-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

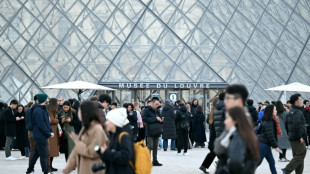

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

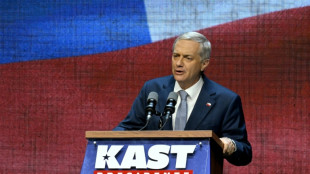

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

Bank shares sink as contagion fears return

Bank shares tumbled on Friday, jolting stock markets as fears about the health of the financial sector resurfaced, with Deutsche Bank now in the eye of the storm.

Markets had rallied earlier this week after financial authorities took steps aimed at preventing contagion from the collapse of US regional lenders earlier this month.

But sentiment has soured following decisions by central banks in the United States, Britain and Switzerland to hike interest rates despite concerns about the impact of the monetary tightening on banks.

Fears of contagion led to the takeover of embattled Swiss bank Credit Suisse by domestic rival UBS on Sunday.

The focus has now turned to another major European lender, Deutsche Bank, whose shares nosedived by as much as 14 percent on Friday as the cost of insuring against the bank defaulting on its debt spiked. It closed 8.5 percent lower.

The German lender returned to financial health last year following a major restructuring after years of problems.

European officials lined up to reassure the markets.

German Chancellor Olaf Scholz said after an EU summit that "there is no reason to be concerned" about Deutsche Bank as the lender is "very profitable".

European Central Bank President Christine Lagarde told EU leaders that the single currency area's banking sector is "resilient because it has strong capital and liquidity positions", according to an EU official.

But City Index analyst Fiona Cincotta told AFP that the selloff in bank shares has highlighted "just how fragile sentiment is towards the sector".

"As central banks continued hiking rates this week the outlook is looking increasingly shaky," she told AFP, adding that "Deutsche Bank has come under the spotlight as a possible target for contagion risk."

European stock markets finished another turbulent week sharply lower, with London down 1.3 percent while Frankfurt and Paris both shed around 1.7 percent.

Wall Street's three main indices opened lower but the Dow and S&P 500 steadied around lunch time.

Shares in US financial giant JPMorgan Chase and Citigroup were down around two percent while Bank of America fell 0.5 percent.

In Paris, Societe Generale sank more than six percent and BNP Paribas dropped more than five percent.

UK bank Standard Chartered also tanked by more than six percent in London while Barclays was down around four percent.

- Oil prices slide -

Concerns that the turmoil could trigger a recession sent oil prices sliding more than two percent.

Share prices in energy majors including BP, Shell and TotalEnergies also tanked.

Global markets were slammed earlier this month by the collapse of three regional US lenders, notably Silicon Valley Bank, which had lost $1.8 billion in the sale of a bond portfolio whose value dropped due to the higher interest rates.

US authorities moved to protect bank deposits but Treasury Secretary Janet Yellen revived concerns on Wednesday when she said authorities were not looking at a blanket increase in deposit insurance for banks.

Yellen was chairing a meeting of financial regulators on Friday.

"Contagion fears are not yet going away," said Finalto analyst Neil Wilson.

"It only stops once people stop asking who's next. And it does not seem like we are at that stage yet."

Some investors are hopeful, however, that central banks could be nearing the end of their interest rate-hiking cycle.

The turmoil has forced the Fed and others to change their monetary policy game plan to avoid further problems in the finance industry.

On Wednesday, the Fed indicated it could pause soon after announcing a quarter-point rate hike -- half what was expected before the latest upheaval.

- Key figures around 1645 GMT -

New York - Dow: FLAT at 32,118.86 points

London - FTSE 100: DOWN 1.3 percent at 7,405.45 (close)

Frankfurt - DAX: DOWN 1.7 percent at 14,957.23 (close)

Paris - CAC 40: DOWN 1.7 percent at 7,015.10 (close)

EURO STOXX 50: DOWN 1.8 percent at 4,130.62 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 27,385.25 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 19,915.68 (close)

Shanghai - Composite: DOWN 0.6 percent at 3,265.65 (close)

Euro/dollar: DOWN at $1.0756 from $1.0840 on Thursday

Pound/dollar: DOWN at $1.2219 from $1.2286

Euro/pound: DOWN at 88.02 pence from 88.20 pence

Dollar/yen: DOWN at 130.75 yen from 130.86 yen

Brent North Sea crude: DOWN 1.5 percent at $74.40 per barrel

West Texas Intermediate: DOWN 1.3 percent at $69.04 per barrel

burs-lth/gw

Th.Berger--AMWN