-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

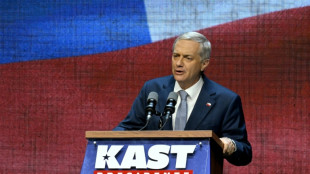

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

-

Apex Discovers Mineralized Carbonatite at its Lac Le Moyne Project, Québec

Apex Discovers Mineralized Carbonatite at its Lac Le Moyne Project, Québec

-

Lin Xiang Xiong Art Gallery Officially Opens

-

Fintravion Business Academy (FBA) Aligns Technology Development Strategy Around FintrionAI 6.0 Under Adrian T. Langshore

Fintravion Business Academy (FBA) Aligns Technology Development Strategy Around FintrionAI 6.0 Under Adrian T. Langshore

-

Pantheon Resources PLC - Retirement of Director

-

HyProMag USA Provides Positive Update to Valuation Of Expanded Dallas-Fort Worth Plant And Commences Strategic Review to Explore a U.S. Listing

HyProMag USA Provides Positive Update to Valuation Of Expanded Dallas-Fort Worth Plant And Commences Strategic Review to Explore a U.S. Listing

-

Relief Therapeutics and NeuroX Complete Business Combination and Form MindMaze Therapeutics

-

Far-right candidate Kast wins Chile presidential election

Far-right candidate Kast wins Chile presidential election

-

Father and son gunmen kill 15 at Jewish festival on Australia's Bondi Beach

-

Rodrygo scrapes Real Madrid win at Alaves

Rodrygo scrapes Real Madrid win at Alaves

-

Jimmy Lai, the Hong Kong media 'troublemaker' in Beijing's crosshairs

-

Hong Kong court to deliver verdicts on media mogul Jimmy Lai

Hong Kong court to deliver verdicts on media mogul Jimmy Lai

-

Bills rein in Patriots as Chiefs eliminated

-

Chiefs eliminated from NFL playoff hunt after dominant decade

Chiefs eliminated from NFL playoff hunt after dominant decade

-

Far right eyes comeback as Chile presidential polls close

-

Freed Belarus dissident Bialiatski vows to keep resisting regime from exile

Freed Belarus dissident Bialiatski vows to keep resisting regime from exile

-

Americans Novak and Coughlin win PGA-LPGA pairs event

-

Zelensky, US envoys to push on with Ukraine talks in Berlin on Monday

Zelensky, US envoys to push on with Ukraine talks in Berlin on Monday

-

Toulon edge out Bath as Saints, Bears and Quins run riot

-

Inter Milan go top in Italy as champions Napoli stumble

Inter Milan go top in Italy as champions Napoli stumble

-

ECOWAS threatens 'targeted sanctions' over Guinea Bissau coup

-

World leaders express horror at Bondi beach shooting

World leaders express horror at Bondi beach shooting

-

Joyous Sunderland celebrate Newcastle scalp

-

Guardiola hails Man City's 'big statement' in win at Palace

Guardiola hails Man City's 'big statement' in win at Palace

-

Lens reclaim top spot in Ligue 1 with Nice win

Asian markets drop with Wall St as tech fears revive

Asian markets dropped Monday as concerns about the AI-fuelled tech rally returned to the spotlight after weak earnings from two big-name firms last week revived questions about the wisdom of the vast sums invested in the sector.

The selling came as traders turned their attention away from the Federal Reserve's monetary policy after it cut interest rates for a third successive meeting on Wednesday.

However, there will be plenty of interest in key US data over the next few days -- including on jobs creation and inflation -- that could play a big role in the central bank's decision-making at next month's meeting.

Tech firms have been at the forefront of a global surge in equity markets for the past two years as they pumped cash into all things linked to artificial intelligence, with chip giant Nvidia becoming the first to top $5 trillion in October.

But they have hit a sticky patch in recent weeks amid worries that their valuations have gone too far and the AI investments will take some time to make returns, if at all.

Those concerns were compounded last week following disappointing earnings from sector giants Oracle and Broadcom.

After hefty losses on Wall Street on Friday, where the S&P 500 and Nasdaq both shed more than one percent, Asia suffered a tech-led retreat.

Tokyo and Seoul, which have chalked up multiple record highs this year on the back of the tech surge, led losses Monday, while there was also selling in Sydney, Singapore, Wellington and Taipei. Shanghai was flat with investors unmoved by another round of weak Chinese consumer data.

Among the biggest losers were South Korean chip giants Samsung and SK hynix, while Japanese tech investment titan SoftBank tanked more than seven percent.

Investors are also bracing for a heavy week of data, including the reports on US jobs for October and November, which were delayed by the government shutdown, as well as inflation.

The readings will be pored over for an idea about the Fed's plans for January's rate decision, even as traders pare back their expectations for cuts next year.

The bank has lowered borrowing costs at the past three meetings citing worries about the labour market, though there has been some dissent among policymakers who are concerned about persistently high inflation.

Also in view is the race to take the helm at the Fed after boss Jerome Powell steps down in May, with Donald Trump's top economic aide Kevin Hassett and Fed governor Kevin Warsh said to be the front-runners.

The US president said that whoever takes over should consult with him, telling the Wall Street Journal: "Typically, that's not done anymore.

"It used to be done routinely. It should be done."

He added: "It doesn’t mean -- I don't think he should do exactly what we say. I'm a smart voice and should be listened to."

When asked where interest rates should be in a year's time, he replied, "One percent, and maybe lower than that".

"We should have the lowest rate in the world," he said.

Friday sees the Bank of Japan's own policy decision, with forecasts for a rate hike, though analysts were cautious on the outlook.

"The central bank will frame Friday's move as a response to a stronger economy and more durable inflation," wrote analysts at Moody's.

"A solid December Tankan survey (of Japanese business sentiment) early in the week and sticky consumer price inflation data on Friday will reinforce that narrative, but the real driver will be the weak yen."

The Japanese currency has weakened to more than 150 per dollar since October amid growing concerns about the country's economy and Prime Minister Kasuo Takaichi's plans to boost spending that would need more borrowing.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.5 percent at 50,092.10 (break)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 25,806.26

Shanghai - Composite: FLAT at 3,890.89

Euro/dollar: DOWN at $1.1737 from $1.1742 on Friday

Dollar/yen: DOWN at 155.80 yen from 155.83

Pound/dollar: DOWN at $1.3366 from $1.3368

Euro/pound: DOWN at 87.80 pence from 87.83

West Texas Intermediate: UP 0.4 percent at $57.67 per barrel

Brent North Sea Crude: UP 0.4 percent at $61.36 per barrel

New York - Dow: DOWN 0.5 percent at 48,458.05 (close)

London - FTSE 100: DOWN 0.6 percent at 9,649.03 (close)

F.Schneider--AMWN