-

England sees driest spring since 1956: government agency

England sees driest spring since 1956: government agency

-

Trump presses Syria leader on Israel ties after lifting sanctions

-

Rare blue diamond fetches $21.5 mn at auction in Geneva

Rare blue diamond fetches $21.5 mn at auction in Geneva

-

Stock markets fluctuate as China-US trade euphoria fades

-

Ousted Myanmar envoy charged with trespass in London residence row

Ousted Myanmar envoy charged with trespass in London residence row

-

Russia jails prominent vote monitor for five years

-

Umbro owner in joint bid for Le Coq Sportif

Umbro owner in joint bid for Le Coq Sportif

-

Tom Cruise has world guessing as he unleashes 'Mission: Impossible' at Cannes

-

China's Tencent posts forecast-beating Q1 revenue on gaming growth

China's Tencent posts forecast-beating Q1 revenue on gaming growth

-

Trump presses Syria leader on Israel relations after lifting sanctions

-

FA appoint former Man Utd sporting director Dan Ashworth as chief football officer

FA appoint former Man Utd sporting director Dan Ashworth as chief football officer

-

Stop holding opponents incommunicado, UN experts tell Venezuela

-

Indonesian filmmakers aim to impress at Cannes

Indonesian filmmakers aim to impress at Cannes

-

Trump presses Syria leader on Israel after lifting sanctions

-

French PM to testify on child abuse scandal

French PM to testify on child abuse scandal

-

Players stuck in middle with IPL, national teams on collision course

-

Peru PM quits ahead of no-confidence vote

Peru PM quits ahead of no-confidence vote

-

Strikes kill 29 in Gaza as hostage release talks ongoing

-

Court raps Brussels for lack of transparency on von der Leyen vaccine texts

Court raps Brussels for lack of transparency on von der Leyen vaccine texts

-

France summons cryptocurrency businesses after kidnappings

-

Pakistan returns Indian border guard captured after Kashmir attack

Pakistan returns Indian border guard captured after Kashmir attack

-

Baidu plans self-driving taxi tests in Europe this year

-

Trump meets new Syria leader after lifting sanctions

Trump meets new Syria leader after lifting sanctions

-

Equity markets swing as China-US trade euphoria fades

-

Burberry warns 1,700 jobs at risk after annual loss

Burberry warns 1,700 jobs at risk after annual loss

-

Trump to meet new Syrian leader after offering sanctions relief

-

'Children are innocent': Myanmar families in grief after school air strike

'Children are innocent': Myanmar families in grief after school air strike

-

Colombia joins Belt and Road initiative as China courts Latin America

-

Australian champion cyclist Dennis gets suspended sentence after wife's road death

Australian champion cyclist Dennis gets suspended sentence after wife's road death

-

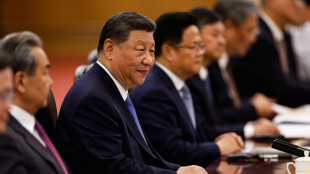

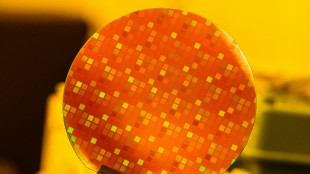

Protection racket? Asian semiconductor giants fear looming tariffs

-

S. Korea Starbucks in a froth over presidential candidates names

S. Korea Starbucks in a froth over presidential candidates names

-

NATO hatches deal on higher spending to keep Trump happy

-

Eurovision stage a dynamic 3D 'playground': producer

Eurovision stage a dynamic 3D 'playground': producer

-

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

-

Suaalii in race to be fit for Lions Tests after fracturing jaw

Suaalii in race to be fit for Lions Tests after fracturing jaw

-

Pacers oust top-seeded Cavs, Nuggets on brink

-

Sony girds for US tariffs after record annual net profit

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

-

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

1847 Holdings Explores Strategic Alternatives for CMD

Strong Inbound Interest Drives Decision to Evaluate Strategic Alternatives

NEW YORK, NY / ACCESS Newswire / March 25, 2025 / 1847 Holdings LLC (NYSE American:EFSH) ("1847 Holdings" or the "Company") today announced that it is evaluating potential strategic alternatives for its subsidiary, CMD Inc. ("CMD"). This decision is a result of the significant inbound interest from both strategic and financial sponsors, which the Company believes reflects CMD's strong market position, financial performance, and growth trajectory.

BMO Capital Markets Corp., ("BMO") a leading financial institution with deep expertise in the building products sector, will support CMD in exploring potential options that would align with CMD's long-term potential with a goal to deliver optimal value for shareholders.

CMD is a premier provider of door solutions, custom cabinetry, and building enhancements serving multi-family residential, institutional, and commercial markets. With a differentiated market position, high-margin business model, and expanding geographic footprint, CMD has attracted substantial interest from potential acquirers seeking exposure to the sector's growth dynamics.

For the nine months ended September 30, 2024, CMD reported revenues of $23.3 million, representing a 21.8% increase over the same period in the prior year. CMD's gross profit for the nine months ended September 30, 2024, increased by 51.3% to $10.8 million, while income from operations rose 85.4% to $6.7 million, in each case, from the nine months ended September 30, 2023. For the nine months ended September 30, 2024, net income grew by 90.6% to $6.6 million over the same period last year, which the Company believes underscores CMD's strong financial trajectory and market demand.

"We are excited to work with BMO Capital Markets as we evaluate strategic alternatives for CMD," said Ellery W. Roberts, CEO of 1847 Holdings. "The substantial inbound interest we have received is a testament to CMD's strong market presence and financial performance. Given CMD's impressive growth and the strategic value it presents, we believe this is the right time to explore opportunities that could unlock significant value for our shareholders. With BMO's extensive M&A expertise and deep industry relationships, we believe we are well-positioned to achieve an optimal outcome."

About 1847 Holdings

1847 Holdings LLC (NYSE American: EFSH), a publicly traded diversified acquisition holding company, was founded by Ellery W. Roberts, a former partner of Parallel Investment Partners, Saunders Karp & Megrue, and Principal of Lazard Freres Strategic Realty Investors. 1847 Holdings' investment thesis is that capital market inefficiencies have left the founders and/or stakeholders of many small business enterprises or lower-middle market businesses with limited exit options despite the intrinsic value of their business. Given this dynamic, 1847 Holdings can consistently acquire businesses it views as "solid" for reasonable multiples of cash flow and then deploy resources to strengthen the infrastructure and systems of those businesses in order to improve operations. These improvements may lead to a sale or IPO of an operating subsidiary at higher valuations than the purchase price and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to 1847 Holdings' ability to pay regular and special dividends to shareholders. For more information, visit www.1847holdings.com.

For the latest insights, follow 1847 on Twitter.

Forward Looking Statements

This press release may contain information about 1847 Holdings' view of its future expectations, plans and prospects that constitute forward-looking statements. All forward-looking statements are based on our management's beliefs, assumptions and expectations of our future economic performance, taking into account the information currently available to it. These statements are not statements of historical fact. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial position. Our actual results may differ materially from the results discussed in forward-looking statements. Factors that might cause such a difference include but are not limited to the risks set forth in "Risk Factors" included in our SEC filings.

Contact:

Crescendo Communications, LLC

Tel: +1 (212) 671-1020

Email: [email protected]

SOURCE: 1847 Holdings LLC

View the original press release on ACCESS Newswire

A.Malone--AMWN