-

Ancelotti says he will reveal future plans at end of season

Ancelotti says he will reveal future plans at end of season

-

India-Pakistan tensions hit tourism in Kashmiri valley

-

Bangladesh Islamists rally in show of force

Bangladesh Islamists rally in show of force

-

Zelensky says won't play Putin's 'games' with short truce

-

Cardinals meet ahead of papal election

Cardinals meet ahead of papal election

-

Pakistan tests missile weapons system amid India standoff

-

France charges 21 prison attack suspects

France charges 21 prison attack suspects

-

Pakistan military says conducts training launch of missile

-

Lives on hold in India's border villages with Pakistan

Lives on hold in India's border villages with Pakistan

-

Musk's dreams for Starbase city in Texas hang on vote

-

Rockets down Warriors to stay alive in NBA playoffs

Rockets down Warriors to stay alive in NBA playoffs

-

Garcia beaten by Romero in return from doping ban

-

Inflation, hotel prices curtail Japanese 'Golden Week' travels

Inflation, hotel prices curtail Japanese 'Golden Week' travels

-

Trump's next 100 days: Now comes the hard part

-

Mexican mega-port confronts Trump's tariff storm

Mexican mega-port confronts Trump's tariff storm

-

Trump's tariffs bite at quiet US ports

-

Ryu stretches lead at LPGA Black Desert Championship

Ryu stretches lead at LPGA Black Desert Championship

-

Singapore votes with new PM seeking strong mandate amid tariff turmoil

-

Five things to know about the Australian election

Five things to know about the Australian election

-

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

-

GISEC Global 2025: Dubai Mobilises Global Cyber Defence Leaders to Combat AI-Driven Cybercrime and Ransomware

GISEC Global 2025: Dubai Mobilises Global Cyber Defence Leaders to Combat AI-Driven Cybercrime and Ransomware

-

Israel launches new Syria strikes amid Druze tensions

-

Finke grabs 400m medley victory over world record-holder Marchand

Finke grabs 400m medley victory over world record-holder Marchand

-

Apple eases App Store rules under court pressure

-

Polls open in Australian vote swayed by inflation, Trump

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

-

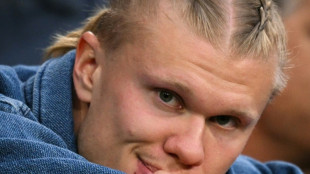

Haaland on bench for Man City as striker returns ahead of schedule

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Solera National Bancorp Announces First Quarter 2025 Financial Results

Net income of $4.6 million ($1.08 per share), a $1.6 million or 54% increase from Q1 2024.

Q1 2025 pre-tax and pre-provision income of $6.4 million. 3rd best quarter!

LAKEWOOD, CO / ACCESS Newswire / April 21, 2025 / Solera National Bancorp, Inc. (OTC PINK:SLRK) ("Company"), the holding company for Solera National Bank ("Bank"), a business-focused bank located in the Denver metropolitan area, today reported financial results for the three months ended March 31, 2025. See highlights below.

1Q25 Financial Highlights

Net income of $4.6 million ($1.08 per share), a $1.6 million or 54% increase from Q1 2024.

Net interest margin has improved 53 bps to 3.93% vs Q1 2024.

Solera had a pre-tax and pre-provision income of $6.4 million. 19% or $1.0 million increase from Q1 24.

Cost of funds has decreased to 2.49%, an improvement of 28 bps from Q1 2024.

Return on assets was 1.62%, a 65 bps improvement from Q1 2024.

Return on equity was 20.64%, a 561 bps improvement from Q1 2024.

Efficiency ratio was 44.31%, a 418 bps improvement from Q1 2024.

Mike Quagliano, Executive Chairman of the Board, commented: "We are $1.6M above last year, and we are off to a great start."

Steve Snailum, COO, commented: "Operational efficiency continues to be a tremendous strength for Solera. Through continuous process improvements and technological advancements, the team has been able to drive record-breaking customer outcomes. The average hold time to engage with one of our representatives is now below 30 seconds, and customer feedback remains extremely positive. It is easier than ever to become a customer of Solera, and once you are here, you will love your experience."

