-

Polls open in Australian vote swayed by inflation, Trump

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

-

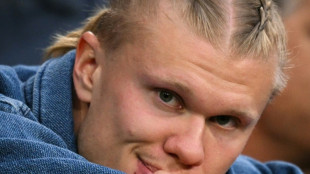

Haaland on bench for Man City as striker returns ahead of schedule

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

Australians vote in election swayed by inflation, Trump

-

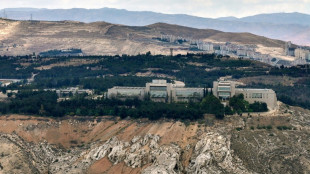

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

-

Berlin culture official quits after funding cut backlash

Berlin culture official quits after funding cut backlash

-

US hiring better than expected despite Trump uncertainty

-

EU fine: TikTok's latest setback

EU fine: TikTok's latest setback

-

Stocks gain on US jobs data, tariff talks hopes

-

Barca's Ter Stegen to return from long lay-off for Valladolid trip

Barca's Ter Stegen to return from long lay-off for Valladolid trip

-

US hiring slows less than expected, unemployment unchanged

Unpaid Tax Debt Could Trigger Wage Garnishment - Clear Start Tax Explains What Most Don’t Know

Clear Start Tax Warns Taxpayers About the Risks of IRS Wage Garnishment-and How to Stop It Before It Starts

IRVINE, CALIFORNIA / ACCESS Newswire / April 21, 2025 / When tax debt goes unresolved, many people assume the worst-case scenario is a larger bill or a few extra penalties. But according to Clear Start Tax, the real risk is often more immediate and more financially damaging than many realize. The IRS has the legal authority to garnish wages without a court order, and for many taxpayers, this action comes with little warning.

Wage garnishment can create a financial domino effect, making it difficult for individuals to cover everyday expenses, support their families, or keep up with other obligations. Clear Start Tax is working to raise awareness about how the IRS uses wage garnishment-and what taxpayers can do to prevent or stop it.

How IRS Wage Garnishment Works

When a taxpayer ignores IRS notices or fails to resolve outstanding debt, the IRS may initiate wage garnishment through a legal process called a Notice of Intent to Levy (LT11). After sending multiple letters, the IRS can legally notify an employer to begin withholding a portion of an employee's paycheck.

"Most people don't realize how fast this can happen," said the Head of Client Solutions at Clear Start Tax. "The IRS doesn't need court approval to garnish wages-once the process begins, it's difficult to stop without professional intervention."

The Impact of Wage Garnishment

For taxpayers already living paycheck to paycheck, IRS wage garnishment can be devastating. The amount withheld depends on income, filing status, and dependents, but even a partial reduction in take-home pay can disrupt a household's entire financial balance.

Garnishment often leads to missed rent or mortgage payments, overdrawn accounts, unpaid medical bills, and growing credit issues. It can also create a ripple effect, forcing people to rely on high-interest loans or credit cards just to cover essentials.

Many taxpayers don't realize that the garnishment continues until the balance is paid in full-or until a resolution is negotiated.

How Taxpayers Can Stop or Avoid Wage Garnishment

Clear Start Tax works with individuals who are facing garnishment or at risk of it. Depending on the taxpayer's financial circumstances, there are several legal options available to stop or prevent enforcement:

Offer in Compromise (OIC) - Settle the debt for less than what's owed

Installment Agreements - Set up an affordable payment plan

Currently Not Collectible (CNC) - Temporarily halt IRS collection activity

Appeals and levy release requests - Challenge a garnishment or request relief due to hardship

"Stopping a wage garnishment requires taking action, not waiting for another letter," added the Head of Client Solutions. "The earlier we step in, the more options we have to protect the client's income and negotiate a fair solution."

Clear Start Tax: Helping Taxpayers Protect Their Paychecks

Clear Start Tax provides full-service tax resolution support, from responding to IRS notices to negotiating directly with the agency. With thousands of cases resolved, the firm focuses on helping clients:

Avoid or stop wage garnishment

Reduce total tax liability where possible

Stay compliant and avoid future enforcement

Understand every step of the resolution process

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 535-1627

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

H.E.Young--AMWN