-

Asian stock markets rise, dollar dips as traders await US jobs

Asian stock markets rise, dollar dips as traders await US jobs

-

Britain's Harris Dickinson on John Lennon, directing and news overload

-

9 killed in Canada mass shooting that targeted school, residence

9 killed in Canada mass shooting that targeted school, residence

-

Wembanyama scores 40 as Spurs rout Lakers, Pacers stun Knicks

-

UK's crumbling canals threatened with collapse

UK's crumbling canals threatened with collapse

-

Hong Kong convicts father of wanted activist over handling of funds

-

Australia charges two Chinese nationals with foreign interference

Australia charges two Chinese nationals with foreign interference

-

'Overloading' may have led to deadly Philippine ferry sinking

-

Bangladesh to vote on democratic reform charter

Bangladesh to vote on democratic reform charter

-

China coach warns of 'gap' ahead of Women's Asian Cup title defence

-

Glitzy Oscar nominees luncheon back one year after LA fires

Glitzy Oscar nominees luncheon back one year after LA fires

-

Pacers outlast Knicks in overtime

-

9 killed in Canada mass shooting that targeted school, residence: police

9 killed in Canada mass shooting that targeted school, residence: police

-

De Zerbi leaves Marseille 'by mutual agreement'

-

Netanyahu to push Trump on Iran missiles in White House talks

Netanyahu to push Trump on Iran missiles in White House talks

-

England captain Stokes has surgery after being hit in face by ball

-

Rennie, Joseph lead running to become next All Blacks coach

Rennie, Joseph lead running to become next All Blacks coach

-

Asian stock markets mixed as traders weigh US data, await jobs

-

Australian Olympic snowboarder airlifted to hospital with broken neck

Australian Olympic snowboarder airlifted to hospital with broken neck

-

Moderna says US refusing to review mRNA-based flu shot

-

'Artists of steel': Japanese swords forge new fanbase

'Artists of steel': Japanese swords forge new fanbase

-

New York model, carved in a basement, goes on display

-

Noisy humans harm birds and affect breeding success: study

Noisy humans harm birds and affect breeding success: study

-

More American women holding multiple jobs as high costs sting

-

Charcoal or solar panels? A tale of two Cubas

Charcoal or solar panels? A tale of two Cubas

-

Genflow Biosciences PLC Announces Notice of GM

-

Tocvan Announces Restart Of Exploration Drilling At The Gran Pilar Project South Block

Tocvan Announces Restart Of Exploration Drilling At The Gran Pilar Project South Block

-

Corporate Treasury & Digital Infrastructure Note: The Active Management Divergence

-

Several wounded in clashes at Albania opposition rally

Several wounded in clashes at Albania opposition rally

-

Chelsea's draw with Leeds 'bitter pill' for Rosenior

-

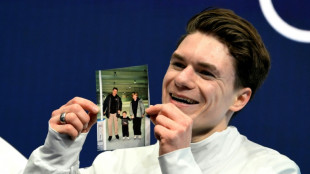

'On autopilot': US skate star Malinin nears more Olympic gold

'On autopilot': US skate star Malinin nears more Olympic gold

-

Carrick frustrated by Man Utd's lack of sharpness in West Ham draw

-

Frank confident of keeping Spurs job despite Newcastle defeat

Frank confident of keeping Spurs job despite Newcastle defeat

-

James's All-NBA streak ends as Lakers rule superstar out of Spurs clash

-

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

Anti-Khamenei slogans in Tehran on eve of revolution anniversary: social media footage

-

Colombian senator kidnapped, president targeted in election run-up

-

Britney Spears sells rights to her music catalog: US media

Britney Spears sells rights to her music catalog: US media

-

West Ham end Man Utd's winning run, Spurs sink to 16th

-

US skate star Malinin leads after short programme in Olympics

US skate star Malinin leads after short programme in Olympics

-

Man Utd's Sesko strikes late to rescue West Ham draw

-

Shiffrin flops at Winter Olympics as helmet row grows

Shiffrin flops at Winter Olympics as helmet row grows

-

Celtics' Tatum practices with G League team but injury return uncertain

-

Gisele Pelicot publishes memoirs after rape trial ordeal

Gisele Pelicot publishes memoirs after rape trial ordeal

-

Newcastle beat sorry Spurs to leave Frank on the brink

-

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

'Outrage' as LGBTQ Pride flag removed from Stonewall monument

-

Chappell Roan leaves agency headed by embattled 2028 Olympic chief

-

Venezuelan authorities move Machado ally to house arrest

Venezuelan authorities move Machado ally to house arrest

-

YouTube rejects addiction claims in landmark social media trial

-

Google turns to century-long debt to build AI

Google turns to century-long debt to build AI

-

'I felt guided by them': US skater Naumov remembers parents at Olympics

Corporate Treasury & Digital Infrastructure Note: The Active Management Divergence

NEW YORK CITY, NY / ACCESS Newswire / February 11, 2026 / Black Titan Corporation (NASDAQ:BTTC):

Executive Summary:

The corporate digital asset sector is witnessing a structural bifurcation between "Passive Accumulators" (e.g., MicroStrategy) and "Active Allocators". This week, the emergence of compliant, KYC-gated lending pools on Base has provided the necessary infrastructure for the latter group to operationalize balance sheet assets, effectively transforming corporate treasuries into on-chain liquidity providers.

