-

Mikaela Shiffrin, skiing's greatest back on top of the world

Mikaela Shiffrin, skiing's greatest back on top of the world

-

Denmark's King Frederik X arrives in Greenland in show of support

-

Gabon cuts off Facebook, TikTok amid teachers' strike

Gabon cuts off Facebook, TikTok amid teachers' strike

-

Ukraine's officials to boycott Paralympics over Russian flag decision

-

Notorious Courbet painting goes on show in Vienna

Notorious Courbet painting goes on show in Vienna

-

In reversal, US agrees to review new Moderna flu shot

-

Glencore still open to 'mega-miner' deal after Rio collapse

Glencore still open to 'mega-miner' deal after Rio collapse

-

Shiffrin finally strikes Olympic gold, China win first title

-

Russian era ends at abandoned launchpad in South American jungle

Russian era ends at abandoned launchpad in South American jungle

-

'Utterly absurd': Kosovo ex-president denies war crimes as trial closes

-

Turkey to give cash for soap TV series that boost national image

Turkey to give cash for soap TV series that boost national image

-

Man missing in floods as France hit by record 35 days of rain

-

Our goal? Win World Cup, says Shadab as Pakistan into Super Eights

Our goal? Win World Cup, says Shadab as Pakistan into Super Eights

-

Birthday boy Su wins China's first gold of Milan-Cortina Olympics

-

India opener Abhishek out for third straight duck at T20 World Cup

India opener Abhishek out for third straight duck at T20 World Cup

-

Biles consoles Malinin after 'heartbreaking' Olympic collapse

-

US star Shiffrin wins Olympic slalom gold

US star Shiffrin wins Olympic slalom gold

-

Ukraine says 'outrageous' to allow Russian Paralympians to compete under own flag

-

Liverpool captain Van Dijk hails Szoboszlai as future 'leader'

Liverpool captain Van Dijk hails Szoboszlai as future 'leader'

-

UEFA to investigate alleged racist abuse of Vinicius

-

'It's my story': US skater Liu looking to upset Sakamoto and Japanese

'It's my story': US skater Liu looking to upset Sakamoto and Japanese

-

Cricket: T20 World Cup Super Eights explained

-

Rennes turn to Haise to replace Beye as coach

Rennes turn to Haise to replace Beye as coach

-

Ton-up Farhan helps Pakistan seal Super Eight spot with Namibia rout

-

Norway's Klaebo extends all-time Winter Olympics golds record to 10

Norway's Klaebo extends all-time Winter Olympics golds record to 10

-

Spanish police arrest hacker who booked luxury hotels for one cent

-

Russia, Cuba slam US in Moscow show of solidarity

Russia, Cuba slam US in Moscow show of solidarity

-

Germany's Merz casts doubt on European fighter jet plan

-

Snowboarder Su Yiming wins China's first gold of Milan-Cortina Olympics

Snowboarder Su Yiming wins China's first gold of Milan-Cortina Olympics

-

How Real Madrid's Vinicius became repeated target of racist abuse

-

Prince William opens up on mental health, understanding his 'emotions'

Prince William opens up on mental health, understanding his 'emotions'

