-

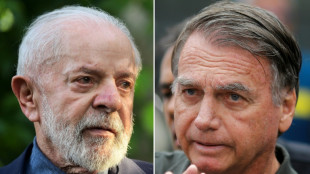

Brazil's Lula vetoes law reducing Bolsonaro's sentence

Brazil's Lula vetoes law reducing Bolsonaro's sentence

-

Macron accuses US of 'turning away' from allies, breaking rules

-

Joshua pays tribute to close friends killed in crash

Joshua pays tribute to close friends killed in crash

-

Protesters, US law enforcement clash after immigration officer kills woman

-

French ex-spy chief cops suspended jail term for 15 mn euro shakedown

French ex-spy chief cops suspended jail term for 15 mn euro shakedown

-

Syria bombs Kurdish areas in city of Aleppo

-

Confusion reigns over Venezuela's oil industry as US looms

Confusion reigns over Venezuela's oil industry as US looms

-

Stocks retrench as traders eye geopolitics, US jobs data

-

US trade gap shrinks to smallest since 2009 as imports fall

US trade gap shrinks to smallest since 2009 as imports fall

-

Russia releases French researcher in prisoner exchange

-

Spain signs agreement with Church to compensate abuse victims

Spain signs agreement with Church to compensate abuse victims

-

Macron accuses US of 'breaking free from international rules'

-

US could run Venezuela, tap its oil for years, Trump says

US could run Venezuela, tap its oil for years, Trump says

-

England to stick with Stokes and McCullum despite Ashes flop

-

Nobel laureate Bialiatski tells AFP 'important' to keep pressure on Belarus

Nobel laureate Bialiatski tells AFP 'important' to keep pressure on Belarus

-

Russia slams Western peacekeeping plan for Ukraine

-

Bordeaux's Du Preez wary of Northampton's Champions Cup revenge mission

Bordeaux's Du Preez wary of Northampton's Champions Cup revenge mission

-

Romero apologises for Spurs slump as crisis deepens

-

Former Premier League referee Coote gets suspended sentence for indecent image

Former Premier League referee Coote gets suspended sentence for indecent image

-

New clashes hit Iran as opposition urges protests, strikes

-

Stocks retreat as traders eye geopolitics, US jobs data

Stocks retreat as traders eye geopolitics, US jobs data

-

'Girl with a Pearl Earring' to be shown in Japan, in rare trip abroad

-

Syria tells civilians to leave Aleppo's Kurdish areas

Syria tells civilians to leave Aleppo's Kurdish areas

-

'Sign of life': defence boom lifts German factory orders

-

Japan's Fast Retailing raises profit forecast after China growth

Japan's Fast Retailing raises profit forecast after China growth

-

Olympic champion Zheng out of Australian Open

-

England's Brook 'deeply sorry' for nightclub fracas

England's Brook 'deeply sorry' for nightclub fracas

-

New clashes in Iran as opposition urges more protests

-

Equity markets mostly down as traders eye US jobs data

Equity markets mostly down as traders eye US jobs data

-

England cricket board launches immediate review into Ashes debacle

-

Dancing isn't enough: industry pushes for practical robots

Dancing isn't enough: industry pushes for practical robots

-

Asian markets mostly down as traders eye US jobs data

-

Australia to hold royal commission inquiry into Bondi Beach shooting

Australia to hold royal commission inquiry into Bondi Beach shooting

-

Sabalenka accuses tour chiefs over 'insane' tennis schedule

-

Cambodia to liquidate bank founded by accused scam boss

Cambodia to liquidate bank founded by accused scam boss

-

Farmers enter Paris on tractors in protest at trade deal

-

Viral 'Chinese Trump' wins laughs on both sides of Pacific

Viral 'Chinese Trump' wins laughs on both sides of Pacific

-

Stokes vows to stay on but 'wrongs to put right' after crushing Ashes defeat

-

Lidl to drop broadcast TV ads in France

Lidl to drop broadcast TV ads in France

-

Stokes admits 'wrongs to put right' after crushing Ashes defeat

-

Sabalenka impresses again in Australian Open warm-up, vows more to come

Sabalenka impresses again in Australian Open warm-up, vows more to come

-

Gilgeous-Alexander to the rescue as Thunder sink Jazz in overtime

-

From Diaz to 'Mazadona' - five new faces starring at AFCON

From Diaz to 'Mazadona' - five new faces starring at AFCON

-

Startups go public in litmus test for Chinese AI

-

Death of Bazball: Five things we learned from Ashes series

Death of Bazball: Five things we learned from Ashes series

-

Australia's emotional Khawaja bows out for final time with Ashes win

-

Asian markets mixed as traders eye US jobs data

Asian markets mixed as traders eye US jobs data

-

Australia win final Test to complete 4-1 Ashes triumph over England

-

Trump withdraws US from key climate treaty, deepening global pullback

Trump withdraws US from key climate treaty, deepening global pullback

-

Trump pulls US out of key climate treaty, deepening global pullback

| RYCEF | 0.29% | 17.05 | $ | |

| CMSC | -0.11% | 22.975 | $ | |

| RBGPF | -0.27% | 81.57 | $ | |

| NGG | -0.05% | 79.35 | $ | |

| GSK | 0.27% | 50.755 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RELX | 0.61% | 42.44 | $ | |

