-

Indian army reports 'first calm night' after Kashmir truce with Pakistan holds

Indian army reports 'first calm night' after Kashmir truce with Pakistan holds

-

As world heats up, UN cools itself the cool way: with water

-

Pacers push Cavs to brink in NBA playoffs, Thunder pull even with Nuggets

Pacers push Cavs to brink in NBA playoffs, Thunder pull even with Nuggets

-

US, China to publish details of 'substantial' trade talks in Geneva

-

Asian markets rally after positive China-US trade talks

Asian markets rally after positive China-US trade talks

-

Indians buy 14 million ACs a year, and need many more

-

Election campaigning kicks off in South Korea

Election campaigning kicks off in South Korea

-

UK hosts European ministers for Ukraine talks after ceasefire ultimatum

-

Leo XIV gets down to business on first full week as pope

Leo XIV gets down to business on first full week as pope

-

White at the double as Whitecaps fight back against LAFC

-

Trump hails Air Force One 'gift' after Qatari luxury jet reports

Trump hails Air Force One 'gift' after Qatari luxury jet reports

-

'Tool for grifters': AI deepfakes push bogus sexual cures

-

US and China to publish details of 'substantial' trade talks in Geneva

US and China to publish details of 'substantial' trade talks in Geneva

-

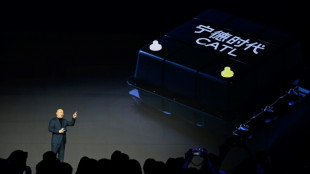

Chinese EV battery giant CATL aims to raise $4 bn in Hong Kong IPO

-

Kiwi Fox wins PGA Myrtle Beach title in playoff

Kiwi Fox wins PGA Myrtle Beach title in playoff

-

Thunder edge Nuggets to level NBA playoff series

-

Straka holds firm to win PGA Tour's Truist Championship

Straka holds firm to win PGA Tour's Truist Championship

-

Philippines heads to polls with Marcos-Duterte feud centre stage

-

Napoli give Inter Scudetto hope after being held by Genoa

Napoli give Inter Scudetto hope after being held by Genoa

-

US, China hail 'substantial progress' after trade talks in Geneva

-

Blessings but not tips from Pope Leo at Peru diner

Blessings but not tips from Pope Leo at Peru diner

-

Alcaraz, Zverev march into Italian Open last 16

-

US and China hail 'progress' after trade talks end in Geneva

US and China hail 'progress' after trade talks end in Geneva

-

Jeeno keeps cool to win LPGA's Americas Open

-

Hamas to release hostage as part of direct Gaza talks with US

Hamas to release hostage as part of direct Gaza talks with US

-

Marvel's 'Thunderbolts*' retains top spot in N.America box office

-

Parade, protests kick off Eurovision Song Contest week

Parade, protests kick off Eurovision Song Contest week

-

Forest owner Marinakis says Nuno row due to medical staff's error

-

Hamas officials say group held direct Gaza ceasefire talks with US

Hamas officials say group held direct Gaza ceasefire talks with US

-

Zelensky offers to meet Putin in Turkey 'personally'

-

Inter beat Torino and downpour to move level with Napoli

Inter beat Torino and downpour to move level with Napoli

-

'Not nice' to hear Alexander-Arnold booed by Liverpool fans: Robertson

-

'We'll defend better next season': Barca's Flick after wild Clasico win

'We'll defend better next season': Barca's Flick after wild Clasico win

-

Trump urges Ukraine to accept talks with Russia

-

Amorim warns Man Utd losing 'massive club' feeling after Hammers blow

Amorim warns Man Utd losing 'massive club' feeling after Hammers blow

-

Complaint filed over 'throat-slitting gesture' at Eurovision protests: Israeli broadcaster

