-

England seek their own Bradman in bid for historic Ashes comeback

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

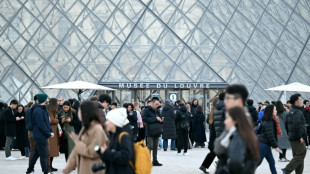

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

Stock markets mixed as investors digest corporate results

Global stock markets diverged on Wednesday as investors digested a mixed bag of corporate earnings and the likelihood that the US Federal Reserve would wait longer than hoped to cut interest rates.

Wall Street opened higher, with the broad-based S&P 500 nearing the 5,000-point mark.

US stocks rose after automaker Ford beat earnings estimates in results released Tuesday after the bell, while Chipotle Mexican Grill also exceeded market expectations.

Ford shares surged over three percent in early trading while Chipotle jumped seven percent.

The US markets rose despite concern over regional US lender New York Community Bancorp, whose shares were down eight percent after Moody's downgraded its credit rating.

"The broader stock market remains resilient to selling interest," said Briefing.com analyst Patrick O'Hare.

In Europe, however, London, Paris and Frankfurt were all in the red in afternoon trading.

In the UK, British housebuilder Barratt agreed to buy competitor Redrow for £2.5 billion ($3.2 billion) amid a housing market that has been hit by higher interest rates.

Shares in Barratt dived seven percent but Redrow surged more than 13 percent.

In Paris, shares in French oil and gas giant TotalEnergies were down three percent after it reported a net profit of $21.4 billion for last year, which was a new record but fell short of expectations.

Norwegian energy group Equinor took a bigger market beating, falling six percent in Oslo after reporting that its annual net profit plunged 59 percent to $11.9 billion on lower oil and gas prices.

The Frankfurt DAX was down after official data showed that industrial production in Germany fell for a seventh straight month in December, capping a year of manufacturing weakness in Europe's largest economy.

Investors were also mulling expectations that the Federal Reserve was unlikely to cut US interest rates as soon as March, as inflation stays high.

"Fed probabilities of a rate cut continue to get pushed out," said Nathan Peterson, director of derivatives analysis at the Schwab Center for Financial Research.

- Shanghai surge -

In Asia, announcements this week out of Beijing continued to light a fire under equities in Shanghai, though Hong Kong succumbed to profit-taking.

Observers warned that Chinese measures aimed at shoring up its economy would not be enough to revive confidence among weary investors, adding that much more need was needed to address a property-sector debt crisis.

Charu Chanana of Saxo Capital "the effect may be temporary as all these are band-aid measures that cannot fix the structural issues that China is facing from property sector to lack of productivity".

Central Huijin Investment, the unit that holds Chinese government stakes in major financial institutions, said it would increase investments in funds.

China's Securities Regulatory Commission meanwhile called on listed firms to ramp up share buybacks, a move that typically boosts stock prices.

Following this, Chinese state media on Wednesday reported that Beijing had removed the head of the CSRC.

- Key figures around 1455 GMT -

New York - Dow: UP 0.2 percent at 38,586.78 points

New York - S&P 500: UP 0.4 percent at 4,972.31

New York - Nasdaq Composite: UP 0.3 percent at 15,662.71

London - FTSE 100: DOWN 0.5 percent at 7,642.54

Paris - CAC 40: DOWN 0.2 percent at 7,623.72

Frankfurt - DAX: DOWN 0.5 percent at 16,946.56

EURO STOXX 50: DOWN 0.2 percent at 4,683.15

Tokyo - Nikkei 225: DOWN 0.1 percent at 36,119.92 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 16,081.89 (close)

Shanghai - Composite: UP 1.4 percent at 2,829.70 (close)

Euro/dollar: UP at $1.0767 from $1.0758 on Tuesday

Dollar/yen: DOWN at 147.86 yen from 147.91 yen

Pound/dollar: UP at $1.2633 from $1.2600

Euro/pound: DOWN at 85.27 pence from 85.36 pence

Brent North Sea Crude: UP 0.5 percent at $78.98 per barrel

West Texas Intermediate: UP 0.5 percent at $73.69 per barrel

burs-lth/js

Ch.Havering--AMWN