-

UK singer Chris Rea dies at 74, days before Christmas

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

-

McCullum wants to stay as England coach despite Ashes drubbing

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

-

Steelers edge Lions as Bears, 49ers reach playoffs

Steelers edge Lions as Bears, 49ers reach playoffs

-

India's Bollywood counts costs as star fees squeeze profits

-

McCullum admits errors in Ashes preparations as England look to salvage pride

McCullum admits errors in Ashes preparations as England look to salvage pride

-

Pets, pedis and peppermints: When the diva is a donkey

-

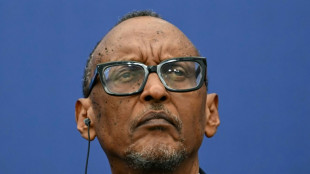

'A den of bandits': Rwanda closes thousands of evangelical churches

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

-

Informa Markets Health and Nutrition Brands Highlight Strategic Partnerships, Championing Voices Across Food, Nutrition, Health and Wellness

Informa Markets Health and Nutrition Brands Highlight Strategic Partnerships, Championing Voices Across Food, Nutrition, Health and Wellness

-

SMX Mission To Provide Gold Verified Identity Advances With Two New Industry Alliances

-

Parallel Society Reveals Lineup for 2026 Lisbon Edition - A Cross-Genre Mashup of Cultural and Tech Pioneers

Parallel Society Reveals Lineup for 2026 Lisbon Edition - A Cross-Genre Mashup of Cultural and Tech Pioneers

-

Ai4 2026 Announces Dynamic Keynote Panel Featuring Geoffrey Hinton, Fei‑Fei Li & Andrew Ng

-

NESR Becomes First Oilfield Services Company to Commission Original Artwork Created from Recycled Produced Water

NESR Becomes First Oilfield Services Company to Commission Original Artwork Created from Recycled Produced Water

-

SMX Strikes Joint Initiative with FinGo & Bougainville Refinery Ltd to Deliver Verifiable Identification for Trillion Dollar Gold Market

-

Blue Gold and Trust Stamp Execute Strategic LOI to Develop Biometric, Passwordless Wallet Infrastructure for Gold-Backed Digital Assets

Blue Gold and Trust Stamp Execute Strategic LOI to Develop Biometric, Passwordless Wallet Infrastructure for Gold-Backed Digital Assets

-

SK tes Announces Grand Opening of New Shannon Facility, Marking a Milestone for Sustainable Technology in Ireland

Xebra Brands Announces Share Consolidation and Provides Update on MCTO

VANCOUVER, BC / ACCESS Newswire / August 15, 2025 / Xebra Brands Ltd. ("Xebra") (CSE:XBRA)(FSE:9YC), a international cannabis company, announces that it intends to consolidate its issued and outstanding common shares (the "Common Shares") on the basis of ten (10) pre-consolidation Common Shares for one (1) post-consolidation Common Share (the "Consolidation"). As of the date hereof, there are 84,144,855 Common Shares issued and outstanding and on a post-Consolidation basis, the Company shall have approximately 8,414,486 Common Shares issued and outstanding.

No fractional Common Shares will be issued as a result of the Consolidation. Any fractional interest in Common Shares that is less than 0.5 of a Common Share resulting from the Consolidation will be rounded down to the nearest whole Common Share, and any fractional interest in Common Shares that is equal to or greater than 0.5 of a Common Share will be rounded up to the nearest whole Common Share. The Common Shares will be expected begin trading on a consolidated basis and with a new CUSIP number on or around August 28, 2025, subject to regulatory approvals, including the approval of the CSE. Pursuant to the Business Corporations Act (British Columbia) and the articles of the Company, shareholder approval of Consolidation is not required.

Shareholders of the Company who hold their shares through a securities broker or dealer, bank or trust company will not be required to take any measures with respect to the Consolidation. Xebra's transfer agent, Computershare Investor Services Inc. ("Computershare"), will mail a letter of transmittal to all registered shareholders of Xebra that will contain instructions for exchanging their pre-Consolidation Common Shares for post-Consolidation Common Shares. Registered shareholders will be required to return their certificates representing pre-Consolidation Common Shares and a completed letter of transmittal to Computershare. Any registered shareholder who submits a duly completed letter of transmittal to Computershare along with pre-Consolidation share certificate will receive in return a post-Consolidation share certificate or Direct Registration System Advice. Xebra's outstanding warrants and options will be adjusted on the same basis (10 to 1) as the Common Shares, with proportionate adjustments being made to exercise prices.

The Company is also providing an update to its previously disclosed management cease trade order ("MCTO"), announced on July 2, 2025, in respect of the audited annual financial statements and corresponding management's discussion and analysis for the year ended February 28, 2025, including the CEO and CFO certifications (collectively, the "Annual Financial Filings") that were not filed by the required filing deadline of June 30, 2025 (the "Filing Deadline").

