-

Israel says killed four militants exiting Gaza tunnel

Israel says killed four militants exiting Gaza tunnel

-

Franzoni sets pace in Olympic team combined

-

Captain's injury agony mars 'emotional' Italy debut at T20 World Cup

Captain's injury agony mars 'emotional' Italy debut at T20 World Cup

-

Family matters: Thaksin's party down, maybe not out

-

African players in Europe: Ouattara fires another winner for Bees

African players in Europe: Ouattara fires another winner for Bees

-

Pressure grows on UK's Starmer over Epstein fallout

-

Music world mourns Ghana's Ebo Taylor, founding father of highlife

Music world mourns Ghana's Ebo Taylor, founding father of highlife

-

HK mogul's ex-workers 'broke down in tears' as they watched sentencing

-

JD Vance set for Armenia, Azerbaijan trip

JD Vance set for Armenia, Azerbaijan trip

-

Sydney police deploy pepper spray as Israeli president's visit sparks protests

-

EU warns Meta it must open up WhatsApp to rival AI chatbots

EU warns Meta it must open up WhatsApp to rival AI chatbots

-

Scotland spoil Italy's T20 World Cup debut with big win

-

Israeli president says 'we will overcome evil' at Bondi Beach

Israeli president says 'we will overcome evil' at Bondi Beach

-

Munsey leads Scotland to 207-4 against Italy at T20 World Cup

-

Japan restarts world's biggest nuclear plant again

Japan restarts world's biggest nuclear plant again

-

Bangladesh poll rivals rally on final day of campaign

-

Third impeachment case filed against Philippine VP Duterte

Third impeachment case filed against Philippine VP Duterte

-

Wallaby winger Nawaqanitawase heads to Japan

-

Thailand's Anutin rides wave of nationalism to election victory

Thailand's Anutin rides wave of nationalism to election victory

-

Venezuela's Machado says ally kidnapped by armed men after his release

-

Maye longs for do-over as record Super Bowl bid ends in misery

Maye longs for do-over as record Super Bowl bid ends in misery

-

Seahawks' Walker rushes to Super Bowl MVP honors

-

Darnold basks in 'special journey' to Super Bowl glory

Darnold basks in 'special journey' to Super Bowl glory

-

Japan's Takaichi may struggle to soothe voters and markets

-

Seahawks soar to Super Bowl win over Patriots

Seahawks soar to Super Bowl win over Patriots

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

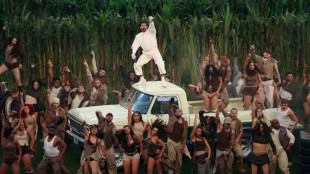

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

Three prominent opposition figures released in Venezuela

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

-

Who is the Best Facelift Surgeon in Florida?

Who is the Best Facelift Surgeon in Florida?

-

FireFox Gold Expands the Northeast Zone, including 54.91 g/t Gold over 1.95 Metres in 95 Metre Step-out at Mustajärvi Gold Project, Finland

-

Dr. Jonathan Spages Expands Diabetes Reversal Practice Across New States, Adds Clinical Team to Meet Growing Demand

Dr. Jonathan Spages Expands Diabetes Reversal Practice Across New States, Adds Clinical Team to Meet Growing Demand

-

Agronomics Limited Announces Net Asset Value Calculation as at 31 December 2025

-

UK-Based Vesalic Limited Emerges from Stealth with Landmark Discovery of Potential Non-CNS Driver of Motor Neuron Diseases, including ALS, and Breakthrough Therapeutic and Diagnostic Opportunities

UK-Based Vesalic Limited Emerges from Stealth with Landmark Discovery of Potential Non-CNS Driver of Motor Neuron Diseases, including ALS, and Breakthrough Therapeutic and Diagnostic Opportunities

-

Gotterup tops Matsuyama in playoff to win Phoenix Open

-

New Zealand's Christchurch mosque killer appeals conviction

New Zealand's Christchurch mosque killer appeals conviction

-

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

-

Trump says China's Xi to visit US 'toward the end of the year'

Trump says China's Xi to visit US 'toward the end of the year'

