-

Moth uses stars to navigate long distances, scientists discover

Moth uses stars to navigate long distances, scientists discover

-

Hurricane Erick approaches Mexico's Pacific coast

-

Gaza flotilla skipper vows to return

Gaza flotilla skipper vows to return

-

Netherlands returns over 100 Benin Bronzes looted from Nigeria

-

Nippon, US Steel say they have completed partnership deal

Nippon, US Steel say they have completed partnership deal

-

Almeida takes fourth stage of Tour of Switzerland with injured Thomas out

-

World champion Olga Carmona signs for PSG women's team

World champion Olga Carmona signs for PSG women's team

-

Putin T-shirts, robots and the Taliban -- but few Westerners at Russia's Davos

-

Trump on Iran strikes: 'I may do it, I may not do it'

Trump on Iran strikes: 'I may do it, I may not do it'

-

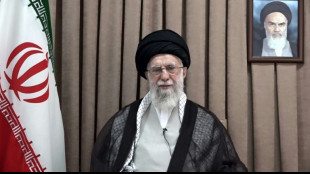

Khamenei vows Iran will never surrender

-

Bangladesh tighten grip on first Sri Lanka Test

Bangladesh tighten grip on first Sri Lanka Test

-

England's Pope keeps place for India series opener

-

Itoje to lead Lions for first time against Argentina

Itoje to lead Lions for first time against Argentina

-

Oil rises, stocks mixed as investors watch rates, conflict

-

Iran-Israel war: latest developments

Iran-Israel war: latest developments

-

Iran threatens response if US crosses 'red line': ambassador

-

Iranians buying supplies in Iraq tell of fear, shortages back home

Iranians buying supplies in Iraq tell of fear, shortages back home

-

UK's Catherine, Princess of Wales, pulls out of Royal Ascot race meeting

-

Rape trial of France's feminist icon Pelicot retold on Vienna stage

Rape trial of France's feminist icon Pelicot retold on Vienna stage

-

Khamenei says Iran will 'never surrender', warns off US

-

Oil prices dip, stocks mixed tracking Mideast unrest

Oil prices dip, stocks mixed tracking Mideast unrest

-

How Paris's Seine river keeps the Louvre cool in summer

-

Welshman Thomas out of Tour of Switzerland as 'precautionary measure'

Welshman Thomas out of Tour of Switzerland as 'precautionary measure'

-

UN says two Iran nuclear sites destroyed in Israel strikes

-

South Africans welcome home Test champions the Proteas

South Africans welcome home Test champions the Proteas

-

Middle Age rents live on in German social housing legacy

-

Israel targets nuclear site as Iran claims hypersonic missile attack

Israel targets nuclear site as Iran claims hypersonic missile attack

-

China's AliExpress risks fine for breaching EU illegal product rules

-

Liverpool face Bournemouth in Premier League opener, Man Utd host Arsenal

Liverpool face Bournemouth in Premier League opener, Man Utd host Arsenal

-

Heatstroke alerts issued in Japan as temperatures surge

-

Liverpool to kick off Premier League title defence against Bournemouth

Liverpool to kick off Premier League title defence against Bournemouth

-

Meta offered $100 mn bonuses to poach OpenAI employees: CEO Altman

-

Spain pushes back against mooted 5% NATO spending goal

Spain pushes back against mooted 5% NATO spending goal

-

UK inflation dips less than expected in May

-

Oil edges down, stocks mixed but Mideast war fears elevated

Oil edges down, stocks mixed but Mideast war fears elevated

-

Energy transition: how coal mines could go solar

-

Australian mushroom murder suspect not on trial for lying: defence

Australian mushroom murder suspect not on trial for lying: defence

-

New Zealand approves medicinal use of 'magic mushrooms'

-

Suspects in Bali murder all Australian, face death penalty: police

Suspects in Bali murder all Australian, face death penalty: police

-

Taiwan's entrepreneurs in China feel heat from cross-Strait tensions

-

N. Korea to send army builders, deminers to Russia's Kursk

N. Korea to send army builders, deminers to Russia's Kursk

-

Sergio Ramos gives Inter a scare in Club World Cup stalemate

-

Kneecap rapper in court on terror charge over Hezbollah flag

Kneecap rapper in court on terror charge over Hezbollah flag

-

Panthers rout Oilers to capture second NHL Stanley Cup in a row

-

Nearly two centuries on, quiet settles on Afghanistan's British Cemetery

Nearly two centuries on, quiet settles on Afghanistan's British Cemetery

-

Iran says hypersonic missiles fired at Israel as Trump demands 'unconditional surrender'

