-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

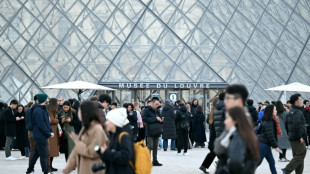

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

European equities rebound on SVB sale

European stock markets rebounded slightly Monday after US lender First Citizens bought most of collapsed rival Silicon Valley Bank, easing fears of a sector crisis.

Frankfurt rallied 1.3 percent, with shares in troubled Deutsche Bank surging more than five percent after diving Friday on investor fears over its financial health.

London and Paris stocks also jumped, with British lender Barclays and French peer BNP Paribas each gaining about two percent.

Oil rose modestly after slumping on demand fears before the weekend, while the dollar largely steadied.

- 'Relative calm' -

The US Federal Deposit Insurance Corporation (FDIC) announced that First Citizens agreed to buy the deposits and loans of SVB, whose collapse this month had sparked fears of a global contagion.

Analysts remained cautious over the outlook.

"European stock markets bounced... as relative calm returned amid the choppy seas of the banking 'crisis' as a buyer was found for Silicon Valley Bank's assets," said analyst Neil Wilson at trading firm Finalto.

The news helped "lift sentiment across the banking sector after a rocky end to last week, though the pall of banking stress still hangs over the market".

The IMF also injected a note of caution.

International Monetary Fund chief Kristalina Georgieva on Sunday warned that risks to financial stability had increased -- and stressed "the need for vigilance" following the turmoil.

Concerns over Deutsche Bank had rocked markets late week, particularly after Switzerland's enforced UBS takeover of troubled rival Credit Suisse.

The turmoil prompted US President Joe Biden, German Chancellor Olaf Scholz and other European officials to try and calm investors about the sector.

In Asia on Monday, Hong Kong and Shanghai stocks fell, while Tokyo, Sydney and Singapore rose following a positive finish on Wall Street last week.

- 'No bank is immune' -

Clifford Bennett, chief economist at ACY Securities, said it was unlikely the German government would allow Deutsche Bank to collapse or face restructuring.

But it showed "the continuing and growing pressure on the banking system among the major Western economies", he wrote in a note.

"No bank is immune in the current climate. The forces that lead to the crisis so far seen, of higher rates and depositor uncertainty, only continue to grow."

Deutsche Bank returned to financial health last year following a major restructuring after years of problems.

Yet its share price has shed more than 15 percent in value so far this year.

Markets were partly soothed last week after financial authorities acted to prevent contagion from the collapse of US regional lenders this month.

But sentiment soured following decisions by central banks in the United States, Britain and Switzerland to hike interest rates, despite concerns about the impact on commercial lenders.

- Key figures around 1120 GMT -

London - FTSE 100: UP 0.8 percent at 7,462.95 points

Frankfurt - DAX: UP 1.3 percent at 15,146.43

Paris - CAC 40: UP 1.1 percent at 7,093.77

EURO STOXX 50: UP 1.0 percent at 4,172.57

Tokyo - Nikkei 225: UP 0.3 percent at 27,476.87 (close)

Hong Kong - Hang Seng Index: DOWN 1.8 percent at 19,567.69 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,248.97 (close)

New York - Dow: UP 0.4 percent at 32,237.53 (close)

Euro/dollar: UP at $1.0767 from $1.0760 on Friday

Pound/dollar: UP at $1.2256 from $1.2233

Euro/pound: DOWN at 87.86 pence from 87.95 pence

Dollar/yen: UP at 131.42 yen from 130.73 yen

Brent North Sea crude: UP 0.5 percent at $75.33 per barrel

West Texas Intermediate: UP 0.5 percent at $69.58 per barrel

P.Costa--AMWN