-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

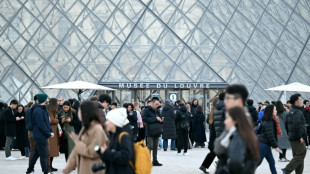

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

First Citizens to acquire collapsed Silicon Valley Bank

US bank First Citizens said Monday it has agreed to purchase much of Silicon Valley Bank, whose collapse this month sparked global fears about the sector.

SVB, a key lender to the tech industry since the 1980s, became the biggest US bank to fail since 2008.

Regulators seized it after a sudden run on deposits, creating Silicon Valley Bridge Bank. That entity will be taken over by First Citizens from Monday.

First Citizens said it had agreed to purchase "substantially all loans and certain other assets, and assume all customer deposits and certain other liabilities of Silicon Valley Bridge Bank."

It said the 17 former branches of SVB will open on Monday as "Silicon Valley Bank, a division of First Citizens Bank."

The transaction includes the sale of $72 billion in assets at a discount of $16.5 billion, the US Federal Deposit Insurance Corporation (FDIC) said in a statement.

Depositors of SVB will "automatically become depositors of First Citizens Bank," added the FDIC, which will continue to insure deposits.

All of the entity's loans and deposits will now be managed by First Citizens, while the FDIC will retain some $90 billion in securities and other assets.

SVB's collapse sparked a crisis of confidence among the customers of similarly sized US banks, with many withdrawing their money and depositing it into bigger institutions seen as too big for the government to not bail them out in a crisis.

The FDIC said it estimates the cost of SVB's failure to its Deposit Insurance Fund (DIF) to be approximately $20 billion.

- Global worries -

"This has been a remarkable transaction in partnership with the FDIC that should instill confidence in the banking system," Frank Holding Jr, chief executive of First Citizens, said in a statement according to Bloomberg.

Along with the FDIC, the United States Treasury and Federal Reserve had set out plans to ensure SVB customers would be able to access their deposits, while the Fed introduced a new lending tool for banks in an effort to prevent a repeat of SVB's quick demise.

The turmoil also spread to Europe, where troubled Swiss lender Credit Suisse was taken over by UBS.

Most recently, shares in long-troubled Deutsche Bank fell heavily on Friday on the lender's surging cost of default cover, reigniting fears about a widening banking sector crisis.

Despite global contagion fears, central banks have pushed on with monetary tightening as they focus on fighting inflation -- even though the troubles in the banking sector have been linked to their rate hikes.

SVB took a $1.8 billion loss in the sale of a bond-heavy portfolio whose value dropped dramatically due to the rate hikes.

burs-dhw/qan

T.Ward--AMWN