Avram Shabanyan, EVP, commented: "During my six years with Solera Bank, I've been proud to work closely with our self-directed partners-connecting customers to innovative banking products and expert support as they use their retirement accounts to invest in alternative assets. Solera Bank remains the industry leader in self-directed banking because we always put the customer first."

Jay Hansen, Chief Financial Officer, commented: "Our goal was to get to a 10% Tier 1 capital ratio, and we got to 10.4%. See my previous Q4 comment. We will take advantage of the very high treasury yields and improve our investment returns. The tariffs present some uncertainty in the market, but I believe we are well-positioned and have an amazing team and customers."

About Solera National Bancorp, Inc.

Solera National Bancorp, Inc. was incorporated in 2006 to organize and serve as the holding company for Solera National Bank, which opened for business in September 2007. Solera National Bank is a community bank serving the needs of emerging businesses and real estate investors. At the core of Solera National Bank is welcoming, attentive, and respectful customer service, a focus on supporting a growing and diverse economy, and a passion to serve our community through service, education, and volunteerism. For more information, please visit http://www.SoleraBank.com.

This press release contains statements that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements contained in this release, which are not historical facts and that relate to future plans or projected results of Solera National Bancorp, Inc. and its wholly-owned subsidiary, Solera National Bank, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, or implied. We undertake no obligation to update or revise any forward-looking statement. Readers of this release are cautioned not to put undue reliance on forward-looking statements.

Contacts: Jay Hansen, CFO (303) 209-8600

FINANCIAL TABLES FOLLOW

SOLERA NATIONAL BANCORP, INC.

CONSOLIDATED BALANCE SHEET

(unaudited)

($000s) | 3/31/25 | 12/31/24 | 9/30/24 | 6/30/24 | 3/31/24 | |||||

ASSETS | ||||||||||

Cash and due from banks | $ | 2,401 | $ | 1,576 | $ | 2,193 | $ | 2,241 | $ | 2,095 |

Federal funds sold | - | 800 | 400 | - | - | |||||

Interest-bearing deposits with banks | 1,033 | 148 | 595 | 844 | 1,079 | |||||

Investment securities, available-for-sale | 290,397 | 322,375 | 317,180 | 183,311 | 185,120 | |||||

Investment securities, held-to-maturity | - | - | - | 200,457 | 200,575 | |||||

FHLB and Federal Reserve Bank stocks, at cost | 5,525 | 7,457 | 3,204 | 10,959 | 7,952 | |||||

Paycheck Protection Program (PPP) loans, gross | 5 | 20 | 35 | 50 | 65 | |||||

Traditional loans, gross | 766,687 | 792,753 | 797,516 | 792,739 | 820,936 | |||||

Allowance for loan and lease losses | (10,914 | ) | (10,913 | ) | (10,912 | ) | (10,810 | ) | (10,808 | ) |

Net traditional loans | 755,773 | 781,840 | 786,604 | 781,929 | 810,128 | |||||

Premises and equipment, net | 33,236 | 33,476 | 32,289 | 30,625 | 29,448 | |||||

Accrued interest receivable | 7,153 | 7,750 | 6,940 | 7,808 | 7,807 | |||||

Bank-owned life insurance | 5,159 | 5,127 | 5,095 | 5,063 | 5,033 | |||||

Other assets | 11,103 | 8,820 | 8,734 | 8,325 | 8,607 | |||||

TOTAL ASSETS | $ | 1,111,785 | $ | 1,169,389 | $ | 1,163,269 | $ | 1,231,612 | $ | 1,257,909 |

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||

Noninterest-bearing demand deposits | $ | 466,455 | $ | 484,604 | $ | 497,661 | $ | 503,819 | $ | 508,615 |

Interest-bearing demand deposits | 60,507 | 54,734 | 64,606 | 62,905 | 53,514 | |||||

