-

Leo XIV gets down to business on first full week as pope

Leo XIV gets down to business on first full week as pope

-

White at the double as Whitecaps fight back against LAFC

-

Trump hails Air Force One 'gift' after Qatari luxury jet reports

Trump hails Air Force One 'gift' after Qatari luxury jet reports

-

'Tool for grifters': AI deepfakes push bogus sexual cures

-

US and China to publish details of 'substantial' trade talks in Geneva

US and China to publish details of 'substantial' trade talks in Geneva

-

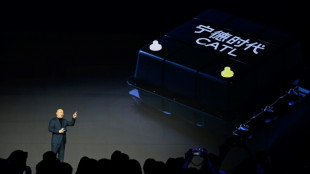

Chinese EV battery giant CATL aims to raise $4 bn in Hong Kong IPO

-

Kiwi Fox wins PGA Myrtle Beach title in playoff

Kiwi Fox wins PGA Myrtle Beach title in playoff

-

Thunder edge Nuggets to level NBA playoff series

-

Straka holds firm to win PGA Tour's Truist Championship

Straka holds firm to win PGA Tour's Truist Championship

-

Philippines heads to polls with Marcos-Duterte feud centre stage

-

Napoli give Inter Scudetto hope after being held by Genoa

Napoli give Inter Scudetto hope after being held by Genoa

-

US, China hail 'substantial progress' after trade talks in Geneva

-

Blessings but not tips from Pope Leo at Peru diner

Blessings but not tips from Pope Leo at Peru diner

-

Alcaraz, Zverev march into Italian Open last 16

-

US and China hail 'progress' after trade talks end in Geneva

US and China hail 'progress' after trade talks end in Geneva

-

Jeeno keeps cool to win LPGA's Americas Open

-

Hamas to release hostage as part of direct Gaza talks with US

Hamas to release hostage as part of direct Gaza talks with US

-

Marvel's 'Thunderbolts*' retains top spot in N.America box office

-

Parade, protests kick off Eurovision Song Contest week

Parade, protests kick off Eurovision Song Contest week

-

Forest owner Marinakis says Nuno row due to medical staff's error

-

Hamas officials say group held direct Gaza ceasefire talks with US

Hamas officials say group held direct Gaza ceasefire talks with US

-

Zelensky offers to meet Putin in Turkey 'personally'

-

Inter beat Torino and downpour to move level with Napoli

Inter beat Torino and downpour to move level with Napoli

-

'Not nice' to hear Alexander-Arnold booed by Liverpool fans: Robertson

-

'We'll defend better next season': Barca's Flick after wild Clasico win

'We'll defend better next season': Barca's Flick after wild Clasico win

-

Trump urges Ukraine to accept talks with Russia

-

Amorim warns Man Utd losing 'massive club' feeling after Hammers blow

Amorim warns Man Utd losing 'massive club' feeling after Hammers blow

-

Complaint filed over 'throat-slitting gesture' at Eurovision protests: Israeli broadcaster

-

Newcastle win top-five showdown with Chelsea, Arsenal rescue Liverpool draw

Newcastle win top-five showdown with Chelsea, Arsenal rescue Liverpool draw

-

Departing Alonso says announcement on next move 'not far' away

-

Arsenal hit back to rescue valuable draw at Liverpool

Arsenal hit back to rescue valuable draw at Liverpool

-

Pakistan's Kashmiris return to homes, but keep bunkers stocked

-

Postecoglou hopeful over Kulusevski injury ahead of Spurs' Europa final

Postecoglou hopeful over Kulusevski injury ahead of Spurs' Europa final

-

Washington hails 'substantive progress' after trade talks with China

-

Barca edge Real Madrid in thriller to move to brink of Liga title

Barca edge Real Madrid in thriller to move to brink of Liga title

-

Albanians vote in election seen as key test of EU path

-

Forest owner Marinakis confronts Nuno after draw deals Champions League blow

Forest owner Marinakis confronts Nuno after draw deals Champions League blow

-

Dortmund thump Leverkusen to spoil Alonso's home farewell

-

Pedersen sprints back into Giro pink after mountain goat incident

Pedersen sprints back into Giro pink after mountain goat incident

-

Zverev cruises into Rome last 16, Sabalenka battles past Kenin

-

Newcastle win top-five showdown with Chelsea, Forest held to damaging draw

Newcastle win top-five showdown with Chelsea, Forest held to damaging draw

-

Iran says nuclear talks 'difficult but useful', US 'encouraged'

