-

Top Trump official exiting after chat group scandal: reports

Top Trump official exiting after chat group scandal: reports

-

Madrid Open holder Swiatek thrashed by Gauff in semis

-

Sheinbaum says agreed with Trump to 'improve' US-Mexico trade balance

Sheinbaum says agreed with Trump to 'improve' US-Mexico trade balance

-

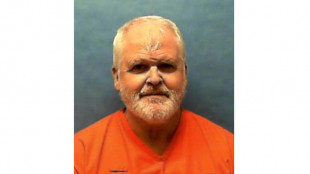

US veteran convicted of quadruple murder to be executed in Florida

-

UK counter terrorism police probe Irish rappers Kneecap

UK counter terrorism police probe Irish rappers Kneecap

-

S. Korea crisis deepens with election frontrunner retrial, resignations

-

Trump administration releases report critical of youth gender care

Trump administration releases report critical of youth gender care

-

IKEA opens new London city centre store

-

Police deploy in force for May Day in Istanbul, arrest hundreds

Police deploy in force for May Day in Istanbul, arrest hundreds

-

Syria Druze leader condemns 'genocidal campaign' against community

-

Prince Harry to hear outcome of UK security appeal on Friday

Prince Harry to hear outcome of UK security appeal on Friday

-

Microsoft raises Xbox prices globally, following Sony

-

US stocks rise on Meta, Microsoft ahead of key labor data

US stocks rise on Meta, Microsoft ahead of key labor data

-

Toulouse injuries mount as Ramos doubtful for Champions Cup semi

-

Guardiola glad of Rodri return but uncertain if he'll play in FA Cup final

Guardiola glad of Rodri return but uncertain if he'll play in FA Cup final

-

Ruud sails past Medvedev into Madrid Open semis

-

'Not a commodity': UN staff rally over deep cuts

'Not a commodity': UN staff rally over deep cuts

-

Flintoff proud as Afghan refugee protege plays for Lancashire second team

-

Peruvian cardinal accused of abuse challenges late pope's sanction

Peruvian cardinal accused of abuse challenges late pope's sanction

-

Trans women barred from women's football by English, Scottish FAs

-

Oil prices drop, stocks diverge amid economic growth fears

Oil prices drop, stocks diverge amid economic growth fears

-

Israel brings fire near Jerusalem 'under control', reopens roads

-

Lopetegui appointed coach of Qatar

Lopetegui appointed coach of Qatar

-

UK counter-terrorism unit probes rappers Kneecap but music stars back band

-

Yamal heroics preserve Barca Champions League final dream

Yamal heroics preserve Barca Champions League final dream

-

2026 T20 World Cup 'biggest women's cricket event in England' - ECB

-

Bangladesh begins three days of mass political rallies

Bangladesh begins three days of mass political rallies

-

Children learn emergency drills as Kashmir tensions rise

-

Millions of children to suffer from Trump aid cuts

Millions of children to suffer from Trump aid cuts

-

Veteran Wallaby Beale set for long-awaited injury return

-

Syria's Druze take up arms to defend their town against Islamists

Syria's Druze take up arms to defend their town against Islamists

-

Tesla sales plunge further in France, down 59% in April

-

US calls on India and Pakistan to 'de-escalate'

US calls on India and Pakistan to 'de-escalate'

