-

Umerov: 'Wonder' dealmaker from Crimea leading Ukraine peace talks

Umerov: 'Wonder' dealmaker from Crimea leading Ukraine peace talks

-

Australia's Starc opts out of return to IPL: reports

-

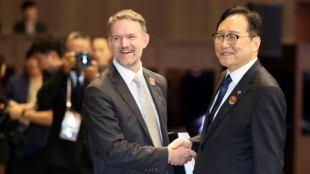

APEC says 'concerned' over challanges to global trade

APEC says 'concerned' over challanges to global trade

-

Coach Chaabani wishes Berkane were not CAF Cup final favourites

-

Eurovision in numbers

Eurovision in numbers

-

Eurovision comes full circle, showing changing times

-

Salman Rushdie attacker faces sentencing

Salman Rushdie attacker faces sentencing

-

Influencer's murder shows dark side of Mexican social media fame

-

Russia and Ukraine to meet in Istanbul, but expectations low

Russia and Ukraine to meet in Istanbul, but expectations low

-

'He's killing us': Cannes dealmakers hate Trump's big Hollywood idea

-

Last Champions League place, relegation to be decided in Ligue 1 finale

Last Champions League place, relegation to be decided in Ligue 1 finale

-

De Bruyne seeks fitting Man City farewell in FA Cup final

-

Crystal Palace go for glory as Man City seek salvation in FA Cup final

Crystal Palace go for glory as Man City seek salvation in FA Cup final

-

Napoli's first match point as Scudetto race reaches climax

-

Dortmund hope to take 'final step' in unlikely top-four rescue act

Dortmund hope to take 'final step' in unlikely top-four rescue act

-

Raisuqe death to 'motivate' Castres in Top 14 season run-in

-

Eurovision favourite KAJ shines spotlight on Finland's Swedish- speaking minority

Eurovision favourite KAJ shines spotlight on Finland's Swedish- speaking minority

-

'Serious problem': Afghan capital losing race against water shortages

-

Jokic, Strawther star as Nuggets down Thunder to tie series

Jokic, Strawther star as Nuggets down Thunder to tie series

-

Buttler to leave extended IPL early for England duty

-

Asian markets stagger into weekend as trade rally runs out of legs

Asian markets stagger into weekend as trade rally runs out of legs

-

US singer Chris Brown charged with assault in Britain

-

YouTube star MrBeast upsets Mexican officials with temple videos

YouTube star MrBeast upsets Mexican officials with temple videos

-

Take-Two earnings boost delayed along with 'GTA VI'

-

Independence hero assassin's calligraphy breaking auction records in Seoul

Independence hero assassin's calligraphy breaking auction records in Seoul

-

Trump caps Gulf tour in Abu Dhabi with dizzying investment pledges

-

Iran, European powers to hold nuclear talks in Turkey

Iran, European powers to hold nuclear talks in Turkey

-

Opposition leader vows 'empty' polling stations for Venezuelan legislative vote

-

Venezuelan Vegas birdies five of last six to grab PGA lead

Venezuelan Vegas birdies five of last six to grab PGA lead

-

Nose cone glitch wipes Australian rocket launch

-

Curry 'excited' by Warriors future despite playoff exit

Curry 'excited' by Warriors future despite playoff exit

-

Formation Metals Advances 2025 Drilling Program with ATI Application for N2 Property

