-

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

-

China executes 11 linked to Myanmar scam compounds

-

Germany to harden critical infrastructure as Russia fears spike

Germany to harden critical infrastructure as Russia fears spike

-

Colombia plane crash investigators battle poor weather to reach site

-

Serena Williams refuses to rule out return to tennis

Serena Williams refuses to rule out return to tennis

-

New glove, same fist: Myanmar vote ensures military's grip

-

Deutsche Bank logs record profits, as new probe casts shadow

Deutsche Bank logs record profits, as new probe casts shadow

-

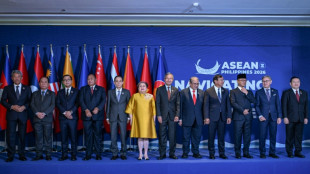

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

-

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

Senegal coach Thiaw gets five-match ban after AFCON final chaos

Senegal coach Thiaw gets five-match ban after AFCON final chaos

-

Phan Huy: the fashion prodigy putting Vietnam on the map

-

Hongkongers snap up silver as gold becomes 'too expensive'

Hongkongers snap up silver as gold becomes 'too expensive'

-

Britain's Starmer meets China's Xi for talks on trade, security

-

Chinese quadriplegic runs farm with just one finger

Chinese quadriplegic runs farm with just one finger

-

Gold soars past $5,500 as Trump sabre rattles over Iran

-

China's ambassador warns Australia on buyback of key port

China's ambassador warns Australia on buyback of key port

-

'Bombshell': What top general's fall means for China's military

-

As US tensions churn, new generation of protest singers meet the moment

As US tensions churn, new generation of protest singers meet the moment

-

Venezuelans eye economic revival with hoped-for oil resurgence

-

Online platforms offer filtering to fight AI slop

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

Samsung Electronics posts record profit on AI demand

-

Strategic Friction: Turning Diversity into a Competitive Moat

-

Rockets veteran Adams out for rest of NBA season

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Tesla profits tumble on lower EV sales, AI spending surge

-

Joao Pedro fires Chelsea into Champions League last 16, dumps out Napoli

Joao Pedro fires Chelsea into Champions League last 16, dumps out Napoli

-

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

-

Barca rout Copenhagen to reach Champions League last 16

-

Arsenal complete Champions League clean sweep for top spot

Arsenal complete Champions League clean sweep for top spot

-

Kolo Muani and Solanke send Spurs into Champions League last 16

-

Bayern inflict Kane-ful Champions League defeat on PSV

Bayern inflict Kane-ful Champions League defeat on PSV

-

Pedro double fires Chelsea into Champions League last 16, dumps out Napoli

-

US capital Washington under fire after massive sewage leak

US capital Washington under fire after massive sewage leak

-

Anti-immigration protesters force climbdown in Sundance documentary

-

US ambassador says no ICE patrols at Winter Olympics

US ambassador says no ICE patrols at Winter Olympics

-

Norway's Kristoffersen wins Schladming slalom

-

Springsteen releases fiery ode to Minneapolis shooting victims

Springsteen releases fiery ode to Minneapolis shooting victims

-

Brady latest to blast Belichick Hall of Fame snub

-

Trump battles Minneapolis shooting fallout as agents put on leave

Trump battles Minneapolis shooting fallout as agents put on leave

-

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

Emerging Growth Research Maintains Buy-Extended Rating on SBC Medical Group Holdings, Inc. with $9.00 Price Target Following Strategic U.S. Market Entry

NEW YORK, NY / ACCESS Newswire / January 7, 2026 / Emerging Growth Research today announced the release of its Flash Report on SBC Medical Group Holdings, Inc. (Nasdaq:SBC), maintaining a Buy-Extended rating and its 12-month price target of $9.00, representing significant upside from the Company's closing price of $4.44 on January 6, 2026.

The Flash Report highlights SBC's major milestone entry into the United States medical aesthetics market through a strategic minority equity investment and structured collaboration framework with OrangeTwist, a leading U.S.-based MedSpa chain. This transaction marks a pivotal expansion in SBC's global growth strategy and follows the Company's prudent phased approach to international M&A.

