-

Lives on hold in India's border villages with Pakistan

Lives on hold in India's border villages with Pakistan

-

Musk's dreams for Starbase city in Texas hang on vote

-

Rockets down Warriors to stay alive in NBA playoffs

Rockets down Warriors to stay alive in NBA playoffs

-

Garcia beaten by Romero in return from doping ban

-

Inflation, hotel prices curtail Japanese 'Golden Week' travels

Inflation, hotel prices curtail Japanese 'Golden Week' travels

-

Trump's next 100 days: Now comes the hard part

-

Mexican mega-port confronts Trump's tariff storm

Mexican mega-port confronts Trump's tariff storm

-

Trump's tariffs bite at quiet US ports

-

Ryu stretches lead at LPGA Black Desert Championship

Ryu stretches lead at LPGA Black Desert Championship

-

Singapore votes with new PM seeking strong mandate amid tariff turmoil

-

Five things to know about the Australian election

Five things to know about the Australian election

-

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

-

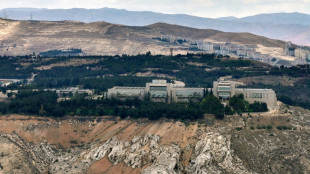

Israel launches new Syria strikes amid Druze tensions

Israel launches new Syria strikes amid Druze tensions

-

Finke grabs 400m medley victory over world record-holder Marchand

-

Apple eases App Store rules under court pressure

Apple eases App Store rules under court pressure

-

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

Rangers hire two-time NHL champion Sullivan as coach

-

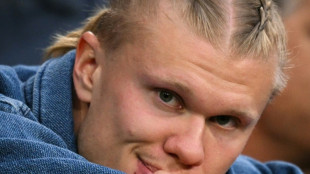

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

Asian markets mixed as Ukraine fears return, oil extends losses

Asian markets were mixed Friday following a steep drop on Wall Street fuelled by renewed fears that Russia will soon invade Ukraine, adding to long-running angst about the Federal Reserve's plans to hike interest rates.

While tensions in Eastern Europe continue to absorb most of the attention, oil extended losses as traders grow increasingly optimistic of a deal on Iran's nuclear programme that could see it restart crude exports.

After a disappointing start to the year, investors are still to get their mojo back as they contend with a range of risk-off issues including Russia-Ukraine, soaring inflation, imminent rate hikes, supply chain snarls and China's Covid outbreaks.

And analysts warned the uncertainty will likely last for some time.

For now eyes are on the Russia-Ukraine border after Joe Biden warned Vladimir Putin's forces could attack any time soon.

There had been optimism the crisis had passed after Moscow said troops were withdrawing but Western powers said there is no sign that is the case, while accusing it of preparing a "false flag operation" as a pretext for invasion.

Putin denies he is planning any incursion but investors remain on edge as observers warn such a move could have wide-ranging implications for the world economic recovery, particularly with Russia being a major energy exporter.

The mood was given a little help when Washington said Thursday that US Secretary of State Antony Blinken and his Russian counterpart Sergei Lavrov will meet next week if there is no invasion.

All three main US indexes ended well down, with the Nasdaq almost three percent off, though Asia fared slightly better.

Tokyo, Hong Kong, Sydney, Singapore, Taipei, Wellington and Manila slipped, though Shanghai, Mumbai, Jakarta and Bangkok edged up slightly. Seoul was flat.

"For now, simmering frictions in the Ukraine are keeping markets nervous and after (Thursday's) glimpses of a risk of tone, news over the past 24 hours have turned sentiment decisively negative," said National Australia Bank's Rodrigo Catril.

Still, oil prices remain in their downward spiral, dropping again Friday after a two percent drop Thursday as it emerged that Tehran and world powers were edging closer to an agreement on its nuclear programme.

A deal could see the return of hundreds of thousands of barrels of crude to the global market, providing a much-needed boost to supplies just as demand surges and uncertainty reigns in Europe. Both main contracts remain around their 2014 levels, however, and analysts expect them to break $100 this year.

The crisis in the Ukraine comes as traders continue to contend with the prospect of interest rates rising sharply this year as the Fed tries to rein in inflation at a 40-year high.

After spending most of last year saying surging prices would be transitory, the US central bank is now in full-on firefighting mode but commentators fear it may be behind the curve and will have to act more stringently than previously thought.

While minutes from January's meeting appeared to ease worries of a big 50 basis point rise in March, there is an expectation it could still lift borrowing costs as many as seven times this year. As early as late 2021 markets were pricing in three.

The prospect of higher costs has dealt a blow to the two-year pandemic rally and while the economy continues to recover, observers warn the uncertainty will not go away soon.

"We've been calling for a long time for increased volatility, but when it finally comes it's nerve wracking for everybody," Carol Schleif, at BMO Family Office, told Bloomberg TV.

"It's important to remember that the Fed isn't going to start pulling back its support for the economy -- either in terms of the balance sheet purchases or interest-rate raises -- if they weren't trying to cool a very strong economy."

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 27,122.07 (close)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 24,541.06

Shanghai - Composite: DOWN 0.7 percent at 3,490.76 (close)

West Texas Intermediate: DOWN 0.4 percent at $91.37 per barrel

Brent North Sea crude: DOWN 0.4 percent at $92.64 per barrel

Euro/dollar: UP at $1.1369 from $1.1366 late Wednesday

Pound/dollar: DOWN at $1.3610 from $1.3615

Euro/pound: UP at 83.49 pence from 83.44 pence

Dollar/yen: DOWN at 115.18 yen from 114.91 yen

New York - Dow: DOWN 1.8 percent at 34,312.03 (close)

London - FTSE 100: DOWN 0.9 percent at 7,537.37 (close)

L.Harper--AMWN