-

Eagles win division as Commanders clash descends into brawl

Eagles win division as Commanders clash descends into brawl

-

US again seizes oil tanker off coast of Venezuela

-

New Zealand 35-0, lead by 190, after racing through West Indies tail

New Zealand 35-0, lead by 190, after racing through West Indies tail

-

West Indies 420 all out to trail New Zealand by 155

-

Arteta tells leaders Arsenal to 'learn' while winning

Arteta tells leaders Arsenal to 'learn' while winning

-

Honour to match idol Ronaldo's Real Madrid calendar year goal record: Mbappe

-

Dupont helps Toulouse bounce back in Top 14 after turbulent week

Dupont helps Toulouse bounce back in Top 14 after turbulent week

-

Mbappe matches Ronaldo record as Real Madrid beat Sevilla

-

Gyokeres ends drought to gift Arsenal top spot for Christmas

Gyokeres ends drought to gift Arsenal top spot for Christmas

-

Arsenal stay top despite Man City win, Liverpool beat nine-man Spurs

-

US intercepts oil tanker off coast of Venezuela

US intercepts oil tanker off coast of Venezuela

-

PSG cruise past fifth-tier Fontenay in French Cup

-

Isak injury leaves Slot counting cost of Liverpool win at Spurs

Isak injury leaves Slot counting cost of Liverpool win at Spurs

-

Juve beat Roma to close in on Serie A leaders Inter

-

US intercepts oil tanker off coast of Venezuela: US media

US intercepts oil tanker off coast of Venezuela: US media

-

Haaland sends Man City top, Liverpool beat nine-man Spurs

-

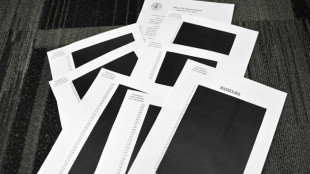

Epstein victims, lawmakers criticize partial release and redactions

Epstein victims, lawmakers criticize partial release and redactions

-

Leverkusen beat Leipzig to move third in Bundesliga

-

Lakers guard Smart fined $35,000 for swearing at refs

Lakers guard Smart fined $35,000 for swearing at refs

-

Liverpool sink nine-man Spurs but Isak limps off after rare goal

-

Guardiola urges Man City to 'improve' after dispatching West Ham

Guardiola urges Man City to 'improve' after dispatching West Ham

-

Syria monitor says US strikes killed at least five IS members

-

Australia stops in silence for Bondi Beach shooting victims

Australia stops in silence for Bondi Beach shooting victims

-

Olympic champion Joseph helps Perpignan to first Top 14 win despite red card

-

Zelensky says US mooted direct Ukraine-Russia talks on ending war

Zelensky says US mooted direct Ukraine-Russia talks on ending war

-

Wheelchair user flies into space, a first

-

Brazil's Lula, Argentina's Milei clash over Venezuela at Mercosur summit

Brazil's Lula, Argentina's Milei clash over Venezuela at Mercosur summit

-

Haaland sends Man City top, Chelsea fightback frustrates Newcastle

-

Thailand on top at SEA Games clouded by border conflict

Thailand on top at SEA Games clouded by border conflict

-

Chelsea chaos not a distraction for Maresca

-

Brazil's Lula asks EU to show 'courage' and sign Mercosur trade deal

Brazil's Lula asks EU to show 'courage' and sign Mercosur trade deal

-

Africa Cup of Nations to be held every four years after 2028 edition

-

Zelensky says US mooted direct Ukraine-Russia talks on ending war in Miami

Zelensky says US mooted direct Ukraine-Russia talks on ending war in Miami

-

Armed conflict in Venezuela would be 'humanitarian catastrophe': Lula

-

Chelsea fightback in Newcastle draw eases pressure on Maresca

Chelsea fightback in Newcastle draw eases pressure on Maresca

-

FIFA Best XI 'a joke' rages Flick over Raphinha snub

-

Swiss Von Allmen pips Odermatt to Val Gardena downhill

Swiss Von Allmen pips Odermatt to Val Gardena downhill

-

Vonn claims third podium of the season at Val d'Isere

-

India drops Shubman Gill from T20 World Cup squad

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Forward Water Technologies Corp. Announces Extension of Non-Brokered Private Placement Closing Date

TORONTO, ON / ACCESS Newswire / September 22, 2025 / Forward Water Technologies Corp. ("FWTC" or the "Company") (TSXV:FWTC) is pleased to announce that, in response to investor interest, it has sought and obtained consent from the TSX Venture Exchange to extend the closing date for its offering of convertible debentures (the "Offering") announced on August 6, 2025. Closing is now expected to occur on or before October 22, 2025. The extended closing time was sought to accommodate a number of recent expressions of interest.

