-

AI stock boom delivers bumper quarter for Japan's SoftBank

AI stock boom delivers bumper quarter for Japan's SoftBank

-

Asian stocks struggle as US shutdown rally loses steam

-

India probes deadly Delhi blast, vows those responsible will face justice

India probes deadly Delhi blast, vows those responsible will face justice

-

Pistons win streak hits seven on night of NBA thrillers

-

US state leaders take stage at UN climate summit -- without Trump

US state leaders take stage at UN climate summit -- without Trump

-

Burger King to enter China joint venture, plans to double stores

-

Iraqis vote in general election in rare moment of calm

Iraqis vote in general election in rare moment of calm

-

Philippines digs out from Typhoon Fung-wong as death toll climbs to 18

-

'Demon Slayer' helps Sony hike profit forecasts

'Demon Slayer' helps Sony hike profit forecasts

-

Who can qualify for 2026 World Cup in next round of European qualifiers

-

Ireland's climate battle is being fought in its fields

Ireland's climate battle is being fought in its fields

-

Sony hikes profit forecasts on strong gaming, anime sales

-

End to US government shutdown in sight as stopgap bill advances to House

End to US government shutdown in sight as stopgap bill advances to House

-

'Western tech dominance fading' at Lisbon's Web Summit

-

Asian stocks rise as record US shutdown nears end

Asian stocks rise as record US shutdown nears end

-

'Joy to beloved motherland': N.Korea football glory fuels propaganda

-

Taiwan coastguard faces China's might near frontline islands

Taiwan coastguard faces China's might near frontline islands

-

Concentration of corporate power a 'huge' concern: UN rights chief

-

Indian forensic teams scour deadly Delhi car explosion

Indian forensic teams scour deadly Delhi car explosion

-

Trump says firebrand ally Greene has 'lost her way' after criticism

-

Show shines light on Mormons' unique place in US culture

Show shines light on Mormons' unique place in US culture

-

Ukraine, China's critical mineral dominance, on agenda as G7 meets

-

AI agents open door to new hacking threats

AI agents open door to new hacking threats

-

Syria joins alliance against Islamic State after White House talks

-

As COP30 opens, urban Amazon residents swelter

As COP30 opens, urban Amazon residents swelter

-

NHL unveils new Zurich office as part of global push

-

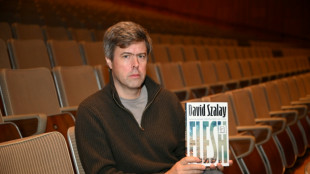

Szalay wins Booker Prize for tortured tale of masculinity

Szalay wins Booker Prize for tortured tale of masculinity

-

Tocvan Announces Maiden Drill Program Underway at North Block Gran Pilar Gold-Silver Project

-

'Netflix House' marks streaming giant's first theme park

'Netflix House' marks streaming giant's first theme park

-

UN warns of rough winter ahead for refugees

-

Brazil's 'action agenda' at COP30 takes shape

Brazil's 'action agenda' at COP30 takes shape

-

Trump threatens $1 billion action as BBC apologises for edit error

-

Sinner dominates injury-hit Auger-Aliassime in ATP Finals opener

Sinner dominates injury-hit Auger-Aliassime in ATP Finals opener

-

Trump hails Syria's 'tough' ex-jihadist president after historic talks

-

Syria's ex-jihadist president meets Trump for historic talks

Syria's ex-jihadist president meets Trump for historic talks

-

Top US court hears case of Rastafarian whose hair was cut in prison

-

US mediator Kushner and Netanyahu discuss phase two of Gaza truce

US mediator Kushner and Netanyahu discuss phase two of Gaza truce

-

End to US government shutdown in sight as Democrats quarrel

-

Trump threatens air traffic controllers over shutdown absences

Trump threatens air traffic controllers over shutdown absences

-

US to remove warnings from menopause hormone therapy

-

UK water firm says 'highly likely' behind plastic pellet pollution incident

UK water firm says 'highly likely' behind plastic pellet pollution incident

-

Syria's ex-jihadist president holds historic Trump talks

-

End to record-long US government shutdown in sight

End to record-long US government shutdown in sight

-

France's ex-leader Sarkozy says after jail release 'truth will prevail'

