-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

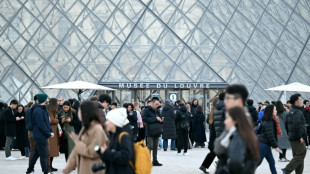

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

Asian markets mixed after Wall St record, Shanghai extends rally

Asian stocks were mixed Thursday following another record on Wall Street, with strong earnings, a resilient US economy and Chinese moves to boost the country's markets playing up against fading hopes for an early Federal Reserve interest rate cut.

Fresh comments from US monetary policymakers pushing back against reducing borrowing costs too early were unable to overshadow a string of forecast-beating reports from top firms this season including Amazon and Facebook parent Meta.

With traders now resigned to fewer rate cuts this year, they are also focusing on readings showing that US growth remained on track and jobs were still being created, all as inflation came down.

In the latest moves to temper bets on a dovish Fed pivot, the bank's Richmond president Tom Barkin said he was "very supportive of being patient" on announcing the first reduction, citing the strong metrics.

And governor Adriana Kugler added that she wanted to wait until more data was available before moving.

While figures continue to show the inflation battle is being won, decision-makers are reluctant to cut too early in case prices bounce back.

Still, New York traders were in a good mood, helped by healthy results from Disney, auto giant Ford and Chipotle Mexican Grill.

That helped the S&P 500 push to a new all-time high within a whisker of the 5,000-point mark, while the Nasdaq and Dow were also well up.

"Higher rates don't appear to burden consumers or corporations significantly, enabling the Fed to wait longer to ensure inflation control without disrupting the stock market's momentum," said Stephen Innes at SPI Asset Management.

"It's becoming increasingly evident that equities are unfazed and indifferent to the Federal Reserve's less dovish stance, which suggests that unless there is a substantial deterioration in the labour market, the central bank's baseline expectation for 2024 includes three rate cuts."

Asia fluctuated, though Shanghai was again sharply higher heading into the Lunar New Year break.

The market built on the almost five percent gains over the previous two days as investors cheered a number of pledges from Beijing to staunch a long-running rout.

- 'A new broom' -

There was also positive reaction to news that the chairman of China's securities regulator, Yi Huiman, had been replaced after overseeing a sell-off that has wiped trillions off companies' valuations.

He will be replaced by banking veteran Wu Qing.

"This is long overdue in my opinion, if one chief cannot do the job, then maybe we should give someone else a chance," Jiang Liangqing, of Zhuhai Greenbamboo Private Fund Management, said.

"At the minimum, a new broom sweeps clean and he could be more bold in taking action instead of just words."

Shujin Chen of Jefferies Financial Group added that the decision "signals more attention to capital markets" by President Xi Jinping.

The announcement follows a series of measures and pledges aimed at boosting confidence on trading floors, including curbs on short-selling purchases by state-owned enterprises and share-buying by China's "national team".

Still, observers warned the moves would not solve the country's deeper economic problems -- particularly in the property sector -- which needed to be addressed to fully restore optimism.

Data showing China's consumer prices fell for a fourth straight month in January -- and at the sharpest pace since 2009 -- highlighted the hard work leaders face in turning the ship around.

There were also gains in Tokyo, Sydney, Seoul and Manila, though Singapore, Mumbai, Bangkok and Wellington dropped.

Hong Kong was dealt a blow lower by a more than six percent dive in market heavyweight Alibaba, which was hit by a worse-than-expected earnings report that overshadowed a huge stock buyback.

- Key figures around 0700 GMT -

Tokyo - Nikkei 225: UP 2.1 percent at 36,863.28 (close)

Hong Kong - Hang Seng Index: DOWN 1.5 percent at 15,848.25

Shanghai - Composite: UP 1.3 percent at 2,865.90 (close)

Dollar/yen: UP at 148.75 yen from 148.16 yen on Wednesday

Pound/dollar: UP at $1.2630 from $1.2628

Euro/dollar: UP at $1.0783 from $1.0777

Euro/pound: UP at 85.37 pence from 85.32 pence

West Texas Intermediate: UP 0.5 percent at $74.26 per barrel

Brent North Sea Crude: UP 0.6 percent at $79.65 per barrel

New York - Dow: UP 0.4 percent at 38,677.36 points (close)

London - FTSE 100: DOWN 0.7 percent at 7,628.75 (close)

M.Thompson--AMWN