-

Forest Champions League dreams hit after Brentford defeat

Forest Champions League dreams hit after Brentford defeat

-

'Resilient' Warriors aim to close out Rockets in bruising NBA playoff series

-

US expects Iran talks but Trump presses sanctions

US expects Iran talks but Trump presses sanctions

-

Baffert returns to Kentucky Derby, Journalism clear favorite

-

Top Trump security official replaced after chat group scandal

Top Trump security official replaced after chat group scandal

-

Masked protesters attack Socialists at France May Day rally

-

Mumbai eliminate Rajasthan from IPL playoff race with bruising win

Mumbai eliminate Rajasthan from IPL playoff race with bruising win

-

McDonald's profits hit by weakness in US market

-

Rio goes Gaga for US singer ahead of free concert

Rio goes Gaga for US singer ahead of free concert

-

New research reveals where N. American bird populations are crashing

-

Verstappen late to Miami GP as awaits birth of child

Verstappen late to Miami GP as awaits birth of child

-

Zelensky says minerals deal with US 'truly equal'

-

Weinstein lawyer says accuser sought payday from complaint

Weinstein lawyer says accuser sought payday from complaint

-

Police arrest more than 400 in Istanbul May Day showdown

-

Herbert named head coach of Canada men's basketball team

Herbert named head coach of Canada men's basketball team

-

'Boss Baby' Suryavanshi falls to second-ball duck in IPL

-

Shibutani siblings return to ice dance after seven years

Shibutani siblings return to ice dance after seven years

-

300,000 rally across France for May 1, union says

-

US-Ukraine minerals deal: what we know

US-Ukraine minerals deal: what we know

-

Top Trump official ousted after chat group scandal: reports

-

Schueller hat-trick sends Bayern women to first double

Schueller hat-trick sends Bayern women to first double

-

Baudin in yellow on Tour de Romandie as Fortunato takes 2nd stage

-

UK records hottest ever May Day

UK records hottest ever May Day

-

GM cuts 2025 outlook, projects up to $5 bn hit from tariffs

-

Thousands of UK children write to WWII veterans ahead of VE Day

Thousands of UK children write to WWII veterans ahead of VE Day

-

Top Trump official exiting after chat group scandal: reports

-

Madrid Open holder Swiatek thrashed by Gauff in semis

Madrid Open holder Swiatek thrashed by Gauff in semis

-

Sheinbaum says agreed with Trump to 'improve' US-Mexico trade balance

-

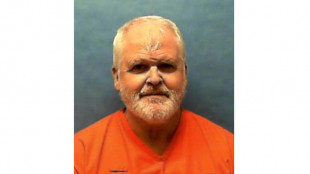

US veteran convicted of quadruple murder to be executed in Florida

US veteran convicted of quadruple murder to be executed in Florida

-

UK counter terrorism police probe Irish rappers Kneecap

-

S. Korea crisis deepens with election frontrunner retrial, resignations

S. Korea crisis deepens with election frontrunner retrial, resignations

-

Trump administration releases report critical of youth gender care

-

IKEA opens new London city centre store

IKEA opens new London city centre store

-

Police deploy in force for May Day in Istanbul, arrest hundreds

-

Syria Druze leader condemns 'genocidal campaign' against community

Syria Druze leader condemns 'genocidal campaign' against community

-

Prince Harry to hear outcome of UK security appeal on Friday

-

Microsoft raises Xbox prices globally, following Sony

Microsoft raises Xbox prices globally, following Sony

-

US stocks rise on Meta, Microsoft ahead of key labor data

-

Toulouse injuries mount as Ramos doubtful for Champions Cup semi

Toulouse injuries mount as Ramos doubtful for Champions Cup semi

-

Guardiola glad of Rodri return but uncertain if he'll play in FA Cup final

-

Ruud sails past Medvedev into Madrid Open semis

Ruud sails past Medvedev into Madrid Open semis

-

'Not a commodity': UN staff rally over deep cuts

-

Flintoff proud as Afghan refugee protege plays for Lancashire second team

Flintoff proud as Afghan refugee protege plays for Lancashire second team

-

Peruvian cardinal accused of abuse challenges late pope's sanction

-