-

US cops investigating Smokey Robinson after sex assault lawsuit

US cops investigating Smokey Robinson after sex assault lawsuit

-

Fresh woes for Brazil football as federation boss dismissed

-

'Unique' Barca family key to title triumph: Flick

'Unique' Barca family key to title triumph: Flick

-

Sinner demolishes Ruud as Gauff battles into Italian Open final

-

Aussie Davis, American Gerard share PGA Championship lead

Aussie Davis, American Gerard share PGA Championship lead

-

Austrian opera, Finnish lust through to Eurovision final

-

Combs's ex Cassie faces intense defense questioning

Combs's ex Cassie faces intense defense questioning

-

How Flick's Barca wrestled La Liga back from Real Madrid

-

Kiwi Fox, local hero Smalley make most of late PGA calls

Kiwi Fox, local hero Smalley make most of late PGA calls

-

Oil prices fall on hopes for Iran nuclear deal

-

European walkout after late Infantino delays FIFA Congress

European walkout after late Infantino delays FIFA Congress

-

Eurovision: the grand final line-up

-

Yamal pearl seals Barcelona La Liga title triumph at Espanyol

Yamal pearl seals Barcelona La Liga title triumph at Espanyol

-

Rubio has no high expectations for Ukraine-Russia talks

-

Milkshakes, opera and lust as Eurovision semi votes counted

Milkshakes, opera and lust as Eurovision semi votes counted

-

Trump admin leaves door open for tougher PFAS drinking water standards

-

No.1 Scheffler, No.3 Schauffele blast PGA over "mud balls"

No.1 Scheffler, No.3 Schauffele blast PGA over "mud balls"

-

Eric Trump says father's energy policies will help crypto

Asian markets stagger into weekend as trade rally runs out of legs

Markets limped into the weekend as investors consolidated gains fed by the China-US trade war hiatus, having enjoyed one of their best weeks since Donald Trump unloaded his "Liberation Day" tariff bazooka last month.

The dollar edged down after data showed US wholesale prices rose less than expected last month and retail sales were flat -- following below-forecast consumer inflation figures -- providing hope the Federal Reserve could cut interest rates this year.

Oil prices inched up, though they remain subdued after sinking Thursday on hopes for a breakthrough in Iran nuclear talks after Trump said progress had been made on a deal.

Investors are now awaiting signals from the US president on the progress of talks with his country's trading partners as governments line up to strike deals to avoid his steep levies.

However, analysts warn that the euphoria over Beijing and Washington's detente -- which saw them slash tit-for-tat tariffs for 90 days to allow for talks -- has likely given way to the fact that levies are still elevated and pose a threat to economic growth.

"Even if more trade deals are announced, it is still the case that tariffs on goods entering the US will be much higher than anyone dared to contemplate," said IG chief market analyst Chris Beauchamp.

"This should result in a not insignificant hit to earnings, though the impact will only start to become clear in future earnings reports.

"The question for all investors is, have markets already priced in enough bad news following their big losses in the first half of April to avoid further falls later in the year?"

The head of US retail titan Walmart highlighted the threat to consumers as he warned of price increases caused by Trump's tariffs on imports from around the world.

CEO Doug McMillon welcomed the dialling down of tensions with China but said the levies remained too high for his firm to absorb.

"We will do our best to keep our prices as low as possible but given the magnitude of the tariffs, even at the reduced levels, we aren't able to absorb all the pressure," he told analysts after reporting a solid quarter of earnings.

Asian markets dropped in morning trade.

Tokyo retreated after the release of figures showing Japan's economy saw its first quarterly contraction for a year from January to March.

Hong Kong also fell, with e-commerce titan Alibaba shedding more than four percent after reporting a disappointing rise in first-quarter revenue as Chinese consumer spending remained sluggish. Other tech firms were also lower, with e-commerce rival JD.com down along with Tencent and Meituan.

Shanghai, Singapore, Wellington and Manila were all lower but Sydney, Seoul and Taipei rose.

- Key figures at around 0200 GMT -

Tokyo - Nikkei 225: DOWN 0.5 percent at 37,572.88

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 2,3303.08

Shanghai - Composite: DOWN 0.3 percent at 3,370.03

Euro/dollar: UP at $1.1203 from $1.1185 on Thursday

Pound/dollar: UP at $1.3314 from $1.3304

Dollar/yen: DOWN at 145.20 yen from 145.65 yen

Euro/pound: UP at 84.14 from 84.07 pence

West Texas Intermediate: UP 0.1 percent at $61.65 per barrel

Brent North Sea Crude: UP 0.1 percent at $64.56 per barrel

New York - Dow: UP 0.7 percent at 42,322.75 (close)

London - FTSE 100: UP 0.6 percent at 8,633.75 (close)

O.Norris--AMWN