The Offering is a non-brokered private placement of unsecured convertible debentures (the "Convertible Debentures") for proceeds of up to $750,000 (the "Private Placement"). The Company intends to issue units ("Debenture Units"), each priced at $1,000, with each Debenture Unit consisting of (i) $1,000 principal amount of Convertible Debentures and (ii) 5,000 common share purchase warrants ("Warrants"). Each Warrant will entitle the holder to acquire one common share of the Company (a "Common Share") at any time up to the 36-month anniversary of the date of issuance. The exercise price of the Warrants will be $0.07 per Common Share if exercised on or before the first anniversary of issuance, and $0.10 per Common Share thereafter. In addition, the Convertible Debentures will now include a pre-payment right in favour of the Company, exercisable at any time following the date that is 12 months from the date of issuance. All other material terms of the private placement remain unchanged from those set out in the Company's prior press release and are summarized below for reference.

The Convertible Debentures will mature on the date that is 36 months from the date of issuance (the "Maturity Date") and bear interest at 14% per annum, payable annually. Until the principal and all interest owing are paid, a holder shall have the option to convert the principal owing pursuant to the Convertible Debenture into common shares of the Company at a conversion price of $0.07 per share during the first year of the term, and at a conversion price of $0.10 thereafter, subject to customary adjustments. At the holder's option, the Company will apply to the TSX Venture Exchange for approval to convert accrued interest into Common Shares at the then prevailing market price, pursuant to the policies of the TSX Venture Exchange.

Certain insiders of the Company intend to participate in the Private Placement and are expected to subscribe for at least 25% of the offering. Any participation by insiders in the Private Placement will constitute a "related party transaction" as defined under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company intends to rely on exemptions from the formal valuation and minority approval requirements of sections 5.5(a) and 5.7(1)(a) of MI 61-101 in respect of such insider participation, based on a determination that fair market value of the participation in the Offering by insiders will not exceed 25% of the market capitalization of the Company, as determined in accordance with MI 61-101.

Closing of the Private Placement is subject to the Company obtaining all necessary corporate and regulatory approvals, including approval of the TSXV. The Private Placement will be conducted in reliance upon certain prospectus exemptions. Pursuant to applicable Canadian securities laws, all securities issued in connection with the Private Placement will be subject to a statutory hold period of four months plus a day from the date of issuance. The Company may pay finders' fees in connection with the Private Placement and in accordance with the policies of the TSXV.

About Forward Water Technologies Corp.

Forward Water Technologies Corp. is a publicly traded Canadian company dedicated to saving the earth's water supply using its patented Forward Osmosis technology. The Company was founded by GreenCentre Canada, a leading technology innovation centre supported by the government of Canada. The Company's technology allows for the reduction of challenging waste streams simultaneously returning fresh water for re-use or surface release. The Company's mandate is to focus on the large-scale implementation of its technology in multiple sectors, including industrial wastewater, oil and gas, mining, agriculture and ultimately municipal water supply and re-use market sectors. In addition, the Company has initiated early stage R&D for the treatment of food and beverage process streams.

For more information, please visit www.forwardwater.com.

For more information or interview requests, please contact:

C. Howie Honeyman - Chief Executive Officer

[email protected]

1-519-333-5888

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Caution Concerning Forward Looking Information

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable securities laws. Any statements that are contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "will", "estimates", "believes", "intends" "expects" and similar expressions which are intended to identify forward-looking statements. Forward-looking statements in this press release include statements regarding the closing of the Private Placement, the potential use of proceeds from the Private Placement and insider participation in the Private Placement. FWTC cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, assumptions and expectations, many of which are beyond the control of FWTC, including those described in FWTC's disclosure documents available on SEDAR+ at www.sedarplus.ca. The reader is cautioned that assumptions used in the preparation of any forward-looking statements may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties and other factors, many of which are beyond the control of FWTC. The reader is cautioned not to place undue reliance on any forward-looking statements. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

The forward-looking statements contained in this press release are made as of the date of this press release, and FWTC does not undertake to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by securities law.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction.

SOURCE: Forward Water Technologies Inc.

View the original press release on ACCESS Newswire

L.Durand--AMWN