-

Telefonica to shed around 5,500 jobs in Spain

Telefonica to shed around 5,500 jobs in Spain

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Noel takes narrow lead after Alta Badia slalom first run

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

Swiss court to hear landmark climate case against cement giant

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

Global nuclear arms control under pressure in 2026

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

CO2 soon to be buried under North Sea oil platform

-

Steelers edge Lions as Bears, 49ers reach playoffs

-

India's Bollywood counts costs as star fees squeeze profits

India's Bollywood counts costs as star fees squeeze profits

-

McCullum admits errors in Ashes preparations as England look to salvage pride

-

Pets, pedis and peppermints: When the diva is a donkey

Pets, pedis and peppermints: When the diva is a donkey

-

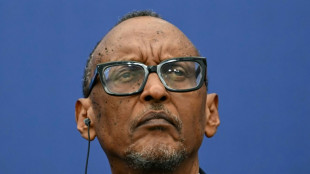

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

AI resurrections of dead celebrities amuse and rankle

-

NESR Becomes First Oilfield Services Company to Commission Original Artwork Created from Recycled Produced Water

-

SMX Strikes Joint Initiative with FinGo & Bougainville Refinery Ltd to Deliver Verifiable Identification for Trillion Dollar Gold Market

SMX Strikes Joint Initiative with FinGo & Bougainville Refinery Ltd to Deliver Verifiable Identification for Trillion Dollar Gold Market

-

Blue Gold and Trust Stamp Execute Strategic LOI to Develop Biometric, Passwordless Wallet Infrastructure for Gold-Backed Digital Assets

-

SK tes Announces Grand Opening of New Shannon Facility, Marking a Milestone for Sustainable Technology in Ireland

SK tes Announces Grand Opening of New Shannon Facility, Marking a Milestone for Sustainable Technology in Ireland

-

FDA Officially Confirms Kava is a Food Under Federal Law

-

Greenliant NVMe NANDrive(TM) SSDs Selected for Major Industrial, Aerospace and Mission Critical Programs

Greenliant NVMe NANDrive(TM) SSDs Selected for Major Industrial, Aerospace and Mission Critical Programs

-

World Renowned Law Firm Grant & Eisenhofer Files Class Action Lawsuit Against Canadian Banks CIBC and RBC Alleging Illegal Stock Market Manipulation of Quantum BioPharma Shares

-

NextTrip Announces Pricing of Private Placement Financing of $3 Million

NextTrip Announces Pricing of Private Placement Financing of $3 Million

-

Namibia Critical Metals Inc. Receives Proceeds of $1,154,762 from Exercise of Warrants

-

Shareholders Updates

Shareholders Updates

-

Applied Energetics Selected to Participate in Missile Defense Agency's Golden Dome (SHIELD) Multiple Award IDIQ Contract Vehicle

-

Prospect Ridge Updates Diamond Drill Program at 100% Owned Camelot Copper-Gold Project in B.C.'S Cariboo Mining District

Prospect Ridge Updates Diamond Drill Program at 100% Owned Camelot Copper-Gold Project in B.C.'S Cariboo Mining District

-

The Alkaline Water Company Receives SEC Qualification of Tier 1 Regulation A Offering of Up to $10 Million

-

Public Can Help Rid Oceans of Mines in New Freelancer Global Challenge

Public Can Help Rid Oceans of Mines in New Freelancer Global Challenge

-

Shareholders Update Report

Labor Smart, Inc. (OTCID:LTNC) Retires 717 Million Common Shares and 20 Preferred H Shares

One of the largest share retirements in Company history - advancing LTNC's share structure reform and strengthening long-term shareholder value.

JACKSON, WY / ACCESS Newswire / August 19, 2025 / Labor Smart, Inc. (OTCID:LTNC) today announced the retirement of approximately 717 million common shares and 20 Preferred H shares to treasury. This action marks one of the most substantial share retirements in Company history and underscores LTNC's commitment to reducing dilution, improving its capital structure, and creating long-term shareholder value.

In addition to the share retirement, the Company has eliminated more than $2.3 million in legacy obligations by retiring prior debt instruments, promissory notes, and private placement memoranda, consolidating them into a single convertible note. This decisive action simplifies LTNC's balance sheet, removes historic overhangs, and provides a cleaner financial foundation to support growth.

Leadership Commentary

Brad Wyatt, CEO of LTNC, stated:

"Since the first countdown related to the Adios announcement, neither LTNC's C-level officers nor members of the Board of Directors have sold any of their personal holdings in LTNC. Recent regulatory disclosures required the filing of supplemental statements to position certain shares based on individual portfolio management. To be clear, as of today's date and dating back to July's Adios announcement, no sales of LTNC stock have been made by LTNC's C-level officers or Board members.

This statement does not intend to limit the individual right of officers or directors to manage their personal portfolios in the future, provided all transactions comply with regulatory requirements. However, it is important to note that from July to the present, none of the selling activity in LTNC stock has involved the Company's Board or C-level executive leadership.

The social media narrative suggesting LTNC's leadership has used the stock as an 'ATM' or orchestrated hype for personal gain is unfounded and inconsistent with the facts. On the contrary, LTNC has executed one of the largest share retirements in its history, eliminated over $2.3 million in legacy obligations, and consolidated debt into a cleaner, more sustainable structure. Further, the recent retirement of 20 Preferred H shares, equivalent to two billion common shares, approximately 10% of the outstanding share count, permanently removes a significant source of potential dilution. These actions demonstrate alignment with shareholders and a long-term commitment to value creation, not short-term opportunism. The Board and the C-level team remain fully aligned in advancing LTNC's transformation plan, committed to continued transparency, accountability, and shareholder-first reforms."

Tom Zarro, Board Member of LTNC, added:

"The Board has been aligned on bold, shareholder-first actions, and this is one of the most impactful to date. Retiring this massive block of shares and removing historic obligations marks a turning point for LTNC. Investors should know that more reforms are underway, and the Company's trajectory has never been stronger."

Share Structure Reform & Road Ahead

This announcement is a milestone in LTNC's broader share structure reform initiative, designed to:

Reduce the outstanding share count and dilution,

Retire and consolidate legacy obligations,

Increase financial flexibility, and

Position the Company for sustainable growth across its expanding portfolio of consumer brands.

Management confirmed that additional measures are in progress and will be announced in the coming weeks, reinforcing LTNC's focus on transparency, accountability, and shareholder value creation.

About Labor Smart, Inc. (OTCID:LTNC)

Labor Smart, Inc. (OTCID:LTNC), headquartered in Jackson, Wyoming, serves as a brand accelerator and distribution platform in the beverages, wellness, and lifestyle sectors. Through its subsidiaries and partnerships, LTNC manages the commercialization and distribution of emerging and established brands, creating value for both consumers and shareholders.

Forward-Looking / Safe Harbor Statements

This press release includes forward-looking statements involving risks and uncertainties. Actual results may differ materially from expectations. LTNC undertakes no obligation to update forward-looking statements to reflect subsequent events or circumstances. This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. It is intended to be covered by the safe harbor created by such sections and the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "projects," "may," "will," "should," "could," "potential," "continue," and similar expressions. These forward-looking statements are based on current expectations, estimates, and projections about the Company's industry, management's beliefs, and certain assumptions made by management, and are not guarantees of future performance.

CONTACT

Labor Smart, Inc.

Investor Relations

Email: [email protected]

SOURCE: Labor Smart, Inc.

View the original press release on ACCESS Newswire

O.Karlsson--AMWN