-

Tech researchers sue US Trump administration over visa bans

Tech researchers sue US Trump administration over visa bans

-

UK warplanes down drones in Middle East, conduct 'defensive' sorties for UAE

-

Australia grants asylum to Iran women footballers

Australia grants asylum to Iran women footballers

-

Djokovic suvives scare to reach Indian Wells last 16

-

Trump hints end of Iran war in sight, saying operations 'very complete'

Trump hints end of Iran war in sight, saying operations 'very complete'

-

McIlroy racing to be fit for Players defense

-

Slot's Liverpool ready for Galatasaray cauldron

Slot's Liverpool ready for Galatasaray cauldron

-

Barca must conquer 'best league in world' in Newcastle clash: Flick

-

Lebanon president accuses Hezbollah of working to 'collapse' state

Lebanon president accuses Hezbollah of working to 'collapse' state

-

Shipping giant MSC halts Gulf exports amid war risks

-

Europe can help Spurs improve, but Premier League priority: Tudor

Europe can help Spurs improve, but Premier League priority: Tudor

-

EU lawmakers back 'return hubs' for migrants

-

Trump's limited options to curb Iran war oil price surge

Trump's limited options to curb Iran war oil price surge

-

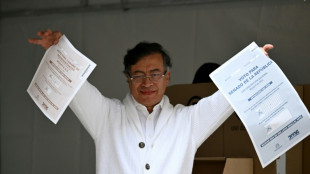

Colombia's left boosted by legislative vote

-

Patrick Halgren: America's greatest showman at the Paralympics

Patrick Halgren: America's greatest showman at the Paralympics

-

Four years after banning Russia, FIFA and IOC passive in the face of war

-

UK finance minister warns of higher inflation amid Iran war

UK finance minister warns of higher inflation amid Iran war

-

Iraq coach calls for World Cup playoff to be re-scheduled

-

Germany's Max Kanter sprints to Paris-Nice second stage win

Germany's Max Kanter sprints to Paris-Nice second stage win

-

France, allies preparing bid to 'gradually' reopen Strait of Hormuz

-

Anthropic takes Trump administration to court over Pentagon row

Anthropic takes Trump administration to court over Pentagon row

-

Antarctic sea ice improves after four years of extreme lows: US scientists

-

Beating Barca would make us Newcastle legends: Howe

Beating Barca would make us Newcastle legends: Howe

-

Iran war sends crude prices soaring as Khamenei son takes charge

-

Zelensky says 11 countries asking Ukraine for drone help against Iran

Zelensky says 11 countries asking Ukraine for drone help against Iran

-

France, allies preparing 'defensive' mission to reopen Strait of Hormuz: Macron

-

Ships brandish China-links to weave through Strait of Hormuz

Ships brandish China-links to weave through Strait of Hormuz

-

Trump says Australia will grant asylum to Iran women footballers

-

War in the Middle East: economic impact around the world

War in the Middle East: economic impact around the world

-

Huge numbers at imminent risk from S.Sudan army offensive: MSF

-

G7 'not there yet' on release of oil reserves: French minister

G7 'not there yet' on release of oil reserves: French minister

-

Live Nation settles antitrust case with US Justice Dept, states object

-

EU lawmakers set to greenlight 'return hubs' for migrants

EU lawmakers set to greenlight 'return hubs' for migrants

-

Macron says France, allies preparing 'defensive' mission to reopen Strait of Hormuz