Key Highlights from the Flash Report:

U.S. Market Entry: SBC has completed a strategic minority equity investment in OrangeTwist alongside longstanding shareholders Hildred Capital and Athyrium Capital, marking the beginning of full-scale, multi-year strategic expansion in the key U.S. medical aesthetics growth market.

Strategic Partnership: OrangeTwist operates 24 locations across 6 U.S. states, specializing in non-invasive aesthetic treatments with strong medical oversight and data-driven clinical operations. The company offers a comprehensive portfolio of injectable, energy-based, and regenerative treatments.

Operational Synergies: Both companies will pursue joint operations leveraging cross-border synergies between the U.S. and Asia to support long-term growth opportunities. OrangeTwist's advanced management system integrating procurement, clinical workflows, and real-time KPI tracking aligns with SBC's operational expertise.

Revenue Stabilization: Following year-over-year revenue pressure through early 2025, SBC's revenue growth stabilized sequentially in Q3:25, with management expecting renewed growth in early-2026 supported by global expansion initiatives.

Strong Financial Position: SBC maintains a robust balance sheet with ample net cash (approximately 40% of current market capitalization) and minimal debt (Debt/MV Equity of just 5%), providing significant financial flexibility for strategic investments and M&A activities.

Prudent Expansion Strategy: SBC's international expansion follows a disciplined 3-phase implementation process: entry, scale, and leadership. This approach involves partnering with high-performing regional operators, deploying SBC's differentiated operating expertise, and securing first-mover advantages.

Significant Upside Potential: Despite strong recovery from ~$3.00/share lows, SBC shares remain heavily undervalued both traditionally and via DCF analysis. The firm's analysis indicates substantial upside, especially net of the Company's ample cash position.

According to Emerging Growth Research's analysis, SBC has successfully navigated near-term competitive pressures while maintaining its position as a cash generation machine with 25 years of operational excellence. The Company's accomplished founder and management team have shepherded SBC from a solo clinic in 2000 to become a global cosmetic treatment center franchiser with operations across Japan, Vietnam, Thailand, Singapore, and now the United States.

The OrangeTwist investment represents a major milestone in SBC's long-term vision to expand from 258 clinics currently to 1,000 clinics over ten years, supported by domestic organic growth and strategic M&A across key global markets.

For a copy of the full Flash Report, please visit:

or

https://www.EmergingGrowth.com/profile/sbc/ (on the right side of the page as you scroll down)

About SBC Medical Group Holdings, Inc.

Founded in 2000 as Shonan Beauty Clinic in Japan, SBC Medical Group Holdings, Inc. (Nasdaq: SBC) has grown into a leading global healthcare management company specializing in cosmetic treatments. Through its franchise model, SBC operates across dermatology, aesthetic surgery, hair removal, orthopedics, ophthalmology, fertility, dentistry, and related services. With operations concentrated in Japan and growing footprints in Vietnam, Thailand, Singapore, and the United States, SBC continues to pursue international expansion.

For more information, please visit https://sbc-holdings.com/en.

About OrangeTwist

OrangeTwist is a leading U.S.-based MedSpa chain specializing in non-invasive aesthetic treatments at 24 locations across 6 U.S. states. With strong medical oversight and data-driven clinical operations, OrangeTwist offers a comprehensive portfolio of injectable, energy-based, and regenerative treatments supported by advanced management systems for operational consistency and scalable growth.

Contact:

Emerging Growth Research

[email protected]

www.EmergingGrowth.com

Forward-Looking Statements

This press release contains forward-looking statements concerning business operations and financial performance as well as plans, objectives, and expectations for SBC Medical Group Holdings, Inc. that are subject to risks and uncertainties. All statements other than statements of historical fact are forward-looking statements. These include but are not limited to statements regarding U.S. market expansion, the OrangeTwist partnership, revenue growth resumption in 2026, clinic expansion targets, global M&A strategy, cross-border operational synergies, and valuation projections. Actual results could differ materially due to competitive, regulatory, operational, international expansion risks, integration challenges, or market risks.

SOURCE: SBC Medical Group Holdings Incorporated

View the original press release on ACCESS Newswire

A.Jones--AMWN