-

Atalanta sack coach Juric after poor start to season

Atalanta sack coach Juric after poor start to season

-

Trump threatens $1 billion action as BBC apologises for speech edit

-

Gattuso wants 'maximum commitment' as Italy's World Cup bid on the line

Gattuso wants 'maximum commitment' as Italy's World Cup bid on the line

-

Indian capital car blast kills at least eight

-

Deadly measles surge sees Canada lose eradicated status

Deadly measles surge sees Canada lose eradicated status

-

Brazil's Lula urges 'defeat' of climate deniers as COP30 opens

US tech titans stumble after pandemic boom

Amazon and Apple were a relative bright spot in a week of otherwise lackluster earnings results for an industry reckoning with the end of heady pandemic-era growth.

A crowded period of quarterly financial releases from the world's biggest tech firms has been marred by misses and uncertainty -- making it clear that the boom triggered by Covid-19 restrictions on getting about has tipped toward downturn.

As people are freed from pandemic lifestyles that had them relying on the internet for shopping, playing, working and learning, inflation is pushing up prices and Covid-19 is causing temporary shutdowns of factories in China relied on by tech firms.

Recession fears, a strong dollar, shrinking advertising budgets and inflation -- headwinds are coming from every direction at the moment.

"When you think about the number of challenges in the quarter, we feel really good about the growth that we put up," Apple chief executive Tim Cook said on an earnings call.

For Apple, product sales tallied $63.4 billion in a drop from the same period a year earlier, but the dip was more than made up for by services revenue that climbed to $19.6 billion, earnings figures showed.

Demand for iPads and Mac computers exceeded supply in the recently-ended quarter, the main cause being pandemic restrictions that caused "plant closures and plants running at less than full utilization," Cook noted.

Apple was also hobbled by an ongoing shortage of computer chips, Cook said.

Meanwhile, US chip giant Intel reported disappointing earnings battered by its own missteps as well as economic conditions -- a post-Covid drop in demand and "supply dislocations in China and other parts of the supply chain," executives said on an earnings call.

Amazon beat sales estimates to reach $121 billion in the quarter, and revenue climbed at its cloud-computing platform Amazon Web Services.

The retailer has made progress reducing ranks of employees that had been beefed up to handle online shopping that surged during the pandemic, executives said.

"Amazon managed pretty well through the second quarter despite tough macro conditions and added costs weighing on its bottom line," said analyst Andrew Lipsman.

Apple, Microsoft and Facebook-owner Meta have talked of the strong dollar eating into earnings, since when America's currency gains too much value, it can make products more expensive overseas or eat away at a beneficial exchange rate.

Meta pointed to the greenback's role in the firm's first year-on-year revenue decline since going public in 2012.

- Not much good news -

In addition to the generally bumpy economic times, firms such as Netflix and Meta are fighting fierce competition from rivals -- and both reported losing some ground.

Meta lost about two million monthly users between quarters, and Netflix shed nearly a million paying customers.

Yet Netflix stock is up about a percent in the past five days, with investors potentially hopeful after the firm projected a coming rebound in subscribers.

Markets seemed similarly assuaged despite Google parent Alphabet missing on revenue and profit.

The Silicon Valley giant's bad news was not unexpected, as the flow of online ad dollars that fuels the company's fortunes has slowed as inflation, war and other troubles vex the overall economy.

"Still, with its tremendous market share in search advertising, Google is relatively well positioned to weather the rough waters that lie ahead," said analyst Evelyn Mitchell.

As advertisers have tightened their belts, and Apple's privacy changes have bitten into firms' sales of costly but highly targeted ads, the damage was uneven.

Meta's income has taken a beating, and with a share price that has lost about half its value since February, it's clear that investors are still wary about the company's future.

"The good news, if we can call it that, is that its competitors in digital advertising are also experiencing a slowdown," said analyst Debra Aho Williamson.

Snapchat's parent firm, for example, reported that its loss in the recently ended quarter nearly tripled to $422 million, despite revenue increasing 13 percent under "more challenging" conditions than expected.

"We are not satisfied with the results we are delivering, regardless of the current headwinds," California-based Snap said in a letter to investors last week.

P.Santos--AMWN