-

Water emerges as a dangerous new war target

Water emerges as a dangerous new war target

-

Scotland locks Cummings and Brown ruled out of Ireland Six Nations clash

-

Stocks slide as oil soars past $100 on Mideast war

Stocks slide as oil soars past $100 on Mideast war

-

NATO intercepts second Iran missile in Turkish airspace: Ankara

-

South Korea squeeze into World Baseball Classic quarter-finals

South Korea squeeze into World Baseball Classic quarter-finals

-

Premier League teams are faster: Atletico's Simeone on Spurs clash

-

North Korea cancels Pyongyang international marathon: tour agency

North Korea cancels Pyongyang international marathon: tour agency

-

Ukrainian bank worker detained by Hungary was forcibly medicated: Kyiv

-

Macron discusses security in Cyprus, plans aircraft carrier visit

Macron discusses security in Cyprus, plans aircraft carrier visit

-

UK PM Starmer says 'monitoring' economic impact of Iran war

-

Stranded Iran sailors put Sri Lanka, India in diplomatic dilemma

Stranded Iran sailors put Sri Lanka, India in diplomatic dilemma

-

Bangladesh scraps light displays as Mideast war worsens fuel crunch

-

Stocks tumble, oil soars past $100 on Mideast war

Stocks tumble, oil soars past $100 on Mideast war

-

Iran war sends oil price soaring as Khamenei son takes charge

-

Incensed North Korea briefly refuse to play in bitter Asian Cup loss

Incensed North Korea briefly refuse to play in bitter Asian Cup loss

-

Landmark trial opens for Turkish opposition champion Imamoglu

Stock markets drift lower as US jobs data looms

Equities fell Friday as traders prepared for the release of US jobs data that could play a key role in the Federal Reserve's decision-making on interest rates, with several officials indicating the cutting has finished for now.

Markets have started the year cautiously, with the optimism that characterised most of the past three months dented by concerns about Donald Trump's coming presidency and the US central bank's hawkish pivot on monetary policy.

With Wall Street closed for a national day of mourning for late former president Jimmy Carter, there were few major catalysts to drive business at the end of a broadly dour week in Asia.

Tokyo, Hong Kong, Shanghai, Sydney, Singapore, Seoul, Taipei, Wellington, Bangkok and Manila fell, while Mumbai and Jakarta edged up.

London dipped at the open, while Frankfurt and Paris were flat.

Friday's non-farm payrolls report is expected to show a slowdown in jobs creation in December, though still at a healthy enough pace to suggest the labour market remains in rude health.

Still, the Fed indicated last month it will cut rates just twice this year -- down from the four previously flagged -- owing to sticky inflation.

That came as speculation began swirling that Trump's plans to slash taxes, regulations and immigration, and impose harsh tariffs on imports, would reignite prices.

And several Fed officials have since lined up to warn they would be keen to take it easy on easing policy this year.

Boston Fed president Susan Collins said "considerable uncertainty" meant a slower pace of reduction would be warranted, adding that borrowing costs were in the right place for now and could be held for longer "if there is little further progress on inflation".

And Fed Governor Michelle Bowman acknowledged that while she backed last month's reduction, she could have been persuaded against it.

"Given the lack of continued progress on lowering inflation and the ongoing strength in economic activity and in the labour market, I could have supported taking no action at the December meeting," she said.

Kansas City boss Jeff Schmid said policy could already be at its ideal zone, while his Philadelphia counterpart Patrick Harker wanted to base his decision on incoming data.

Regan Capital chief investment officer Skyler Weinand said the Fed was "worried about the incoming administration".

He told Bloomberg Television that the growing US fiscal deficit and healthy consumer spending could result in "higher interest rates for the next five to 10 years".

On currency markets, the pound remained under pressure after Thursday saw it hit levels not seen since late 2023, although it remains under pressure on worries about the UK economy amid talk the government might have to make spending cuts or hike taxes.

- Key figures around 0810 GMT -

Tokyo - Nikkei 225: DOWN 1.1 percent at 39,190.40 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 19,064.29 (close)

Shanghai - Composite: DOWN 1.3 percent at 3,168.52 (close)

London - FTSE 100: DOWN 0.1 percent at 8,308.15

Euro/dollar: DOWN at $1.0292 from $1.0296 on Thursday

Pound/dollar: DOWN at $1.2289 from $1.2293

Dollar/yen: UP at 158.42 yen from 157.96 yen

Euro/pound: UP at 83.78 pence from 83.75 pence

West Texas Intermediate: UP 0.9 percent at $74.59 per barrel

Brent North Sea Crude: UP 0.9 percent at $77.62 per barrel

New York - Dow: closed

P.Silva--AMWN