-

Zarco first home winner of French MotoGP since 1954

Zarco first home winner of French MotoGP since 1954

-

Taliban govt suspends chess in Afghanistan over gambling

-

Eduan, Simbine shine at world relays

Eduan, Simbine shine at world relays

-

Washington 'optimistic' amid trade talks with China

-

Tonali sinks 10-man Chelsea as Newcastle win top five showdown

Tonali sinks 10-man Chelsea as Newcastle win top five showdown

-

Ukraine says will meet Russia for talks if it agrees to ceasefire

-

India's worst-hit border town sees people return after ceasefire

India's worst-hit border town sees people return after ceasefire

-

Pope Leo XIV warns of spectre of global war in first Sunday address

Markets mostly down ahead of key US data

Most Asian and European markets were down Tuesday, after a weak lead from Wall Street and with all eyes on key US inflation data due later in the trading day.

Tokyo closed down by nearly two percent, though Hong Kong was up more than one percent by the end of trade.

Shanghai also posted gains, while Seoul, Taipei, Sydney and Singapore were all in the red. Jakarta eked out small gains.

In Europe, London dipped 0.8 percent at the open, while Paris and Frankfurt were both down by just under two percent.

This followed a weak Monday performance from Wall Street and Europe, with sentiment souring on flat UK economic growth and expectations for another strong US inflation report, which will likely bring aggressive interest rate hikes from the Federal Reserve.

The government is set to release the US consumer price index (CPI) for March on Tuesday, after inflation rose 7.9 percent over the 12 months to February, the biggest increase in 40 years.

Calling it the "Putin price hike" in reference to the economic ramifications of Russia's invasion of Ukraine, White House Press Secretary Jen Psaki told reporters: "We expect March headline inflation to be extraordinarily elevated."

Economists are expecting annual US inflation to spike to nearly 8.5 percent, which would be the highest since late 1981.

"It's not really about the level of inflation anymore, as it has been well broadcast that CPI is hotter than hot," said Matt Simpson, senior market analyst at City Index. "The big question is how long it takes to come back down and whether the Fed will tip the US into a recession in doing so."

"What we're faced with this year is stagflation," Kathryn Rooney Vera, head of global macro research at Bulltick LLC, told Bloomberg Television.

"It's a very complicated environment that the Fed has found itself in", and the market is pricing in potentially 50 basis points of hikes at each of the next two policy meetings, she added.

US Treasuries declined, taking the 10-year yield past 2.80 percent.

All those concerns were weighing on the Tokyo market, Okasan Online Securities said in a note.

"Investors will then likely refrain from making major moves ahead of the release of the March US consumer prices data later in the day. The market will likely lose a sense of clear direction" until the data's release, the brokerage said.

"The Chinese government gave out its first online game approvals in months," noted Jeffrey Halley, senior markets analyst at OANDA, in relation to the gains in Hong Kong and Shanghai.

The approvals were for the first batch of new video game licences since July, a step that could ease some of the worst concerns about Beijing's gaming-sector curbs.

But "sentiment hasn't been helped by the latest Covid extended lockdown measures being initiated by Chinese authorities in Shanghai in what is likely to be a fruitless attempt to stem the spread of the more contagious Omicron variant", said Michael Hewson, chief market analyst at CMC Markets UK.

Oil steadied, with Brent crude back just over $100 a barrel, after a tumble that erased most of the commodity's gains sparked by Russia's war in Ukraine.

Stephen Innes of SPI Asset Management attributed the rise to a partial lifting of restrictions in Shanghai "easing concerns around Chinese oil demand".

He added: "Sort of the light-at-the-end-of-the-tunnel trade, but oil bulls have fingers crossed that light isn't a Chinese Covid freight train at the other end of the tunnel."

- Key figures around 0810 GMT -

Tokyo - Nikkei 225: DOWN 1.81 percent at 26,334.98 (close)

Hong Kong - Hang Seng Index: UP 0.52 percent at 21,319.13 (close)

Shanghai - Composite: UP 1.46 percent at 3,213.33 (close)

London - FTSE 100: DOWN 0.81 percent at 7,556.88

Brent North Sea crude: UP 2.42 percent at $100.86 per barrel

West Texas Intermediate: UP 2.53 percent at $96.68 per barrel

Euro/dollar: DOWN at $1.0864 from $1.0871

Pound/dollar: DOWN at $1.3006 from $1.3021

Euro/pound: UP at 83.53 pence from 83.49 pence

Dollar/yen: UP at 125.61 yen from 125.40

New York - Dow: DOWN 1.19 percent at 34,308.08 (close)

-- Bloomberg News contributed to this report --

B.Finley--AMWN