-

Israel reopens key roads as firefighters battle blaze

-

Europe far-right surge masks divisions

Europe far-right surge masks divisions

-

James will mull NBA future after Lakers playoff exit

-

Ukraine's chief rabbi sings plea to Trump to side with Kyiv

Ukraine's chief rabbi sings plea to Trump to side with Kyiv

-

Australian mushroom meal victim 'hunched' in pain, court hears

-

Lakers dumped out of playoffs by Wolves, Rockets rout Warriors

Lakers dumped out of playoffs by Wolves, Rockets rout Warriors

-

Booming tourism and climate change threaten Albania's coast

-

US reaching out to China for tariff talks: Beijing state media

US reaching out to China for tariff talks: Beijing state media

-

Tariffs prompt Bank of Japan to lower growth forecasts

-

Kiss faces little time to set Wallabies on path to home World Cup glory

Kiss faces little time to set Wallabies on path to home World Cup glory

-

Serbian students, unions join forces for anti-corruption protest

-

Slow and easily beaten -- Messi's Miami project risks global embarrassment

Slow and easily beaten -- Messi's Miami project risks global embarrassment

-

Fan in hospital after falling to field at Pirates game

-

Nuclear power sparks Australian election battle

Nuclear power sparks Australian election battle

-

Tokyo stocks rise as BoJ holds rates steady

-

Bank of Japan holds rates, lowers growth forecasts

Bank of Japan holds rates, lowers growth forecasts

-

'Sleeping giants' Bordeaux-Begles awaken before Champions Cup semis

Oil prices drop, stocks diverge amid economic growth fears

Oil prices fell and stocks were mixed on Thursday in thin holiday trading, following weak US economic data that added to growth concerns.

Several markets were shut in Europe and Asia for the May 1 holiday, including in France, Germany, Hong Kong and mainland China.

Among markets that were open, London was flat, while Tokyo climbed over one percent after Japan's central bank kept its key interest rate steady and warned of trade uncertainty.

Oil plunged under $60 per barrel, weighed down by disappointing economic data from the US on Wednesday and on expectations that OPEC+ will increase production more than expected in June.

Lower oil prices impacted energy giants BP and Shell, with their shares falling three percent and two percent respectively on London's FTSE 100 index.

"Oil prices are at lows not seen since the pandemic, as concerns about the trade hit to global growth keep swirling," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

"As economies are expected to slow, demand for energy is set to follow suit," she added.

Tokyo's main Nikkei 225 index closed 1.1 percent higher after the central bank's decision to hold rates caused the yen to fall against the dollar, boosting Japanese exporters.

The Bank of Japan warned that trade tariffs are fuelling global economic uncertainty and revised down its growth forecasts for the world's fourth-largest economy.

US President Donald Trump has imposed hefty levies on trading partners and imports including steel, aluminium and autos to rectify what he says are unfair trade imbalances.

Markets are looking ahead to Friday's US jobs data for April for indications of the Federal Reserve's path for interest rates.

"All that matters for the Fed is the jobs market so we head into a big risk event with tomorrow’s payrolls report," said Neil Wilson, UK investor strategist at Saxo Markets.

Wall Street stocks opened sharply lower on Wednesday after US government data showed the economy shrank by an annual rate of 0.3 percent in the first quarter, amplifying recession worries.

But they moved gradually higher through the day, rising after mid-morning data showed personal spending in March topped estimates.

As more companies pull back from earnings forecasts in the face of the uncertainty regarding US tariffs, tech giants Meta and Microsoft reported quarterly profits that were above expectations on Wednesday.

Shares in Meta -- which owns Facebook, Instagram and WhatsApp -- rose more than four percent in after-market trades.

Investors are now awaiting earnings from US giants Amazon and Apple later in the day for further signals of the impact of tariffs on businesses.

- Key figures at around 1100 GMT -

London - FTSE 100: FLAT at 8,497.13 points

Paris - CAC 40: closed for holiday

Frankfurt - DAX: closed for holiday

Tokyo - Nikkei 225: UP 1.1 percent at 36,241.70 (close)

Hong Kong - Hang Seng Index: closed for holiday

Shanghai - Composite: closed for holiday

New York - Dow: UP 0.4 percent at 40,669.36 (close)

Euro/dollar: DOWN at $1.1333 from $1.1342 on Wednesday

Pound/dollar: UP at $1.3338 from $1.3328

Dollar/yen: UP at 144.29 yen from 143.18 yen

Euro/pound: FLAT at 84.97 pence from 84.97 pence

West Texas Intermediate: DOWN 3.0 percent at $56.45 per barrel

Brent North Sea Crude: DOWN 2.8 percent at $59.38 per barrel

burs-ajb/yad

S.Gregor--AMWN