-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

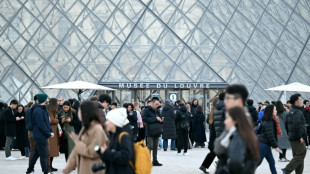

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

Shipping giant Maersk's profit sinks, warns of Red Sea risk

Shares in shipping giant Maersk dived on Thursday after it warned of an uncertain 2024 earnings outlook linked to an oversupply of container vessels and Yemeni rebel attacks in the Red Sea.

The downbeat forecast came after its 2023 earnings were hit by overcapacity in the shipping sector, which caused a drop in freight rates.

The group reported a more than sevenfold drop in its net profit last year to $3.8 billion, compared to $29.2 billion in 2022.

Its revenue reached $51 billion compared to $81.5 billion the previous year.

Freight rates had soared in 2022 due to capacity shortages amid high demand following the end of Covid pandemic restrictions.

"The high demand eventually started to normalise as congestions eased and consumer demand declined leading to an inventory overhang," Maersk said in its earnings report.

This "correction" resulted "in rapid and steep declines in shipped volumes and rates" starting at the end of the third quarter of 2022, it added.

The "oversupply challenges" in the maritime shipping industry are expected to "materialise fully" over the course of 2024, Maersk said.

The group lowered its 2024 forecast for its core profit -- earnings before interest, tax, depreciation and amortisation -- to a range of between $1.0 billion and $6.0 billion.

"High uncertainty remains around the duration and degree of the Red Sea disruption, with the duration from one quarter to full year reflected in the guidance range," Maersk said.

Maersk's stock price sank more than 13 percent on the Copenhagen stock exchange after the release of the earnings report, which also included the announcement of the suspension of its share buyback plan.

Chairman Robert Maersk Uggla and CEO Vincent Clerc said in the earnings report that "2023 ended with multiple distressing attacks on cargo ships in the Red Sea and the Gulf of Aden".

They noted that two of the company's ships had been targeted.

"We are horrified by the escalation of this unfortunate conflict," they said.

Maersk and other shipping companies have redirected ships away from the Red Sea, taking the longer and costlier route around the southern tip of Africa.

The Red Sea usually carries about 12 percent of global maritime trade.

- 'Price pressure' -

Yemen's Iran-backed Huthi rebels have harassed ships travelling through the Red Sea since November.

They say they are targeting vessels linked to Israel, the United States and Britain, to show support for Palestinians in the war in Gaza.

Their attacks have triggered reprisals by US and British forces.

The Huthis have either attacked or threatened commercial vessels more than 40 times since November 19, according to the Pentagon.

Maersk reported a loss of $456 million in the last three months of 2023, with sales dropping 34 percent to $17.8 billion compared to the same period in 2022.

In a separate statement, Clerc said: "While the Red Sea crisis has caused immediate capacity constraints and a temporary increase in rates, eventually the oversupply in shipping capacity will lead to price pressure and impact our results."

Maersk also announced it would spin off its towage business, Svitzer, as a separate listed company.

D.Cunningha--AMWN