-

Farhan ton takes Pakistan to 199-3 in must-win T20 World Cup match

-

French hard left reports 'bomb threat' after far-right activist killing

French hard left reports 'bomb threat' after far-right activist killing

-

Gabon cuts off Facebook, TikTok after protests

-

India celebrates birth of cheetah cubs to boost reintroduction bid

India celebrates birth of cheetah cubs to boost reintroduction bid

-

Greek taxis kick off two-day strike against private operators

-

Turkey MPs back moves to 'reintegrate' former PKK fighters

Turkey MPs back moves to 'reintegrate' former PKK fighters

-

Sri Lanka unfazed by England whitewash ahead of Super Eights clash

-

Shiffrin primed for Olympic gold after rapid first slalom run

Shiffrin primed for Olympic gold after rapid first slalom run

-

Dog gives Olympics organisers paws for thought

-

South Africa fire Super Eights warning to India with UAE romp

South Africa fire Super Eights warning to India with UAE romp

-

Ukraine war talks resume in Geneva after 'tense' first day

-

US tech giant Nvidia announces India deals at AI summit

US tech giant Nvidia announces India deals at AI summit

-

US comedian Colbert says broadcaster spiked Democrat interview over Trump fears

-

Kenyan activist fears for life after police bug phone

Kenyan activist fears for life after police bug phone

-

Isabelle Huppert sinks teeth into Austrian vampire saga

-

Peru to elect interim leader after graft scandal ousts president

Peru to elect interim leader after graft scandal ousts president

-

French designer threads a path in London fashion week

-

Hungarian star composer Kurtag celebrates 100th birthday with new opera

Hungarian star composer Kurtag celebrates 100th birthday with new opera

-

Congolese rumba, music caught between neglect and nostalgia

Art's Way Improves Profitability Despite Ongoing AG Market Headwinds

ARMSTRONG, IA / ACCESS Newswire / July 10, 2025 / Art's Way Manufacturing Co., Inc. (NASDAQ:ARTW) (the "Company"), a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for the second quarter of fiscal 2025.

President, CEO and Chairman Marc McConnell reports, "We are pleased to show operational progress and improved profitability during our second quarter despite challenging market conditions in the ag equipment space. During the quarter, we benefited greatly from sustained performance from our Modular Buildings segment while our Agricultural Products segment continued to see modest demand. We remain focused on enhancing our products and customer experience while also further improving our balance sheet and cashflow positions. We are pleased with our progress on these fronts and believe we are on firm footing to work through the uncertainty of the current environment with cautious optimism."

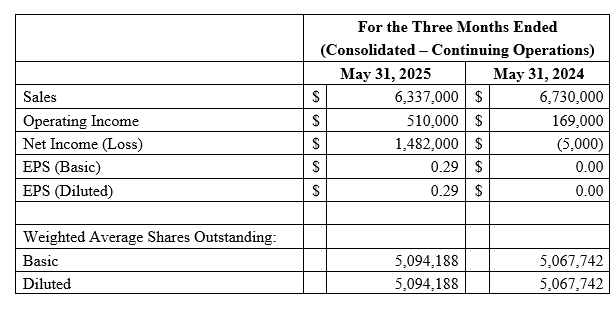

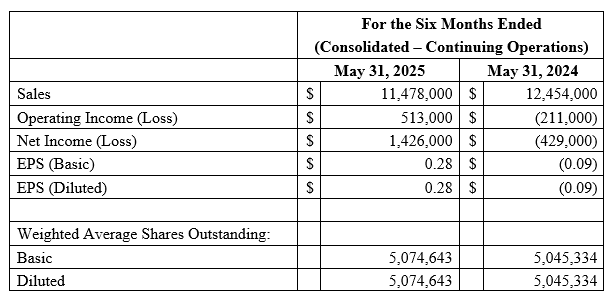

Consolidated - continuing operations

Sales of $6,337,000 for Q2 2025, 5.8% decline from Q1 2024. Six-month sales of $11,478,000, 7.8% decline from the first six months of fiscal 2024.

Six-month gross profit improvement of 3.8% compared to the first six months of fiscal 2024.

Operating expenses reduced by 15.3% for the six months ending May 31, 2025 compared to the same period in fiscal 2024.

Net income of $1,426,000 for the six months ending May 31, 2025, $1,855,000 improvement from same period in fiscal 2024. We received an Employee Retention Credit refund during the six months ending May 31, 2025 that positively impacted net income by $1,154,000.

Agricultural Products

Sales of $4,025,000 for Q2 2025, a 11.6% decline from Q2 2024. Six-month sales of $6,973,000, 20.7% decline from the first six months of fiscal 2024.

Six-month gross profit declined 1.0% compared to the first six months of fiscal 2024.

Operating expenses reduced by 24.2% for the six months ending May 31, 2025 compared to the same period in fiscal 2024.

Net income of $527,000 for the six months ending May 31, 2025, improvement of $1,236,000 from same period in fiscal 2024. We received an Employee Retention Credit refund during the six months ending May 31, 2025 that positively impacted net income by $976,000 in this segment.