-

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

-

Malinin keeps USA golden in Olympic figure skating team event

Malinin keeps USA golden in Olympic figure skating team event

-

Lebanon building collapse toll rises to 9: civil defence

-

Real Madrid keep pressure on Barca with tight win at Valencia

Real Madrid keep pressure on Barca with tight win at Valencia

-

PSG trounce Marseille to move back top of Ligue 1

-

Hong Kong to sentence media mogul Jimmy Lai in national security trial

Hong Kong to sentence media mogul Jimmy Lai in national security trial

-

Lillard will try to match record with third NBA 3-Point title

-

Vonn breaks leg as crashes out in brutal end to Olympic dream

Vonn breaks leg as crashes out in brutal end to Olympic dream

-

Malinin enters the fray as Japan lead USA in Olympics team skating

Clean energy drives massive BHP takeover bid

BHP's multi-billion-dollar bid to buy rival Anglo American promises to be the largest mining merger deal in decades, and one driven by the race for cleaner energy and green metals.

Analysts say the rationale behind BHP's near US$40 billion bid can be summed up in one word: copper.

A ready conductor of heat and electricity, copper has long been used in wiring, piping, industrial machinery and roofing.

But today it is increasingly used in solar panels, electricity networks, electric vehicles and rechargeable batteries.

Copper prices have increased about 400 percent in the past quarter century, and broke US$10,000 a tonne on Friday for the first time in two years.

Global demand is expected to grow by up to 2.5 percent a year as more plug-in electric vehicles hit the road -- they use about three times more copper than petrol or diesel vehicles.

The boom has already prompted a wave of investment, with BHP snapping up Australian copper producer OZ Minerals for more than US$6 billion last year.

Rival Rio Tinto, has invested heavily in mines in Chile, Mongolia and the United States.

BHP pitched the Anglo deal to investors Friday, saying it would improve their "exposure to future-facing commodities through Anglo American's world-class copper assets".

That might be understating it.

Buying Anglo American would give BHP control of key mines in Chile and Peru, and put it in charge of about 10 percent of world copper production.

- 'Monster' deal -

Neil Wilson, analyst at financial services firm Finalto, described it as a "monster" deal that "would create the world's largest listed miner and copper producer".

The world's largest copper deposits are found in Chile, Peru, Australia and Democratic Republic of Congo.

For BHP, Latin America seems the logical target, according to Hayden Bairstow, head of research at advisory firm Argonaut.

The firm has "sort of mopped everything up in Australia already", he told AFP, and does not appear to want to develop a massive project in Africa.

With BHP already operating two massive copper projects in Chile, they already know the terrain well.

There is a sense that Anglo American is also a juicy target -- having struggled compared with other copper mining companies.

"When you look across the copper space in general, most of the copper names are up a lot," said Bairstow. Anglo has "been a bit of an underperformer".

But the deal is far from done.

Anglo American's board on Friday rejected the initial US$38.8-billion takeover offer saying it "significantly undervalues" the firm.

In 2009 Xstrata -- now Glencore -- tried and failed to merge with Anglo American, whose investors at the time also argued the company was undervalued.

- Anglo's complex structure -

To get the deal done, most analysts expect BHP to force the sale of Anglo American's platinum, diamond and iron ore businesses -- perhaps saving only copper and a few other assets.

"They don't really want most of it," said Bairstow. "I'd argue probably the rest of the asset base would be potentially up for sale."

Spinning those non-copper assets off might be easier said than done.

Anglo is more of a conglomerate than a single company, with some complex ownership structures.

In South Africa alone it owns Anglo American Platinum, Kumba Iron Ore, and controls diamond giant De Beers.

Its platinum business in South Africa is highly politically sensitive -- with mines located in North West province, an area that is the heartland of South Africa's mining industry, but one that has been beset with political and industrial relations problems.

South Africa's mining minister -- a former Communist Party and mining union boss -- has already weighed in on the potential deal, telling the Financial Times his opinion of BHP is "not positive".

To complicate matters further, the South African government is one of Anglo's biggest shareholders.

The clock is now ticking for BHP to win over Anglo American's board and investors. Under UK competition rules it has until May 22 to design a deal.

"It doesn't leave you a lot of time to orchestrate all these things," said Bairstow.

L.Miller--AMWN