Trans women barred from women's football by English, Scottish FAs

Trans women barred from women's football by English, Scottish FAs

-

Oil prices drop, stocks diverge amid economic growth fears

-

Israel brings fire near Jerusalem 'under control', reopens roads

Israel brings fire near Jerusalem 'under control', reopens roads

-

Lopetegui appointed coach of Qatar

-

UK counter-terrorism unit probes rappers Kneecap but music stars back band

UK counter-terrorism unit probes rappers Kneecap but music stars back band

-

Yamal heroics preserve Barca Champions League final dream

Upcoming Webinar: "Adapt or Decline" - How Forward-Thinking Lenders Are Future-Proofing Their Operations

Vero, SBS, and Baringa to Host Webinar on Modernizing Asset Finance in an Uncertain Economy

NEW YORK CITY, NY / ACCESS Newswire / April 23, 2025 / In an increasingly volatile economy, with rising credit risk and mounting digital expectations, asset finance providers are confronting a stark reality: evolve or risk falling behind. To help lenders meet this moment, the American Financial Services Association (AFSA), in partnership with Vero, SBS, and Baringa, will host a high-impact webinar titled:

Adapt or Decline: How Forward-Thinking Lenders are Future-Proofing Their Operations

Date: 05/1/2025

Time: 2:00 pm EST

Duration: 60 Minutes

Registration: Follow this link

Webinar Overview

Legacy infrastructure, paper-based processes, and fragmented systems are increasingly unsustainable for lenders trying to manage risk, deliver customer value, and scale efficiently. This webinar will offer a candid conversation with industry experts about how financial institutions are rethinking their operational models - without compromising on compliance or control.

Led by veteran voices in lending transformation, the session will explore:

Why legacy systems are creating operational and risk bottlenecks

How embedded finance and API-first platforms are enabling leaner credit operations

The cultural and organizational shifts necessary for sustainable innovation

Featured Speakers

John Mizzi, CEO - Vero Technologies

Lucas Hancock, VP of Product, North America - SBS

Seth Walker, Direct of Financial Services - Baringa

Rebecca Jennings, Field Marketing Manager - SBS

Each speaker will provide distinct perspectives - from infrastructure modernization and embedded tech enablement to strategy and organizational design - backed by real-world case studies and lessons learned from the field.

What Attendees Can Expect to Learn

How to identify and address critical bottlenecks caused by legacy processes

Tools and tactics that lenders are using today to become more data-driven and responsive

Why future-ready lenders are redesigning not just their tech stack, but their teams and culture

Practical advice for navigating internal resistance and measuring the ROI of modernization efforts

"This isn't just another tech talk. It's a strategic conversation for credit professionals, COOs, and risk leaders who know the current model isn't built for what's coming next," said John Mizzi, CEO of Vero. "We're excited to join SBS, Baringa, and AFSA to provide tangible insights that lenders can act on immediately."

About the Organizers

AFSA is the national trade association for the consumer credit industry, providing advocacy, education, and networking for financial institutions

Vero is a lending infrastructure platform built for wholesale, trade, and asset-based finance, helping institutions modernize operations through automation and risk intelligence

SBS specializes in digital compliance and operational risk solutions for regulated financial institutions

Baringa is a global consulting firm helping organizations transform their strategy, operations, and technology to prepare for the future

Reserve Your Spot

Spaces are limited. Register now to gain insights from operators who are driving real transformation across the lending landscape.

Contact: Frank Paleno, [email protected], +17343550973

SOURCE: Vero Finance Technologies

View the original press release on ACCESS Newswire

Y.Nakamura--AMWN