-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

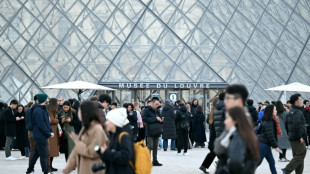

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

US risks debt default as soon as July: budget office

The United States risks defaulting on payment obligations as soon as July, if lawmakers fail to resolve a gridlock and raise the federal borrowing limit, according to Congressional Budget Office estimates Wednesday.

The forecast by the nonpartisan office serving Congress comes as Republicans threaten to block the usually rubber-stamp approval for raising the nation's credit limit, if Democrats do not first agree to steep future budget cuts.

"If the debt limit remains unchanged, the government's ability to borrow using extraordinary measures will be exhausted between July and September 2023," said the CBO.

The latest estimate provides another benchmark on top of the Treasury Department's expectations.

In January, the US hit its $31.4 trillion borrowing cap, prompting the Treasury to start measures that allow it to continue financing the government's activities.

The Treasury earlier said its cash and "extraordinary measures" would likely last until early June.

"If the debt limit is not raised or suspended before the extraordinary measures are exhausted, the government would be unable to pay its obligations fully," the CBO warned Wednesday.

"As a result, the government would have to delay making payments for some activities, default on its debt obligations, or both," it added.

But the date when measures are exhausted remains uncertain as the timing and amount of revenue collections and spending could differ from projections, the CBO said.

In particular, if collections fall short, the Treasury could run out of funds before July, the office added.

- Taking economy 'hostage' -

For now, the Treasury's tools and regular cash inflows would allow it to finance the government's activities "until the summer without an increase in the debt ceiling, a delay in payments, or a default," the CBO said.

The White House accuses Republicans of taking the economy "hostage" in order to posture as fiscally responsible.

On Tuesday, Democratic Senate Majority Leader Chuck Schumer told reporters: "We're continuing to speak to how bad it would be to allow the nation to default.... It's going to affect every American family badly."

At the start of the month, Republican speaker of the House of Representatives Kevin McCarthy said talks with President Joe Biden on the debt ceiling went well.

But both sides have yet to reach a deal.

It is hard for either party to say where they can find significant reductions unless they go into areas like Social Security, Medicare, Medicaid or other government-subsidized healthcare -- which are usually politically untouchable.

- Growing debt -

In a separate report released Wednesday, the CBO said it projects a federal budget deficit of $1.4 trillion for 2023.

This amounts to 5.3 percent of gross domestic product and is set to reach 6.9 percent of GDP in 2033 -- a level exceeded only five times since 1946.

And the shortfall is set to hit $2.7 trillion in 2033.

Meanwhile, the debt-to-GDP ratio is expected to rise each year, hitting a record high of 118 percent by 2033, said the CBO.

"Debt would continue to grow beyond 2033 if current laws generally remained unchanged," the report said.

This comes as the growth of interest costs and mandatory spending outpaces increases in revenues and the economy.

Newly-enacted legislation also adds to deficit predictions, noted CBO director Phillip Swagel.

The rise in mandatory spending is driven by growing costs for Social Security and Medicare, he added.

"The cumulative deficit over the 2023–2032 period that we now project is $3 trillion larger than we projected last May," Swagel said.

The CBO raised its deficit estimate for 2023 and projections over the next decade, in part to account for legislation enacted after the May 2022 forecast.

"Those changes included significant increases in outlays for mandatory veterans' benefits and increases in outlays for discretionary defense programs," it said.

D.Cunningha--AMWN