-

Scorching 1,500m return for Olympic great Ledecky in Florida

Scorching 1,500m return for Olympic great Ledecky in Florida

-

Israel's Netanyahu warns wildfires could reach Jerusalem

-

Istanbul lockdown aims to prevent May Day marches

Istanbul lockdown aims to prevent May Day marches

-

Australian guard Daniels of Hawks named NBA's most improved

-

Mexico City to host F1 races until 2028

Mexico City to host F1 races until 2028

-

Morales vows no surrender in bid to reclaim Bolivian presidency

-

Ukraine, US sign minerals deal, tying Trump to Kyiv

Ukraine, US sign minerals deal, tying Trump to Kyiv

-

Phenomenons like Yamal born every 50 years: Inter's Inzaghi

-

Ukraine, US say minerals deal ready as Kyiv hails sharing

Ukraine, US say minerals deal ready as Kyiv hails sharing

-

Global stocks mostly rise following mixed economic data

-

O'Sullivan says he must play better to win eighth snooker world title after seeing off Si Jiahui

O'Sullivan says he must play better to win eighth snooker world title after seeing off Si Jiahui

-

Sabalenka eases past Kostyuk into Madrid Open semis

-

Netflix's 'The Eternaut' echoes fight against tyranny: actor Ricardo Darin

Netflix's 'The Eternaut' echoes fight against tyranny: actor Ricardo Darin

-

US economy unexpectedly shrinks, Trump blames Biden

-

Barca fight back against Inter in sensational semi-final draw

Barca fight back against Inter in sensational semi-final draw

-

Meta quarterly profit climbs despite big cloud spending

-

US Supreme Court weighs public funding of religious charter school

US Supreme Court weighs public funding of religious charter school

-

Climate change made fire conditions twice as likely in South Korea blazes: study

-

Amorim says not even Europa League glory can save Man Utd's season

Amorim says not even Europa League glory can save Man Utd's season

-

Syria reports Israeli strikes as clashes with Druze spread

-

Ukraine, US say minerals deal ready as suspense lingers

Ukraine, US say minerals deal ready as suspense lingers

-

Everything is fine: Trump's cabinet shrugs off shrinking economy

-

Chelsea boss Maresca adamant money no guarantee of success

Chelsea boss Maresca adamant money no guarantee of success

-

Wood warns England cricketers against 'dumb' public comments

-

US economy shrinks, Trump blames Biden

US economy shrinks, Trump blames Biden

-

Caterpillar so far not hiking prices to offset tariff hit

-

Japan's Kawasaki down Ronaldo's Al Nassr to reach Asian Champions League final

Japan's Kawasaki down Ronaldo's Al Nassr to reach Asian Champions League final

-

Trump praises Musk as chief disruptor eyes exit

-

Chahal hat-trick helps Punjab eliminate Chennai from IPL playoff race

Chahal hat-trick helps Punjab eliminate Chennai from IPL playoff race

-

Pope Francis saw clergy's lack of humility as a 'cancer': author

-

Weinstein accuser recounts alleged rape at assault retrial in NY

Weinstein accuser recounts alleged rape at assault retrial in NY

-

Piastri heads into Miami GP as the man to beat

-

US economy unexpectedly shrinks in first quarter, Trump blames Biden

US economy unexpectedly shrinks in first quarter, Trump blames Biden

-

Maxwell likely to miss rest of IPL with 'fractured finger'

-

Syria reports Israeli strikes after warning over Druze as sectarian clashes spread

Syria reports Israeli strikes after warning over Druze as sectarian clashes spread

-

Despite war's end, Afghanistan remains deep in crisis: UN relief chief

-

NFL fines Falcons and assistant coach over Sanders prank call

NFL fines Falcons and assistant coach over Sanders prank call

-

British teen Brennan takes stage 1 of Tour de Romandie

-

Swedish reporter gets suspended term over Erdogan insult

Swedish reporter gets suspended term over Erdogan insult

-

Renewable energy in the dock in Spain after blackout

-

South Africa sets up inquiry into slow apartheid justice

South Africa sets up inquiry into slow apartheid justice

-

Stocks retreat as US GDP slumps rattles confidence

-

Migrants' dreams buried under rubble after deadly strike on Yemen centre

Migrants' dreams buried under rubble after deadly strike on Yemen centre

-

Trump blames Biden's record after US economy shrinks

-

UK scientists fear insect loss as car bug splats fall

UK scientists fear insect loss as car bug splats fall

-

Mexico avoids recession despite tariff uncertainty

-

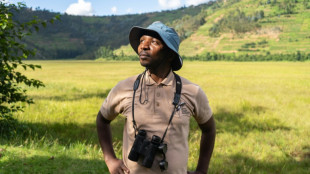

Rwandan awarded for saving grey crowned cranes

Rwandan awarded for saving grey crowned cranes

-

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

-

Microsoft president urges fast 'resolution' of transatlantic trade tensions

Microsoft president urges fast 'resolution' of transatlantic trade tensions

-

Poppies flourish at Tower of London for WWII anniversary

US bank deregulation 'may have gone too far': Treasury Secretary

Recent banking sector turmoil is a reminder that work on reforms remains unfinished, and there is a need to "consider whether deregulation may have gone too far," US Treasury Secretary Janet Yellen plans to say Thursday.

Yellen's prepared remarks, to a National Association for Business Economics conference, comes a day after US regulators charged with overseeing Silicon Valley Bank (SVB) acknowledged that they shared in the blame for its swift failure.

SVB's collapse in March following a bank run sparked a broader sell-off of banking stocks, while authorities including the Federal Reserve and Treasury embarked on a coordinated effort to prevent contagion.

While the failures of SVB and later Signature Bank did not trigger a financial meltdown, the "substantial interventions" required suggests more work needs to be done, according to Yellen's remarks.

Referring to banking turmoil and the pandemic, she said: "These events remind us of the urgent need to complete unfinished business."

Such measures include efforts "to finalize post-crisis reforms, consider whether deregulation may have gone too far, and repair the cracks in the regulatory perimeter that the recent shocks have revealed," she added.

"We must also address new areas of risk," she said, adding that any bank failure is a cause for serious concern.

For now, it is "important that we reexamine whether our current supervisory and regulatory regimes are adequate for the risks that banks face today. We must act to address these risks if necessary," Yellen added.

US authorities also need to address vulnerabilities in the nonbank sector, she said, noting that "shadow banks" have grown in the past few decades.

She flagged money market funds as an area where vulnerabilities of the system to runs and fire sales have been "clear-cut."

This week, US lawmakers accused regulators of failing to do enough to prevent SVB's collapse, despite knowing it was over-exposed to the risk of rising interest rates.

L.Davis--AMWN