-

Leo XIV urges release of jailed journalists as Zelensky invites to Ukraine

Leo XIV urges release of jailed journalists as Zelensky invites to Ukraine

-

Film legend Bardot backs Depardieu ahead of sexual assault verdict

-

Mbappe shows fallen Real Madrid new road to riches

Mbappe shows fallen Real Madrid new road to riches

-

Drones hit Ukraine as Zelensky awaits Putin reply on talks

-

Indian great Kohli follows Rohit in retiring from Test cricket

Indian great Kohli follows Rohit in retiring from Test cricket

-

UK hosts European ministers for Ukraine talks amid ceasefire call

-

Copenhagen to offer giveaways to eco-friendly tourists

Copenhagen to offer giveaways to eco-friendly tourists

-

Ocalan: founder of the Kurdish militant PKK who authored its end

-

Kurdish militant PKK says disbanding, ending armed struggle

Kurdish militant PKK says disbanding, ending armed struggle

-

Under pressure, UK govt unveils flagship immigration plans

-

India great Virat Kohli retires from Test cricket

India great Virat Kohli retires from Test cricket

-

US, China agree to slash tariffs in trade war de-escalation

-

Markets rally after China and US slash tariffs for 90 days

Markets rally after China and US slash tariffs for 90 days

-

India, Pakistan military to confer as ceasefire holds

-

Kurdish militant group PKK says disbanding, ending armed struggle

Kurdish militant group PKK says disbanding, ending armed struggle

-

Virat Kohli: Indian batting great and hero to hundreds of millions

-

India great Virat Kohli announces retirement from Test cricket

India great Virat Kohli announces retirement from Test cricket

-

Netanyahu vows further fighting despite planned US-Israeli hostage release

-

Salt of the earth: Pilot project helping reclaim Sri Lankan farms

Salt of the earth: Pilot project helping reclaim Sri Lankan farms

-

UK towns harness nature to combat rising flood risk

-

Romania's far-right candidate clear favourite in presidential run-off

Romania's far-right candidate clear favourite in presidential run-off

-

UK lab promises air-con revolution without polluting gases

-

Reel tensions: Trump film trade war looms over Cannes

Reel tensions: Trump film trade war looms over Cannes

-

Peru hopes local miracle gets recognition under new pope

-

Opening statements in Sean Combs trial expected Monday

Opening statements in Sean Combs trial expected Monday

-

Indian army reports 'first calm night' after Kashmir truce with Pakistan holds

-

As world heats up, UN cools itself the cool way: with water

As world heats up, UN cools itself the cool way: with water

-

Pacers push Cavs to brink in NBA playoffs, Thunder pull even with Nuggets

-

US, China to publish details of 'substantial' trade talks in Geneva

US, China to publish details of 'substantial' trade talks in Geneva

-

Asian markets rally after positive China-US trade talks

-

Indians buy 14 million ACs a year, and need many more

Indians buy 14 million ACs a year, and need many more

-

Election campaigning kicks off in South Korea

-

UK hosts European ministers for Ukraine talks after ceasefire ultimatum

UK hosts European ministers for Ukraine talks after ceasefire ultimatum

-

Leo XIV gets down to business on first full week as pope

-

White at the double as Whitecaps fight back against LAFC

White at the double as Whitecaps fight back against LAFC

-

Trump hails Air Force One 'gift' after Qatari luxury jet reports

-

'Tool for grifters': AI deepfakes push bogus sexual cures

'Tool for grifters': AI deepfakes push bogus sexual cures

-

US and China to publish details of 'substantial' trade talks in Geneva

-

Chinese EV battery giant CATL aims to raise $4 bn in Hong Kong IPO

Chinese EV battery giant CATL aims to raise $4 bn in Hong Kong IPO

-

Gryphon Digital Mining Announces Merger with American Bitcoin

-

Genflow Biosciences PLC Announces Holding(s) in Company

Genflow Biosciences PLC Announces Holding(s) in Company

-

Funding for Colosseum Project

-

AbTherx and Spice Biotechnologies Announce Multi-Program Antibody Discovery Collaboration

AbTherx and Spice Biotechnologies Announce Multi-Program Antibody Discovery Collaboration