Savings and money market deposits | 104,560 | 100,987 | 103,118 | 102,892 | 255,655 | |||||

Time deposits | 287,378 | 294,338 | 353,405 | 272,744 | 240,047 | |||||

Total deposits | 918,900 | 934,663 | 1,018,790 | 942,360 | 1,057,831 | |||||

Accrued interest payable | 1,808 | 2,587 | 2,618 | 2,104 | 1,347 | |||||

Short-term borrowings | 60,191 | 104,607 | 13,300 | 164,613 | 79,104 | |||||

Long-term FHLB borrowings | 34,000 | 34,000 | 34,000 | 34,000 | 34,000 | |||||

Accounts payable and other liabilities | 6,087 | 4,576 | 5,395 | 3,961 | 4,659 | |||||

TOTAL LIABILITIES | 1,020,987 | 1,080,434 | 1,074,104 | 1,147,038 | 1,176,941 | |||||

Common stock | 43 | 43 | 43 | 43 | 43 | |||||

Additional paid-in capital | 38,763 | 38,748 | 38,748 | 38,778 | 38,763 | |||||

Retained earnings | 77,076 | 72,455 | 67,163 | 61,667 | 57,440 | |||||

Accumulated other comprehensive (loss) gain | (25,084 | ) | (22,291 | ) | (16,789 | ) | (15,914 | ) | (15,278 | ) |

TOTAL STOCKHOLDERS' EQUITY | 90,798 | 88,955 | 89,165 | 84,574 | 80,968 | |||||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 1,111,785 | $ | 1,169,389 | $ | 1,163,269 | $ | 1,231,612 | $ | 1,257,909 |

SOLERA NATIONAL BANCORP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

Three Months Ended | |||||||||||||||||||

($000s, except per share data) | 3/31/25 | 12/31/24 | 9/30/24 | 6/30/24 | 3/31/24 | ||||||||||||||

Interest and dividend income | |||||||||||||||||||

Interest and fees on traditional loans | $ | 13,102 | $ | 13,615 | $ | 13,854 | $ | 13,270 | $ | 13,277 | |||||||||

Interest and fees on PPP loans | (1 | ) | - | - | - | - | |||||||||||||

Investment securities | 3,490 | 3,297 | 3,544 | 3,721 | 3,693 | ||||||||||||||

Dividends on bank stocks | 175 | 131 | 160 | 249 | 224 | ||||||||||||||

Other | 49 | 13 | 19 | 22 | 30 | ||||||||||||||

Total interest income | $ | 16,815 | $ | 17,056 | $ | 17,577 | $ | 17,262 | $ | 17,224 | |||||||||

Interest expense | |||||||||||||||||||

Deposits | 4,959 | 5,564 | 6,312 | 5,285 | 5,833 | ||||||||||||||

FHLB & Fed borrowings | 1,550 | 1,223 | 1,332 | 2,831 | 2,200 | ||||||||||||||

Total interest expense | 6,509 | 6,787 | 7,644 | 8,116 | 8,033 | ||||||||||||||

Net interest income | 10,306 | 10,269 | 9,933 | 9,146 | 9,191 | ||||||||||||||

Provision for loan and lease losses | 7 | 6 | 105 | 4 | 1,203 | ||||||||||||||

Net interest income after provision for loan and lease losses | 10,299 | 10,263 | 9,828 | 9,142 | 7,988 | ||||||||||||||

Noninterest income | |||||||||||||||||||

Customer service and other fees | 300 | 470 | 389 | 468 | 443 | ||||||||||||||

Other income | 807 | 954 | 1,138 | 738 | 616 | ||||||||||||||

Gain on sale of securities | - | - | 858 | - | 60 | ||||||||||||||

Total noninterest income | 1,107 | 1,424 | 2,385 | 1,206 | 1,119 | ||||||||||||||

Noninterest expense | |||||||||||||||||||

Employee compensation and benefits | 2,656 | 2,611 | 2,472 | 2,514 | 2,418 | ||||||||||||||