| AZN | -0.03% | 95.13 | $ | |

| BTI | 1.23% | 53.955 | $ | |

| CMSD | -0.25% | 23.542 | $ | |

| BP | -0.7% | 33.435 | $ | |

| BCC | 5.38% | 77.65 | $ | |

| BCE | 1.73% | 23.74 | $ | |

| JRI | 0.62% | 13.725 | $ | |

| VOD | -0.98% | 13.84 | $ | |

| RIO | -1.93% | 83.27 | $ |

Forte Group Confirms Effective Date of Corporate Name Change to VANTA, advancing its Blackwater Ready-to-Drink Platform and Longevity-Focused Nutraceutical Strategy, and Announces Strategic Share Consolidation to Advance Corporate Growth and Capital Markets Presence

News Release Highlights:

Forte Group has confirmed the effective date of its previously announced corporate name change to Vanta Holdings Inc. ("VANTA") and approved a strategic 10-for-1 share consolidation, both to take effect at the start of trading on January 13, 2026, advancing the Company's corporate growth strategy and capital markets positioning.

The transition to the VANTA identity unifies the Company's Blackwater ready-to-drink platform and longevity-focused nutraceutical portfolio under a single, modernized brand, aligning the parent company and its consumer-facing product ecosystem and supporting scalable commercialization across Canadian, U.S., and international markets.

The share consolidation is intended to enhance the marketability of the Company's common shares, improve investor accessibility, and provide flexibility to support future corporate initiatives and financing activities, while aligning the Company's capital structure with its long-term operational and growth objectives.

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / January 7, 2026 / Forte Group Holdings Inc. (CSE:FGH)(OTC:FGHFF)(FSE:7BC0, WKN:A40L1Z)("Forte Group" or the "Company"), a next-generation beverage and nutraceutical company focused on longevity and human performance, announces that, further to its news release dated November 25, 2025, it has confirmed the effective date of its previously announced corporate name change to Vanta Holdings Inc. ("VANTA") as at January 13, 2025 (the "Name Change"). Concurrent with the Name Change, the Company's trading symbol on the Canadian Securities Exchange ("CSE") will change to "VNTA". The Company's trading symbols on the OTC Markets (OTC Pink) and the Frankfurt Stock Exchange (FSE) will remain unchanged. However, the Company intends to pursue a change to its OTC Markets trading symbol to reflect the new corporate name and will provide updates in due course.

Strategic Rebrand to VANTA

As disclosed in the Company's news release dated November 25, 2025, the strategic Name Change to VANTA marks a significant evolution in the Company's ongoing growth as a next-generation beverage and nutraceutical company focused on longevity and human performance. The rebrand unifies the Company's expanding portfolio of functional beverages and nutraceuticals under one bold and distinctive identity, VANTA, establishing a cohesive platform for accelerated growth, brand scalability, and long-term value creation.

The VANTA identity embodies strength, sophistication, and innovation. Inspired by Vantablack, one of the darkest man-made substances known, the name reflects the Company's commitment to depth, purity, and excellence across its product ecosystem. The rebrand is designed to communicate these same principles to consumers and investors, emphasizing performance, longevity, and authenticity as the Company continues to expand its premium longevity and human performance focused product lines and market presence.

As part of the corporate transformation to VANTA, the Company is undertaking a full strategic unification of its consumer-facing brand. This includes transitioning all existing TRACE branded functional beverages and nutraceutical products to the VANTA brand on a phased basis as current inventory cycles through production and distribution. The transition reflects the Company's objective to align its parent company identity with the consumer brand that will represent its product ecosystem across all markets. Management believes that moving to a single, modernized VANTA brand will strengthen brand continuity, enhance consumer recognition, and support more cohesive marketing and distribution strategies in Canada, the United States, and international markets. This alignment is intended to reinforce the premium positioning of the Company's longevity-focused product portfolio and advance its long-term strategy of establishing VANTA as a next-generation global wellness brand.

Share Consolidation to Advance Corporate Growth and Capital Markets Presence

The Company also announces its intention to consolidate all of its issued and outstanding common shares (the "CommonShares") on the basis of 10:1, with each ten (10) pre-consolidation Common Shares being consolidated into one (1) post-consolidation Common Share (the "Consolidation").

The board of directors (the "Board") of the Company believes the Consolidation will provide the Company with greater flexibility for future corporate activities, including but not limited to those referenced herein, enhance the marketability of the Common Shares and lead to increased interest by a broader spectrum of potential investors, thereby increasing market interest in providing additional financing for operational and growth initiatives.