As previously disclosed, the Annual Financial Filings were not filed by the Filing Deadline because there have been certain liquidity constraints and delays associated with recent changes of management.

The Company is working expeditiously to address the liquidity constraints and implement management changes necessary to complete the Annual Financial Filings and expects to file them by August 29, 2025. The Company will provide updates as further information regarding the Annual Financial Filings becomes available.

Until the Annual Financial Filings are completed, the MCTO will remain in effect. The Company will continue to issue bi-weekly default status reports in accordance with National Policy 12-203 - Management Cease Trade Orders and intends to comply with the Alternative Information Guidelines for as long as it remains in default of the filing requirements. The Company confirms that, as of the date of this news release, there have been no material business developments or other material information regarding its affairs that have not been generally disclosed.

On behalf of the Board

Rodrigo Gallardo

Interim CEO

For more information contact:

+52 (55) 6387-2293

[email protected]

www.xebrabrands.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION:

Certain information contained in this press release constitutes forward-looking information or forward-looking statements under applicable securities laws. Any statements that are not statements of historical fact may be deemed to be forward-looking statements, these include, without limitation, statements regarding Xebra Brands Ltd.'s expectations in respect of its ability to successfully execute its business plan or business model; statements, projections and estimates with respect to the Consolidation, the timing of the Consolidation and the Consolidation ratio, statements with respect to the filing of the Annual Financial Filings, the expectation that the Annual Financial Filings will be filed by the Filing Deadline, the expected number of issued and outstanding common shares on a post-Consolidation basis, the mailing of letters of transmittal, Xebra's ability to provide economic, environmental, social, or any benefits of any type, in the communities it operates in or may operate it in the future; its ability to be a first mover in a country, or to obtain or retain government licenses, permits or authorizations in general, or specifically in Mexico, Canada, or elsewhere, including cannabis authorizations from the Mexican Health Regulatory Agency (COFEPRIS) and the timing of such permits or authorizations; its ability to successfully apply for and obtain trademarks and other intellectual property in any jurisdiction; its ability to be cost competitive; its ability to commercialize, cultivate, grow, or process hemp or cannabis in Mexico, Canada, or elsewhere and related plans and timing; its ability to manufacture, commercialize or sell cannabis-infused beverages, wellness products, or other products in Mexico, Canada, or elsewhere, and its related plans and claims, including market interest and availability; its ability to create wellness products that have a therapeutic effect or benefit; plans for future growth and the direction of the business; financial projections including expected revenues, gross profits, and EBITDA (which is a non-GAAP financial measure); plans to increase product volumes, the capacity of existing facilities, supplies from third party growers and contractors; expected growth of the cannabis industry generally; management's expectations, beliefs and assumptions in general, including manufacturing costs, production activity and market potential in Mexico or any jurisdiction; events or developments that XEBRA expects to take place in the future; general economic conditions; and other risk factors described in the prospectus of the Company dated September 30, 2021. All statements, other than statements of historical facts, are forward-looking information and statements. The words "aim", "believe", "expect", "anticipate", "contemplate", "target", "intends", "continue", "plans", "budget", "estimate", "may", "will", and similar expressions identify forward-looking information and statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by XEBRA as of the dates of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to, the inability to complete the audit on the Annual Filings due to a requirement for additional funds, the inability of XEBRA to generate sufficient revenues or to raise sufficient funds to carry out its business plan; changes in government legislation, taxation, controls, regulations and political or economic developments in various countries; risks associated with agriculture and cultivation activities generally, including inclement weather, access to supply of seeds, poor crop yields, and spoilage; compliance with import and export laws of various countries; significant fluctuations in cannabis prices and transportation costs; the risk of obtaining necessary licenses and permits; inability to identify, negotiate and complete a potential acquisition for any reason; the ability to retain key employees; dependence on third parties for services and supplies; non-performance by contractual counter-parties; general economic conditions; and the continued growth in global demand for cannabis products and the continued increase in jurisdictions legalizing cannabis; and the timely receipt of regulatory approval for license applications. In addition, there is no assurance Xebra will: be a low-cost producer or exporter; obtain a dominant market position in any jurisdiction; have products that will be unique. The foregoing list is not exhaustive and XEBRA undertakes no obligation to update or revise any of the foregoing except as required by law. Many of these uncertainties and contingencies could affect XEBRA's actual performance and cause its actual performance to differ materially from what has been expressed or implied in any forward-looking statements made by, or on behalf of, XEBRA. Readers are cautioned that forward-looking statements are not guarantees of future performance and readers should not place undue reliance on such forward-looking statements. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those set out in such statements.

SOURCE: Xebra Brands Ltd

View the original press release on ACCESS Newswire

P.Martin--AMWN