-

France summons cryptocurrency businesses after kidnappings

France summons cryptocurrency businesses after kidnappings

-

Pakistan returns Indian border guard captured after Kashmir attack

-

Baidu plans self-driving taxi tests in Europe this year

Baidu plans self-driving taxi tests in Europe this year

-

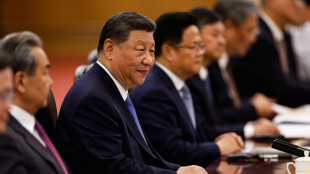

Trump meets new Syria leader after lifting sanctions

-

Equity markets swing as China-US trade euphoria fades

Equity markets swing as China-US trade euphoria fades

-

Burberry warns 1,700 jobs at risk after annual loss

-

Trump to meet new Syrian leader after offering sanctions relief

Trump to meet new Syrian leader after offering sanctions relief

-

'Children are innocent': Myanmar families in grief after school air strike

-

Colombia joins Belt and Road initiative as China courts Latin America

Colombia joins Belt and Road initiative as China courts Latin America

-

Australian champion cyclist Dennis gets suspended sentence after wife's road death

-

Protection racket? Asian semiconductor giants fear looming tariffs

Protection racket? Asian semiconductor giants fear looming tariffs

-

S. Korea Starbucks in a froth over presidential candidates names

-

NATO hatches deal on higher spending to keep Trump happy

NATO hatches deal on higher spending to keep Trump happy

-

Eurovision stage a dynamic 3D 'playground': producer

-

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

-

Suaalii in race to be fit for Lions Tests after fracturing jaw

-

Pacers oust top-seeded Cavs, Nuggets on brink

Pacers oust top-seeded Cavs, Nuggets on brink

-

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

-

Sony logs 18% annual net profit jump, forecast cautious

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

Latin America mourns world's 'poorest president' Mujica, dead at 89

-

Masters champion McIlroy to headline Australian Open

-

Coca-Cola Europacific Partners plc Announces Capital Markets Event

Coca-Cola Europacific Partners plc Announces Capital Markets Event

-

Hemogenyx Pharmaceuticals PLC Announces Pediatric Amendment to Clinical Protocol

-

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

-

McIlroy, Scheffler and Schauffele together for rainy PGA battle

-

Uruguay's Mujica, world's 'poorest president,' dies aged 89

Uruguay's Mujica, world's 'poorest president,' dies aged 89

-

Lift-off at Eurovision as first qualifiers revealed

-

Forest striker Awoniyi placed in induced coma after surgery: reports

Forest striker Awoniyi placed in induced coma after surgery: reports

-

'Kramer vs Kramer' director Robert Benton dies: representative

-

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

-

US stocks mostly rise on better inflation data while dollar retreats

-

Winning farewell for Orlando Pirates' Spanish coach Riveiro

Winning farewell for Orlando Pirates' Spanish coach Riveiro

-

Lift-off at Eurovision as first semi-final takes flight

-

UN relief chief urges action 'to prevent genocide' in Gaza

UN relief chief urges action 'to prevent genocide' in Gaza

-

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

-

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

-

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

-

Uruguay's 'poorest president' Mujica dies aged 89

Uruguay's 'poorest president' Mujica dies aged 89

-

Senior UN official urges action 'to prevent genocide' in Gaza

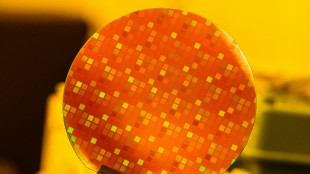

Protection racket? Asian semiconductor giants fear looming tariffs

Inside one of South Korea's oldest semiconductor research institutes, the cleanrooms and workshops are calm and immaculate, but outside the Seoul National University campus, a chip storm is brewing.

Last month, Washington announced a national security probe into imports of semiconductor technology, which could put the industry in the crosshairs of President Donald Trump's trade bazooka and inflict potentially devastating levies.

For chipmaking powerhouses South Korea and Taiwan, the consequences could be enormous.

South Korea is home to Samsung Electronics and SK hynix, while Taiwan hosts the world's largest contract chipmaker, TSMC. Collectively, they produce a significant chunk of high-end chips that have become the lifeblood of the global economy, powering everything from smartphones to missiles.

Taiwan exported $7.4 billion worth of semiconductors to the United States in 2024, while South Korea's exports surged to $10.7 billion, a historic high.

Experts say the spectre of looming tariffs has spurred stockpiling, with fears levies will drive up consumer prices and hurt chipmakers.

The clear intention of Trump's policies is to force the Asian chip giants to relocate production stateside, a former engineer at Taiwanese chip firm MediaTek told AFP.

"TSMC going overseas to the US to build fabs is like paying protection money," they said, adding that the projects barely made a profit with margins "super low" in high-cost America.

"From the American point of view, it's logical to sacrifice the rest of the world for its own interests, only that we happen to be the ones being sacrificed," the engineer said.

- A 'heavy blow' -

The US president's tolls could be "quite complex", Kim Yang-paeng, senior researcher at Korea Institute for Industrial Economics and Trade (KIET), told AFP.

Rather than hitting the industry with a blanket levy, the United States could target different products such as HBM, which is essential for high-speed computing, and DRAM, which is used for memory.

Any significant tariffs on the sector, which relies on complex manufacturing chains to produce high-end tech products, would be a "heavy blow", the MediaTek engineer said.

Samsung, the world's largest memory chipmaker, and leading memory chip supplier SK hynix rely heavily on indirect exports to the United States via China, Taiwan and Vietnam.

For example, Samsung produces television panels in South Korea, which are then assembled into finished televisions in Vietnam before being shipped to the United States.

For these companies, there is "concern about a decline in demand due to rising prices in other sectors using semiconductors", said Jung Jae-wook, professor at Sogang University.

Meanwhile, Seoul and Washington are negotiating a "trade package" aimed at preventing new US tariffs before the July 8 expiration of Trump's pause in his "reciprocal" levies.

- Few alternatives -

US Trade Representative Jamieson Greer is expected to visit South Korea for the APEC trade ministers' meeting this week.

Experts say that in the short term, chips like HBM are less likely to be impacted by tariff wars owing to strong demand driven by artificial intelligence.

And unlike many other sectors such as the auto industry -- which is already hit by tariffs -- "semiconductors have no substitutes from the US perspective", said Kim Dae-jong, a professor at Sejong University.

It is also not feasible to shift chip production entirely stateside, given America's limited capacity, so any measures "are unlikely to be sustained in the long run", said Sogang University's Jung.

"There are not many alternative countries (the United States) can rely on for imports, making price increases inevitable if tariffs are imposed," he said.

While Washington is eager to bolster domestic production, South Korea and Taiwan are keenly aware of the strategic significance of the industry and are not likely to give up capacity.

For Taiwan, semiconductors are a matter of national security, said Kim from KIET.

"Taiwan may expand its manufacturing presence in the United States, but significant changes to its domestic semiconductor ecosystem are unlikely."

Back at the Seoul National University semiconductor institute, its director, Lee Hyuk-jae -- who is also an outside director for Samsung -- spends his days urging the government to invest more in the sector, which he says "holds great importance" for the country.

O.Norris--AMWN