-

Newcastle win top-five showdown with Chelsea, Arsenal rescue Liverpool draw

Newcastle win top-five showdown with Chelsea, Arsenal rescue Liverpool draw

-

Departing Alonso says announcement on next move 'not far' away

-

Arsenal hit back to rescue valuable draw at Liverpool

Arsenal hit back to rescue valuable draw at Liverpool

-

Pakistan's Kashmiris return to homes, but keep bunkers stocked

-

Postecoglou hopeful over Kulusevski injury ahead of Spurs' Europa final

Postecoglou hopeful over Kulusevski injury ahead of Spurs' Europa final

-

Washington hails 'substantive progress' after trade talks with China

-

Barca edge Real Madrid in thriller to move to brink of Liga title

Barca edge Real Madrid in thriller to move to brink of Liga title

-

Albanians vote in election seen as key test of EU path

-

Forest owner Marinakis confronts Nuno after draw deals Champions League blow

Forest owner Marinakis confronts Nuno after draw deals Champions League blow

-

Dortmund thump Leverkusen to spoil Alonso's home farewell

-

Pedersen sprints back into Giro pink after mountain goat incident

Pedersen sprints back into Giro pink after mountain goat incident

-

Zverev cruises into Rome last 16, Sabalenka battles past Kenin

-

Newcastle win top-five showdown with Chelsea, Forest held to damaging draw

Newcastle win top-five showdown with Chelsea, Forest held to damaging draw

-

Iran says nuclear talks 'difficult but useful', US 'encouraged'

US stocks fall on latest hot inflation report; oil prices rise

Equity markets in Europe and New York fell Tuesday following another report showing red-hot US inflation, while oil prices pushed higher.

The consumer price index surged 8.5 percent in March compared with a year ago, the biggest jump since December 1981. CPI climbed 1.2 percent over February's level.

The report was the first to fully encompass the shock caused by Russia's invasion of Ukraine and Western sanctions against Moscow, which have caused energy and food prices to spike worldwide.

Higher prices for food, shelter and fuel are "likely forcing some people to do without," said economist Joel Naroff.

Though the Federal Reserve is poised to raise interest rates quickly to tamp down inflation pressures, the effects would not be immediate.

"Inflation should moderate, if only because some of the biggest increases are behind us. But there is a difference between decelerating and low," Naroff said.

"Since monetary (policy) works with a lag, don’t expect major progress on the inflation front even if the Fed acts aggressively."

US equities initially climbed on the inflation data, with some analysts appearing to view the report as corroborating "peak inflation" narrative based on the idea that pricing pressures will soon ease.

But stocks lost steam later in the session, with the S&P 500 finishing 0.3 percent lower. Some analysts pointed to nervousness heading into the earnings season.

Shares of large banks fell more than one percent ahead of quarterly results, which kick off Wednesday morning with JPMorgan Chase.

Analysts expect banks to report lower earnings compared with last year, when profits from were lifted by the release of funds set aside early in the pandemic in case of bad loans.

Meanwhile, European markets fell, with London's FTSE 100 ending the day down 0.6 percent. Frankfurt off 0.5 percent and Paris shedding 0.3 percent.

Oil prices advanced more than six percent, lifting US benchmark West Texas Intermediate back above $100 a barrel.

"The crude correction ended now that the market has mostly priced in the strategic petroleum release plan, China is beginning to lift some of their lockdowns and as negotiations between Russia and Ukraine appear to have hit a dead-end," said Oanda's Edward Moya.

"The energy market expects to remain very tight from the summer and if geopolitical risks remain elevated, $100 oil should easily hold."

- Key figures around 2040 GMT -

New York - Dow: DOWN 0.3 percent at 34,220.36 (close)

New York - S&P 500: DOWN 0.3 percent at 4,397.45 (close)

New York - Nasdaq: DOWN 0.3 percent at 13,371.57 (close)

London - FTSE 100: DOWN 0.6 percent at 7,576.66 (close)

Paris - CAC 40: DOWN 0.3 percent at 6,537.41 (close)

Frankfurt - DAX: DOWN 0.5 percent at 14,124.95 (close)

EURO STOXX 50: DOWN 0.2 percent at 3,831.47 (close)

Tokyo - Nikkei 225: DOWN 1.8 percent at 26,334.98 (close)

Hong Kong - Hang Seng Index: UP 0.5 percent at 21,319.13 (close)

Shanghai - Composite: UP 1.5 percent at 3,213.33 (close)

Brent North Sea crude: UP 6.3 percent at $104.64 per barrel

West Texas Intermediate: UP 6.7 percent at $100.60 per barrel

Euro/dollar: DOWN at $1.0832 from $1.0884 late Monday

Dollar/yen: DOWN at 125.33 yen from 125.37 yen

Pound/dollar: DOWN at $1.3002 from $1.3030

Euro/pound: DOWN at 83.28 pence from 83.53 pence

burs-jmb

S.F.Warren--AMWN