-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

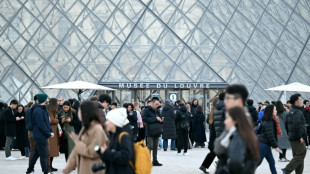

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

European stock markets drop, Shanghai extends gains

European stock markets dropped on Wednesday as traders reacted to more mixed earnings and weak German data, while Shanghai extended a rally on measures aimed at supporting China's ailing economy.

Analysts said sentiment was hit also by expectations that the Federal Reserve was unlikely to cut US interest rates as soon as March, as inflation stays high.

In Europe, official data Wednesday showed industrial production in Germany fell for a seventh straight month in December, capping a year of manufacturing weakness in Europe's largest economy.

Frankfurt's DAX index was down 0.3 percent in midday trading, while Paris and London were also lower.

In Asia, announcements this week out of Beijing continued to light a fire under equities in Shanghai, though Hong Kong succumbed to profit taking.

Observers warned that Chinese measures aimed at shoring up its economy would not be enough to revive confidence among weary investors, adding that much more need was needed to address a property-sector debt crisis.

Saxo Capital Markets' Charu Chanana said "the effect may be temporary as all these are band-aid measures that cannot fix the structural issues that China is facing from property sector to lack of productivity".

Central Huijin Investment -- the unit that holds Chinese government stakes in major financial institutions -- said it would increase investments in funds.

China's Securities Regulatory Commission meanwhile called on listed firms to ramp up share buybacks, a move that typically boosts stock prices.

Following this, Chinese state media on Wednesday reported that Beijing had removed the head of the CSRC.

Elsewhere on markets, Wall Street chalked up small gains Tuesday thanks to healthy corporate results, including from Spotify and data analytics firm Palantir, whose share price soared more than 30 percent on optimism over its artificial intelligence offerings.

In Europe, TotalEnergies on Wednesday reported record-high annual profit, underpinned by performances in its liquefied natural gas and electricity divisions as the French giant continues to invest heavily in fossil fuel production.

Net profit came in at $21.4 billion for 2023, up four percent on a year earlier.

TotalEnergies' share price slid 3.0 percent, however, with the profit total falling short of market expectations.

Investors globally remain on edge over a range of other issues, including wars in Ukraine and the Middle East and China-US tensions.

"We saw some turbulence in January, and we aren't out of the woods with inflation yet. So, while the trends remain positive, risks could increase over the next couple of months," said Brad McMillan at broker Commonwealth Financial Network.

- Key figures around 1145 GMT -

London - FTSE 100: DOWN 0.3 percent at 7,655.64 points

Paris - CAC 40: DOWN 0.1 percent at 7,629.97

Frankfurt - DAX: DOWN 0.3 percent at 16,988.26

EURO STOXX 50: DOWN 0.1 percent at 4,684.60

Tokyo - Nikkei 225: DOWN 0.1 percent at 36,119.92 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 16,081.89 (close)

Shanghai - Composite: UP 1.4 percent at 2,829.70 (close)

New York - Dow: UP 0.4 percent at 38,521.36 (close)

Euro/dollar: UP at $1.0769 from $1.0758 on Tuesday

Dollar/yen: UP at 148.02 yen from 147.91 yen

Pound/dollar: UP at $1.2634 from $1.2600

Euro/pound: DOWN at 85.26 pence from 85.36 pence

Brent North Sea Crude: UP 0.9 percent at $79.32 per barrel

West Texas Intermediate: UP 0.6 percent at $73.77 per barrel

burs-bcp/rfj/lth

S.F.Warren--AMWN