1. The DAT Sector: Black Titan Corp (BTTC) & The "Active Treasury" Pivot

Black Titan Corp (NASDAQ:BTTC): Execution of the DAT+ Framework

Following the successful closure of its $200M convertible note facility, BTTC has commenced the deployment phase of its "Digital Asset Treasury Plus" (DAT+) strategy. Unlike peers that utilize capital solely for asset accumulation, BTTC is executing a "Net Interest Margin" (NIM) strategy.

Strategy Analysis: Market intelligence suggests that when available, BTTC would allocate a portion of stablecoin treasury to capture "DeFi Base Rates" (currently ~8-12% on institutional-grade pools) while its cost of capital on the convertible debt remains significantly lower. This should increase the potential for a positive carry trade previously accessible only to hedge funds.

Peer Comparison: This marks a divergence from the MicroStrategy (MSTR) model. While MSTR focuses on Bitcoin-per-share accretion via passive holding, BTTC is focusing on Yield-per-share accretion via active liquidity provision.

Valuation Impact: We believe the equity markets would value BTTC not just as a beta-proxy to BTC price, but as an operating company based on its projected cash flows derived from on-chain yield generation.

Broader DAT Trends: FASB Adoption

The universal adoption of FASB's fair value accounting standards (effective for fiscal years beginning after Dec. 15, 2024) is accelerating corporate adoption. We are observing a trend where mid-cap companies are exploring "Tokenized Money Market Funds" (e.g., BlackRock BUIDL) as a cash-equivalent layer, serving as a stepping stone toward the more aggressive "Active DAT" model BTTC intends to follow.

2. Institutional Infrastructure: The Enabling Rails (Base & Morpho)

Base: The Corporate On-Ramp

Coinbase's L2 network, Base, has effectively consolidated its role as the "regulated distribution layer." New data from this week indicates a sharp rise in "Coinbase Prime Web3 Wallet" activity interacting with whitelisted smart contracts. This integration allows corporate treasurers to access DeFi applications without managing raw private keys, fulfilling the internal control requirements of public auditors.

Morpho: Scaling "Permissioned Markets"

The Morpho protocol has become the primary venue for Corporate DAT execution due to its modular architecture (Morpho Blue).

Corporate Vaults: We are seeing the proliferation of "Permissioned Vaults" curated by regulated entities (e.g., Steakhouse Financial, Gauntlet). These vaults utilize a whitelist (KYC/KYB) to ensure that corporate liquidity providers like BTTC only interact with compliant counterparties.

Collateral Quality: A key development this week is the increased acceptance of Tokenized U.S. Treasury Bills as collateral within these vaults. This allows DAT issuers to borrow stablecoins against low-volatility RWA collateral, minimizing the liquidation risks associated with volatile assets like ETH or BTC.

Market Interpretation: The "Yield Arbitrage" Thesis

We are witnessing a fundamental shift in how public capital interacts with decentralized finance.

Demand Side (The DATs): Public companies (like BTTC) have access to capital via public equity and debt markets.

Supply Side (The Protocols): DeFi protocols (like Morpho) offer high structural yields due to capital scarcity.

The Synthesis: We believe a new form of arbitrage has emerged. Companies are raising funds in the traditional economy (at ~3-5% cost) and deploying them into the digital economy (at ~8-12% yield). Protocols that can bridge this gap with audit-ready infrastructure - specifically Base (distribution) and Morpho (risk engine) - are capturing the majority of this institutional flow.

Disclaimer

This research note is provided for informational purposes only. It does not constitute an offer to sell or a solicitation of an offer to buy any securities or digital assets. The analysis regarding Black Titan Corp (BTTC) and decentralized protocols involves significant regulatory, technical, and market risks. Past performance of treasury strategies is not indicative of future results.

About Black Titan Corp (NASDAQ:BTTC)

Black Titan Corp is a recent digital asset technology company focusing on the DAT+ strategy, utilizing its corporate balance sheet to support, govern, and provide liquidity to decentralized protocols. For more information, please visit https://www.blacktitancorp.com/ttdat.html.

Media & Investor Contact

Czhang Lin

Co-Chief Executive Officer

[email protected]

SOURCE: Black Titan Corp

View the original press release on ACCESS Newswire

X.Karnes--AMWN