-

Agronomics Limited Announces Net Asset Value Calculation as at 31 March 2025

-

Kiwi Fox wins PGA Myrtle Beach title in playoff

Kiwi Fox wins PGA Myrtle Beach title in playoff

-

Thunder edge Nuggets to level NBA playoff series

-

Straka holds firm to win PGA Tour's Truist Championship

Straka holds firm to win PGA Tour's Truist Championship

-

Philippines heads to polls with Marcos-Duterte feud centre stage

-

Napoli give Inter Scudetto hope after being held by Genoa

Napoli give Inter Scudetto hope after being held by Genoa

-

US, China hail 'substantial progress' after trade talks in Geneva

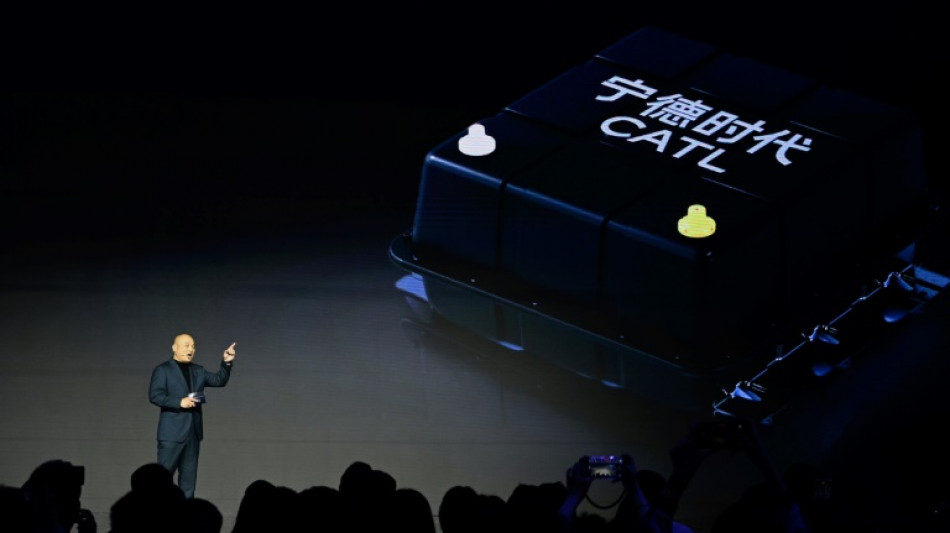

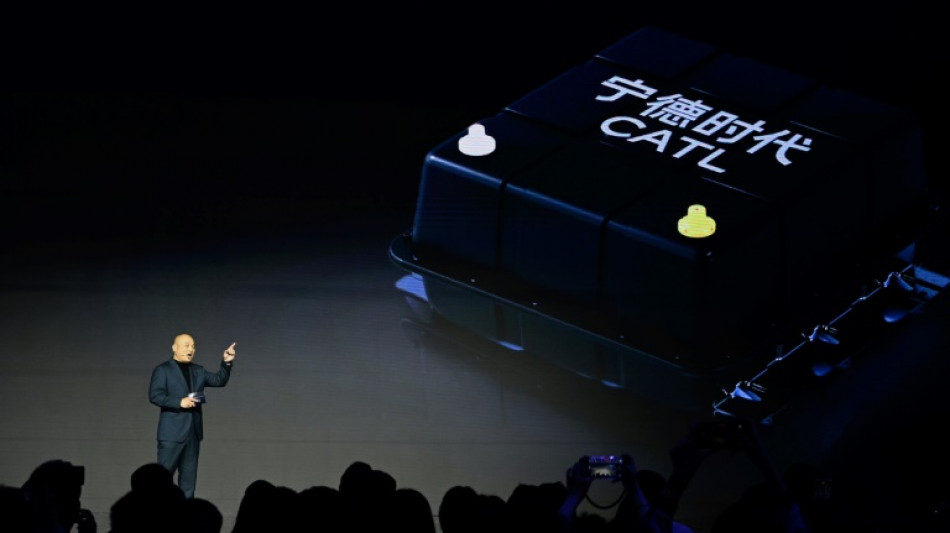

Chinese EV battery giant CATL aims to raise $4 bn in Hong Kong IPO

Chinese EV battery giant CATL aims to raise $4 billion in its Hong Kong listing scheduled for May 20, said a statement filed to the bourse Monday, making it the largest IPO expected in the city so far this year.

A global leader in the sector, CATL produces more than a third of all electric vehicle (EV) batteries sold worldwide, working with major brands including Tesla, Mercedes-Benz, BMW and Volkswagen.

The company is already listed in Shenzhen, and its plan for a secondary listing in Hong Kong was announced in a December filing with the stock exchange.

According to a prospectus filed Monday, CATL will offer approximately 117.9 million units priced at up to HK$263 per share ($33.8) for total expected proceeds of HK$31.01 billion.

The listing is set to take place next Tuesday (May 20).

Cornerstone investors, including Sinopec and Kuwait Investment Authority, agreed to buy shares worth HK$2.62 billion, the prospectus shows.

Founded in 2011 in the eastern Chinese city of Ningde, Contemporary Amperex Technology Co., Limited (CATL) was initially propelled to success by rapid growth in the domestic market.

But the world's largest EV market has more recently begun to show signs of flagging sales amid a broader slowdown in consumption.

The trends have fuelled a fierce price war in China's expansive EV sector, putting smaller firms under huge pressure to compete while remaining financially viable.

But CATL continues to post solid performances, with its net profit jumping 32.9 percent in the first quarter.

Funds raised from a secondary listing could be used to accelerate CATL's overseas expansion, particularly in Europe.

The battery giant is building its second factory on the continent in Hungary after launching its first in Germany in January 2023.

In December, CATL announced that it would work with automotive giant Stellantis on a $4.3 billion factory to make EV batteries in Spain, with production slated to begin by the end of 2026.

- 'Military-linked company' -

Earlier analysts said CATL's float could be a blockbuster initial public offering that could boost Hong Kong's fortunes as a listing hub.

Hong Kong's stock exchange is eager for the return of big-name Chinese listings in hopes of regaining its crown as the world's top IPO venue.

The Chinese finance hub saw a steady decline in new offerings since Beijing's regulatory crackdown starting in 2020 led some Chinese mega-companies to put their plans on hold.

In a list issued in January by the US Defense Department, CATL was designated as a "Chinese military company".

The United States House Select Committee on the Chinese Communist Party highlighted this inclusion in letters to two American banks in April, urging them to withdraw from the IPO deal with the "Chinese military-linked company".

But the two American banks -- JPMorgan and Bank of America -- are still on the deal.

Beijing has denounced the list as "suppression", while CATL denied engaging "in any military related activities".

According to Bloomberg, CATL plans to make the deal as a "Reg S" offering, which doesn't allow sales to US onshore investors, limiting the company's exposure to legal risks in the United States.

L.Harper--AMWN