Weakened row crop prices and high interest rates continued to make for a difficult agricultural market through the first six months of fiscal 2025. Livestock prices, predominately cattle, are at all time highs in fiscal 2025 and have driven strong grinder mixer sales activity thus far in fiscal 2025. While we have seen quite a bit of destocking from heightened levels in fiscal 2024, many dealers are not eager to replace their stock at current interest rate levels. The agriculture market is highly cyclical, and we still believe we are at the bottom of the cycle. We anticipate that conditions will improve in the next 12 to 18 months in our market. Our efforts in fiscal 2024 to right-size our production and administrative staff has reduced our operating expenses, which is aiding in our efforts to weather the bottom of the cycle. In Q3 of fiscal 2025, we expect to be building stock inventory in order to react to retail opportunities in the second half of fiscal 2025. We will continue to release product specific programs in the second half of fiscal 2025 to turn inventory and unlock cash from product lines where our inventory levels are higher, which has been successful so far in fiscal 2025. We are seeing steel prices rise as tariff uncertainty impacts domestic demand. We expect U.S.-based steel manufacturers to be able to increase production to meet ongoing demand and note the presence of a major U.S. investment by Nippon Steel for a new US Steel mill. The United States currently imports approximately 25% of steel used by industry with Canada, Brazil and Mexico being the top suppliers. The majority of our manufacturing components are sourced in the U.S., however, some of our suppliers do source some of their components from China and other countries. We have also been seeing tariff charges from some of these suppliers and expect some minor impact from these tariffs on our gross profit.

Modular Buildings

Sales of $2,312,000 for Q2 2025, up 6.3% from Q2 2025. Six-month sales of $4,505,000, 23.0% increase from the first six months of fiscal 2024.

Six-month gross profit improvement of 12.2% compared to the first six months of fiscal 2024.

Operating expenses increased by 35.0% for the six months ending May 31, 2025 compared to the same period in fiscal 2024.

Net income of $899,000 for the six months ending May 31, 2025, improvement of $619,000 from the same period in fiscal 2024. We received an Employee Retention Credit refund in six months ending May 31, 2025 that positively impacted net income by $179,000 in this segment.

Demand for our modular buildings continues to be strong in fiscal 2025. Our expertise and execution in the custom research and laboratory market has established us as an industry leader. There continues to be a copious amount of quoting activity and custom build inquiries in fiscal 2025, despite some concerns about governmental grants and funding. In Q1 of fiscal 2025, we brought on a Director of Business Development and Sales who is transitioning to replace our retiring President and Director of Sales. The overlap in these positions in fiscal 2025 is providing additional sales capacity for us in fiscal 2025. We also expect to utilize our outgoing President and Director of Sales as a consultant moving forward to improve sales and maintain customer relationships. We are utilizing the transition period to explore new markets where our custom building can offer competitiveness to the marketplace.

Income (Loss) per Share: Income per basic and diluted share for the first six months of fiscal 2025 was $0.28, compared to loss per basic and diluted share of $0.09 for the same period in fiscal 2024.

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 100 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact: Marc McConnell, President, Chief Executive Officer and Chairman

712-208-8467

[email protected]

Or visit the Company's website at www.artsway.com/

Caution Regarding Forward-Looking Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. In some cases you can identify forward-looking statements by the use of words such as "may," "should," "anticipate," "believe," "expect," "plan," "future," "intend," "could," "estimate," "predict," "hope," "potential," "continue," "foresee," or the negative of these terms or other similar expressions. Statements made in this release that are not strictly statements of historical facts, including the Company's expectations regarding: (i) the Company's business position; (ii) demand and potential growth within the Company's business segments; (iii) future results, including but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases, and expectations with respect to backlog and product mix; (iv) the Company's ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company's business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of the Company's customers; the Company's ability to operate at lower expense levels; the Company's ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company's ability to renew or obtain financing on reasonable terms; the Company's ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and tariffs and their effect on the Company's supply chain and demand for its products; domestic and international economic conditions; the Company's ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company's operating segments; and other factors detailed from time to time in the Company's Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co.

View the original press release on ACCESS Newswire

P.Silva--AMWN