This Consolidation forms part of the Company's broader effort to align its capital structure with its long-term operational and growth objectives, while continuing to strengthen its market positioning, corporate governance framework, and overall strategic planning. The Consolidation is intended to support the Company's evolution into a unified, consumer-focused platform under the VANTA brand, enabling more efficient execution of its commercialization strategy across longevity-focused beverages and nutraceuticals, and supporting disciplined growth across Canadian, U.S., and international markets.

As required by CSE policies, effective September 17, 2025, the Company obtained shareholder approval by way of written consent from shareholders holding approximately 51.76% of the then-issued and outstanding common shares, in accordance with Policy 4.6(1)(b) of the CSE, authorizing the Board to implement a consolidation of the common shares on the basis of up to twenty-five (25) pre-Consolidation common shares for one (1) post-Consolidation common share, at any time within one calendar year of September 17, 2025, as disclosed in the Company's news release dated October 2, 2025. The Consolidation has been approved by the Company's board of directors.

The Consolidation will result in the number of issued and outstanding Common Shares being reduced from the current outstanding 43,933,742 Common Shares to approximately 4,393,374 Common Shares, subject to rounding. No fractional shares will be issued as a result of the Consolidation. In accordance with the Business Corporations Act (British Columbia), any fractional Common Shares remaining after the Consolidation that are less than one-half of a Common Share will be cancelled and any fractional Common Shares that are at least one-half of a Common Share will be rounded up to one whole Common Share.

The Name Change and Consolidation will take effect at the start of trading on January 13, 2026 (the "Effective Date"). On the Effective Date, the Company will begin trading under the new symbol "VNTA", with a new CUSIP number 92214C102 and ISIN number CA92214C1023.

A letter of transmittal with respect to the Consolidation will be mailed to registered shareholders of the Company. All registered shareholders with physical certificates will be required to send their certificates representing pre-Consolidation Common Shares along with a completed letter of transmittal to the Company's transfer agent, Olympia Trust Company ("Olympia Trust"), in accordance with the instructions provided in the letter of transmittal. Additional copies of the letter of transmittal can be obtained through Olympia Trust or through the Company's profile on SEDAR+ at www.sedarplus.ca.

About Forte Group Holdings Inc.

Forte Group Holdings Inc. (CSE:FGH)(OTC:FGHFF)(FSE:7BC0, WKN:A40L1Z) is a next-generation beverage and nutraceutical company focused on longevity and human performance. Through its VANTA brand and private-label partnerships, Forte Group develops and manufactures a portfolio of alkaline and mineral-enriched beverages and nutraceutical supplements. Headquartered in British Columbia, Canada, the Company owns a pristine natural alkaline spring water aquifer and operates a 40,000-square-foot, Health Canada and HACCP-certified manufacturing facility near Osoyoos, British Columbia. Forte Group delivers wellness-driven products through traditional retail and e-commerce channels, providing consumers with innovative solutions to support long-term vitality and well-being.

On Behalf of the Board of Directors:

Marcello Leone, Chief Executive Officer and Director

[email protected]

604-569-1414

Disclaimer for Forward-Looking Information

This news release contains forward-looking statements within the meaning of applicable securities laws. Forward-looking statements in this news release relate to future events and anticipated performance and include, without limitation, statements regarding the implementation and expected benefits of the Company's corporate name change to VANTA, the strategic objectives and anticipated impact of the VANTA rebrand, the unification and phased transition of the Company's consumer-facing beverage and nutraceutical products under the VANTA brand, the expected benefits of aligning the Company's parent company identity with its consumer brand, the Company's plans to support scalable commercialization and expansion across Canadian, U.S., and international markets, the anticipated effects of the share consolidation on the Company's capital structure and marketability of its common shares, the expected timing and effectiveness of the Consolidation and commencement of trading under the new trading symbol, and the Company's intention to pursue a corresponding change to its OTC Markets trading symbol. Forward-looking statements in this news release also include statements regarding the anticipated benefits of the share consolidation, including improving investor accessibility, enhancing the marketability of the Company's common shares, providing flexibility to support future corporate initiatives and financing activities, and aligning the Company's capital structure with its long-term operational and growth objectives. Forward-looking statements are based on management's current expectations, assumptions, estimates, and projections as of the date of this news release and are subject to a number of known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, without limitation, risks related to the completion and timing of the name change, share consolidation, and related administrative processes; the receipt of any required regulatory or stock exchange approvals; the completion of corporate and procedural requirements for the Consolidation; risks associated with branding, rebranding, and consumer adoption; competitive market conditions; changes in demand for beverage and nutraceutical products; supply chain and manufacturing risks; general economic, market, and geopolitical conditions; and other risks described in the Company's public disclosure documents available on SEDAR+ at www.sedarplus.ca. Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, except as required by applicable securities laws.

SOURCE: Forte Group Holdings

View the original press release on ACCESS Newswire

F.Pedersen--AMWN