-

Britain's Harris Dickinson on John Lennon, directing and news overload

Britain's Harris Dickinson on John Lennon, directing and news overload

-

9 killed in Canada mass shooting that targeted school, residence

-

Wembanyama scores 40 as Spurs rout Lakers, Pacers stun Knicks

Wembanyama scores 40 as Spurs rout Lakers, Pacers stun Knicks

-

UK's crumbling canals threatened with collapse

-

Hong Kong convicts father of wanted activist over handling of funds

Hong Kong convicts father of wanted activist over handling of funds

-

Australia charges two Chinese nationals with foreign interference

-

'Overloading' may have led to deadly Philippine ferry sinking

'Overloading' may have led to deadly Philippine ferry sinking

-

Bangladesh to vote on democratic reform charter

-

China coach warns of 'gap' ahead of Women's Asian Cup title defence

China coach warns of 'gap' ahead of Women's Asian Cup title defence

-

Glitzy Oscar nominees luncheon back one year after LA fires

-

Pacers outlast Knicks in overtime

Pacers outlast Knicks in overtime

-

9 killed in Canada mass shooting that targeted school, residence: police

-

De Zerbi leaves Marseille 'by mutual agreement'

De Zerbi leaves Marseille 'by mutual agreement'

-

Netanyahu to push Trump on Iran missiles in White House talks

-

England captain Stokes has surgery after being hit in face by ball

England captain Stokes has surgery after being hit in face by ball

-

Rennie, Joseph lead running to become next All Blacks coach

-

Asian stock markets mixed as traders weigh US data, await jobs

Asian stock markets mixed as traders weigh US data, await jobs

-

Australian Olympic snowboarder airlifted to hospital with broken neck

-

Moderna says US refusing to review mRNA-based flu shot

Moderna says US refusing to review mRNA-based flu shot

-

'Artists of steel': Japanese swords forge new fanbase

-

New York model, carved in a basement, goes on display

New York model, carved in a basement, goes on display

-

Noisy humans harm birds and affect breeding success: study

-

More American women holding multiple jobs as high costs sting

More American women holding multiple jobs as high costs sting

-

Charcoal or solar panels? A tale of two Cubas

-

Tocvan Announces Restart Of Exploration Drilling At The Gran Pilar Project South Block

Tocvan Announces Restart Of Exploration Drilling At The Gran Pilar Project South Block

-

Corporate Treasury & Digital Infrastructure Note: The Active Management Divergence

-

Several wounded in clashes at Albania opposition rally

Several wounded in clashes at Albania opposition rally

-

Chelsea's draw with Leeds 'bitter pill' for Rosenior

-

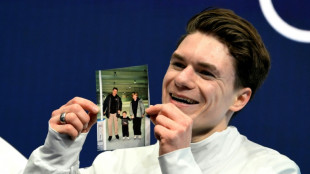

'On autopilot': US skate star Malinin nears more Olympic gold

'On autopilot': US skate star Malinin nears more Olympic gold

-

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

-

Frank confident of keeping Spurs job despite Newcastle defeat

Frank confident of keeping Spurs job despite Newcastle defeat

-

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

-

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

-

Colombian senator kidnapped, president targeted in election run-up

-

Britney Spears sells rights to her music catalog: US media

Britney Spears sells rights to her music catalog: US media

-

West Ham end Man Utd's winning run, Spurs sink to 16th

-

US skate star Malinin leads after short programme in Olympics

US skate star Malinin leads after short programme in Olympics

-

Man Utd's Sesko strikes late to rescue West Ham draw

-

Shiffrin flops at Winter Olympics as helmet row grows

Shiffrin flops at Winter Olympics as helmet row grows

-

Celtics' Tatum practices with G League team but injury return uncertain

-

Gisele Pelicot publishes memoirs after rape trial ordeal

Gisele Pelicot publishes memoirs after rape trial ordeal

-

Newcastle beat sorry Spurs to leave Frank on the brink

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

-

Venezuelan authorities move Machado ally to house arrest

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

Google turns to century-long debt to build AI

-

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

Till death do us bark: Brazilian state lets pets be buried with owners

-

'Confident' Pakistan ready for India blockbuster after USA win

Spurred by TikTok, some Americans return to cash to curb spending

Manicured fingers meticulously place cash in transparent envelopes marked "food," "gas" and other categories, demonstrating in a TikTok video a retro technique for controlling what you spend that is newly popular with some money-conscious Americans.

Returning to cash to control spending may be old fashioned, but in an era of high inflation, a growing number of consumers find that it works.

Judia Griner, 25, started "cash stuffing" two years ago when she was a student at Old Dominion University in Virginia. Now, her TikTok account has more than 200,000 followers.

"I was like, I need to somehow use my own money to pay off the tuition so I won't be in too much debt," Griner told AFP.

"I realized that I had no idea how to do that, because I just didn't know how much money I had," she said.

"I would swipe my card, and I would just kind of cross my fingers and hope that it wouldn't be declined."

It was a similar situation for 31-year-old Jasmine Taylor, who launched her Tiktok channel in February 2021 and now has more than 620,000 followers.

"I had a degree but no outlook for a job. My finances were bad," Taylor, a Texan, said. "I was a pretty big impulse shopper."

Both women decided the way to turn around their spending behavior was to rely on the technique of paying cash for everything.

Once they cash in their pay checks, they separate it into different envelopes for specific expenses -- rent, shopping, etc.

On TikTok, the hashtag #cashstuffing has now reached more than 930 million views.

- Old method, proven results -

The method is reminiscent of the age-old piggy bank system, and was popularized in its current form 20 years ago by financial guru Dave Ramsey, before the era of smartphones and contactless payments.

Despite being outdated and at times inconvenient -- some businesses refuse to accept cash -- the method has allowed Griner to save $7,500 to finance her education.

"The card didn't feel like real money to me," Griner said.

But using cold cash made it very real.

"I could physically see myself spending all my cash and it just went away and that's what helped me curb my spending," she said.

Taylor, too, saw immediate results. She pays 95 percent of her expenses in cash, got rid of $32,000 in student debt, $8,000 in credit card debt and $5,000 in health care debt.

Wracking up debt is a national affliction in a country with abundant credit card offerings that goad households to take on more and more loans.

"It's a problem that my generation kind of suffers from: consumerism and just overspending everything," Griner said.

- Sense of comfort -

For Priya Malani, founder of Stash Wealth, a financial advisory service for young professionals, the economic downturn plays a role in the current success of the envelope system.

"With so many insane headlines -- crypto crashes, market pullbacks, looming recession, the list goes on -- it makes sense that people are looking for a little more control," Malani said.

"A dollar bill you hold in your hand provides that comfort."

But, Jason Howell, a wealth management professor at American University warned that "2023 is probably the worst time to keep your cash in your house" because it earns no interest and depreciates.

Taylor, who keeps her envelopes stuffed with small bills in a fireproof safe in her home, is well aware of this. She still deposits money in the bank when she saves $1,000 or more.

The two experts acknowledge that there is no broader movement back to cash in the United States, where the trend has been the gradual decline of cash in favor of card or mobile payments.

In 2022, about four in ten Americans (41 percent) said they would not make any cash purchases in a typical week, compared to only 24 percent in 2015, according to a recent Pew Research Center study.

According to Griner, the envelope method still represents "the perfect kind of system for a beginner" to manage a budget.

For her, the change has been dramatic: "I trust myself with money."

Howell said that sense of control is a notable achievement.

"It makes you think, it's the greatest benefit of this system," Howell said.

Th.Berger--AMWN