-

Rockets down Warriors to stay alive in NBA playoffs

Rockets down Warriors to stay alive in NBA playoffs

-

Garcia beaten by Romero in return from doping ban

-

Inflation, hotel prices curtail Japanese 'Golden Week' travels

Inflation, hotel prices curtail Japanese 'Golden Week' travels

-

Trump's next 100 days: Now comes the hard part

-

Mexican mega-port confronts Trump's tariff storm

Mexican mega-port confronts Trump's tariff storm

-

Trump's tariffs bite at quiet US ports

-

Ryu stretches lead at LPGA Black Desert Championship

Ryu stretches lead at LPGA Black Desert Championship

-

Singapore votes with new PM seeking strong mandate amid tariff turmoil

-

Five things to know about the Australian election

Five things to know about the Australian election

-

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

-

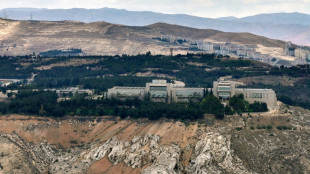

Israel launches new Syria strikes amid Druze tensions

Israel launches new Syria strikes amid Druze tensions

-

Finke grabs 400m medley victory over world record-holder Marchand

-

Apple eases App Store rules under court pressure

Apple eases App Store rules under court pressure

-

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

Rangers hire two-time NHL champion Sullivan as coach

-

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

Lower profits at US oil giants amid fall in crude prices

US oil giants ExxonMobil and Chevron reported lower profits Friday, reflecting the hit from falling crude prices amid global economic uncertainty surrounding President Donald Trump's tariffs.

The results showed the companies remained highly profitable in the first quarter despite about a 20 percent decline in crude prices since Trump's January return to the White House, a drop also spurred by the moves of Saudi Arabia and other crude exporters to boost output.

But the environment marks a change from the surge in profits after Russia's invasion of Ukraine sent oil prices skyrocketing. Both ExxonMobil and Chevron also cited weak refining margins as a negative factor in the first quarter.

ExxonMobil reported profits of $7.7 billion, down 6.2 percent from the year-ago level. Revenues were essentially flat at $83.1 billion.

The 2024 purchase of Pioneer Natural Resources for around $60 billion lifted ExxonMobil's volumes from the Permian Basin, a fast-growing petroleum region in the southwestern United States.

ExxonMobil also saw petroleum production growth in Guyana, which helped to compensate for headwinds in the first quarter, including "significantly weaker" refining margins, the company said in a press release.

ExxonMobil said it is on track to start up 10 "advantaged projects" across its businesses in 2025.

From this group, the company has already started and is ramping production at an "enormous" chemical complex in China that will serve the domestic market and will be "protected from tariff impacts," according to prepared remarks for the company's earnings conference call.

ExxonMobil has also launched an advanced recycling unit in Baytown, Texas.

Chief Executive Darren Woods said ExxonMobil's progress in weeding out inefficient, high-cost projects means the company can "excel in any environment," according to the earnings press release.

During Friday's conference call with analysts, Woods confirmed that ExxonMobil plans to continue to repurchase shares at a fast clip after buying back $4.8 billion last quarter.

Such repurchases reduce the dividend burden after ExxonMobil's all-stock purchase of Pioneer.

"Our stock price is heavily correlated with crude and crude prices... and so it moves down with crude prices," Woods said. "In my mind, that's a great buying opportunity."

- Chevron tempers buybacks -

At Chevron, profits dropped 36 percent to $3.5 billion, while revenues dipped 2.3 percent to $47.6 billion.

The company pointed to recent production increases in Kazakhstan, the Permian Basin and in the Gulf of Mexico.

Chevron plans to temper its share repurchases in the second quarter to between $2.5 billion and $3 billion after spending $3.9 billion in the first quarter.

Chief Executive Mike Wirth said the moderation comes off an extremely robust pace of buybacks in 2023 and 2024.

"The rate at which we're buying shares back now is higher than at any point in our history," Wirth said on a conference call, noting that slowing those purchases makes sense now the crude was moving to the "lower part" of the expected trading range.

The oil giant could make other adjustments if the business conditions worsen, executives said.

"The trade and tariff situation has been dynamic and we need to see how that manifests itself over time," said Wirth, who pointed to the shift in oil exporters as another watch item, while adding "We're very well prepared."

Shares of ExxonMobil dipped 0.1 percent in early-afternoon trading, while Chevron gained 1.3 percent.

M.A.Colin--AMWN