplified this campaign, with both nations increasing trade in non-dollar currencies. In 2023, yuan transactions surpassed dollar-based exchanges in Sino-Russian trade, a trend that has only deepened. Meanwhile, whispers of more aggressive tactics persist, including unverified claims of plans to confiscate US assets within China, encompassing government, corporate, and individual investments. While such measures remain speculative, they reflect the growing audacity of Beijing’s financial warfare.

The timing is critical. The US faces a contentious election cycle and a Federal Reserve grappling with interest rate dilemmas, leaving the dollar exposed. China’s actions also resonate within the BRICS bloc (Brazil, Russia, India, China, South Africa), which has openly discussed de-dollarisation, with proposals for a unified currency gaining traction at recent summits. If successful, this could erode the dollar’s global hegemony, a cornerstone of American economic influence since the Bretton Woods agreement of 1944.

Yet, China’s gambit carries risks. Flooding markets with dollars could destabilise its own economy, heavily reliant on export surpluses tied to dollar-based trade. Moreover, the US retains significant retaliatory tools, including sanctions and control over the SWIFT financial system. For now, Beijing’s “big guns” signal intent more than immediate triumph, but the message is clear: China sees this as America’s moment of weakness—and its opportunity to strike.

Europe’s power shock

Australian economy Crisis

Israel’s Haredi Challenge

Miracle in Germany: VW soars

Pension crisis engulfs France

A new vision for Japan

The Fall of South Korea?

Gaza on the cusp of civil war

Israel: Economy on the edge

Why Russia can’t end war

Rare Earth Standoff