Occupancy | 448 | 492 | 393 | 387 | 401 | ||||||||||||||

Professional fees | 259 | 309 | 122 | 75 | 495 | ||||||||||||||

Other general and administrative | 1,694 | 1,437 | 1,423 | 1,582 | 1,656 | ||||||||||||||

Total noninterest expense | 5,057 | 4,849 | 4,410 | 4,558 | 4,970 | ||||||||||||||

Net Income Before Taxes | $ | 6,349 | $ | 6,838 | $ | 7,803 | $ | 5,790 | $ | 4,137 | |||||||||

Income Tax Expense | 1,711 | 1,526 | 2,294 | 1,564 | 1,118 | ||||||||||||||

Net Income | $ | 4,638 | $ | 5,312 | $ | 5,509 | $ | 4,226 | $ | 3,019 | |||||||||

Income Per Share | $ | 1.08 | $ | 1.24 | $ | 1.28 | $ | 0.98 | $ | 0.70 | |||||||||

Tangible Book Value Per Share | $ | 21.12 | $ | 20.69 | $ | 20.74 | $ | 19.67 | $ | 18.83 | |||||||||

WA Shares outstanding | 4,299,953 | 4,299,953 | 4,299,953 | 4,299,953 | 4,299,953 | ||||||||||||||

Pre-Tax Pre-Provision Income | $ | 6,356 | $ | 6,844 | $ | 7,908 | $ | 5,794 | $ | 5,340 | |||||||||

Net Interest Margin | 3.93 | % | 3.81 | % | 3.67 | % | 3.39 | % | 3.40 | % | |||||||||

Cost of Funds | 2.49 | % | 2.51 | % | 2.72 | % | 2.80 | % | 2.77 | % | |||||||||

Efficiency Ratio | 44.31 | % | 41.47 | % | 38.48 | % | 44.03 | % | 48.49 | % | |||||||||

Return on Average Assets | 1.63 | % | 1.82 | % | 1.84 | % | 1.36 | % | 0.97 | % | |||||||||

Return on Average Equity | 20.64 | % | 23.86 | % | 25.37 | % | 20.42 | % | 15.05 | % | |||||||||

Leverage Ratio | 10.4 | % | 9.5 | % | 9.1 | % | 8.2 | % | 7.7 | % | |||||||||

Asset Quality: | |||||||||||||||||||

Non-performing loans to gross loans | 0.42 | % | 0.52 | % | 0.65 | % | 0.48 | % | 0.53 | % | |||||||||

Non-performing assets to total assets | 0.29 | % | 0.35 | % | 0.45 | % | 0.31 | % | 0.34 | % | |||||||||

Allowance for loan losses to gross traditional loans | 1.42 | % | 1.38 | % | 1.37 | % | 1.36 | % | 1.32 | % | |||||||||

* Not meaningful due to the insignificant amount of non-performing loans. | |||||||||||||||||||

Criticized loans/assets: | |||||||||||||||||||

Special mention | $ | 11,103 | $ | 10,730 | $ | 29,145 | $ | 25,244 | $ | 35,997 | |||||||||

Substandard: Accruing | 19,641 | 14,911 | 22,410 | 23,030 | 19,108 | ||||||||||||||

Substandard: Nonaccrual | 3,251 | 4,142 | 5,180 | 3,784 | 4,332 | ||||||||||||||

Doubtful | - | - | - | - | - | ||||||||||||||

Total criticized loans | $ | 33,995 | $ | 29,782 | $ | 56,735 | $ | 52,058 | $ | 59,437 | |||||||||

Other real estate owned | - | - | - | - | - | ||||||||||||||

Investment securities | - | - | - | - | - | ||||||||||||||

Total criticized assets | $ | 33,995 | $ | 29,782 | $ | 56,735 | $ | 52,058 | $ | 59,437 | |||||||||

Criticized assets to total assets | 3.06 | % | 2.55 | % | 4.88 | % | 4.23 | % | 4.73 | % | |||||||||

SOURCE: Solera National Bank

View the original press release on ACCESS Newswire

P.Silva--AMWN