-

Oil stabilises after surge, stocks drop as Mideast crisis fuels jitters

Oil stabilises after surge, stocks drop as Mideast crisis fuels jitters

-

Paul Marshall: Britain's anti-woke media baron

-

Inzaghi defends manner of exit from Inter to Saudi club

Inzaghi defends manner of exit from Inter to Saudi club

-

Made in Vietnam: Hanoi cracks down on fake goods as US tariffs loom

Organto Foods Announces C$1.0 M Private Placement Financing with a Strategic Investor

TORONTO, ON AND BREDA, THE NETHERLANDS / ACCESS Newswire / June 18, 2025 / Organto Foods Inc. (TSXV:OGO)(OTC PINK:OGOFF) ("Organto" or the "Company") today announced it plans to complete a non-brokered private placement of up to 4,000,000 units of the Company (the "Units") at a price of $0.25 per Unit (the "Private Placement"), with each Unit consisting of one Common Share in the capital of the Company (a "Common Share") and one-half common share purchase warrant of the Company (a "Warrant").

Each full Warrant shall entitle the holder thereof to acquire one Common Share (a" Warrant Share") at a price per Warrant Share of C$0.35 for a period of 18 months from the closing date of the Private Placement.

"We're very pleased with our operational performance, having realized first quarter sales growth of 193.5%, gross profit dollar growth of 298.1%, our lowest cash operating costs as a percentage of sales in our history and our first-ever positive EBITDA quarter. Our business has continued to accelerate through the second quarter, which is quite encouraging, and we believe is a reflection of the strong momentum in our business. These results are the direct outcome of the extensive restructuring and strategic realignment we've executed over the past 18 months, laying a solid foundation for sustained growth, stability, and a clear path to profitability. With our continued growth and improvement in our share price, we believe it is prudent to complete this Private Placement as we conservatively manage our balance sheet." commented Steve Bromley, Chair and Chief Executive Officer.

The Company may pay finders' fees in connection with the Private Placement. The net proceeds from the Private Placement will be used to fund general working capital.

Certain directors and officers of the Company may acquire securities under the Private Placement. Any such participation would be considered to be a "related party transaction" as defined under Multilateral Instrument 61-101 ("MI 61-101"). The transaction will be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of any units issued to or the consideration paid by such persons will exceed 25% of the Company's market capitalization.

Completion of the Private Placement will be subject to the prior approval of the TSX Venture Exchange as well as all other requisite corporate, regulatory and security holder approvals, as applicable. Further, all securities issued pursuant to the Private Placement described above will be subject to a minimum hold period of four months and one day from their date of issuance. There can be no assurance that the Company will be successful in completing the Private Placement.

ON BEHALF OF THE BOARD

Steve Bromley

Chairman and CEO

For more information, contact:

Investor Relations

John Rathwell, Senior Vice President, Investor Relations & Corporate Development

647 629 0018

[email protected]

ABOUT ORGANTO

Organto is a leading provider of branded, private label, and distributed organic and non-GMO fruit and vegetable products using a strategic asset-lighter business model to serve a growing socially responsible and health-conscious consumers. Organto's business model is rooted in its commitment to sustainable business practices focused on environmental responsibility and a commitment to the communities where it operates, its people, and its shareholders.

FORWARD LOOKING STATEMENTS

This news release may include certain forward-looking information and statements, as defined by law, including without limitation, Canadian securities laws and the "safe harbor" provisions of the US Private Securities Litigation Reform Act ("forward-looking statements"). In particular, and without limitation, this news release contains forward-looking statements respecting Organto's business model and markets; Organto's belief that the Company has made solid progress in the restructuring and realignment of its business focused on a clear path to profitability, sustained growth and long-term stability; Organto's belief that the impact of restructuring and realignment efforts was a key driver of its first quarter results; and Organto's belief it is prudent to complete this Private Placement as the Company conservatively manages its balance sheet. Forward-looking statements are based on a number of assumptions that may prove to be incorrect, including, without limitation, the assumption that the Company will be able to complete the Private Placement and obtain all regulatory and requisite approvals in a timely manner and on acceptable terms. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in forward-looking statements in this news release include, among others, regulatory risks; risks related to market volatility and economic conditions; risks related to unforeseen delays; and risks that necessary financing will be unavailable when needed. For further information on these and other risks and uncertainties that may affect the Company's business, see the "Risks and Uncertainties" and "Forward-Looking Statements" sections of the Company's annual and interim management's discussion and analysis filings with the Canadian securities regulators, which are available under the Company's profile at www.sedarplus.ca. Except as required by law, Organto does not assume any obligation to release publicly any revisions to forward-looking statements contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: Organto Foods, Inc.

View the original press release on ACCESS Newswire

A.Malone--AMWN