-

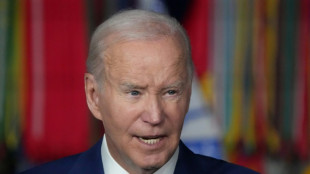

How serious is Biden's prostate cancer diagnosis?

How serious is Biden's prostate cancer diagnosis?

-

Perrier scandal bubbles up as French parliament slams cover-up

-

Gary Lineker: England's World Cup hero turned BBC's 'defining voice'

Gary Lineker: England's World Cup hero turned BBC's 'defining voice'

-

Failure means Man City would not 'deserve' Champions League: Guardiola

-

Joe Biden thanks supporters for 'love' after cancer diagnosis

Joe Biden thanks supporters for 'love' after cancer diagnosis

-

Portugal's far-right party gains as premier holds on

-

Three things we learned from the Emilia Romagna Grand Prix

Three things we learned from the Emilia Romagna Grand Prix

-

Gary Lineker to leave BBC after antisemitism row

-

Serie A title deciders to be played Friday

Serie A title deciders to be played Friday

-

Russian ballet patriarch Yuri Grigorovich dies at 98

-

Gary Lineker to leave BBC after social media 'error'

Gary Lineker to leave BBC after social media 'error'

-

New 'Frankenstein' will be no horror flick, Del Toro says

-

Indian, Romanian climbers die on Nepal's Lhotse

Indian, Romanian climbers die on Nepal's Lhotse

-

EU relief as centrist wins Romania vote but tensions remain

-

African players in Europe: Ndiaye gives Everton perfect send-off

African players in Europe: Ndiaye gives Everton perfect send-off

-

UK forges new ties with EU in post-Brexit era

-

Trump to call Putin in push for Ukraine ceasefire

Trump to call Putin in push for Ukraine ceasefire

-

Guinness maker Diageo cuts costs, eyes US tariff hit

-

Farioli resigns as Ajax coach due to 'different visions'

Farioli resigns as Ajax coach due to 'different visions'

-

Trump turning US into authoritarian regime, says Emmy winner

-

Far right gains in Portuguese polls as PM holds on

Far right gains in Portuguese polls as PM holds on

-

French state covered up Nestle water scandal: Senate report

-

French intelligence rejects Telegram founder's claim of Romania vote meddling

French intelligence rejects Telegram founder's claim of Romania vote meddling

-

Trump tariffs force EU to cut 2025 eurozone growth forecast

-

Israel will 'take control of all' of Gaza, PM says

Israel will 'take control of all' of Gaza, PM says

-

Gael Garcia Bernal retells Philippines history in new film

-

China's Xiaomi to invest nearly $7 bn in chips

China's Xiaomi to invest nearly $7 bn in chips

-

Women claim spotlight in India's macho movie industry

-

Stocks, dollar drop after US loses last triple-A credit rating

Stocks, dollar drop after US loses last triple-A credit rating

-

Bruno Fernandes: Man Utd's visionary leader

-

UK-EU set to seal closer ties in first summit since Brexit

UK-EU set to seal closer ties in first summit since Brexit

-

Europa League golden ticket offers Man Utd, Spurs salvation

-

Tanzania opposition leader defiant as he appears for treason trial

Tanzania opposition leader defiant as he appears for treason trial

-

Israel strikes Gaza after 'basic' food aid pledge

-

Markets drop after US loses last triple-A credit rating

Markets drop after US loses last triple-A credit rating

-

Ryanair annual profit drops 16% as fares fall

-

Five things to know about Scarlett Johansson

Five things to know about Scarlett Johansson

-

Polar bear biopsies to shed light on Arctic pollutants

-

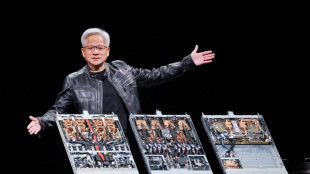

Nvidia unveils plan for Taiwan's first 'AI supercomputer'

Nvidia unveils plan for Taiwan's first 'AI supercomputer'

-

Kiss to coach Australia-New Zealand combined XV against Lions

-

'Leave our marshes alone': Iraqis fear oil drilling would destroy fabled wetlands

'Leave our marshes alone': Iraqis fear oil drilling would destroy fabled wetlands

-

Asian markets drop after US loses last triple-A credit rating

-

China factory output beats forecasts, weathering tariffs

China factory output beats forecasts, weathering tariffs

-

$TRUMP dinner blurs lines between profit and politics

-

Syrians chase equestrian glory in sport once dominated by Assads

Syrians chase equestrian glory in sport once dominated by Assads

-

Trump to hold call with Putin in push for Ukraine ceasefire

-

Trump to hold call with Putin in push for Ukraine ceasfire

Trump to hold call with Putin in push for Ukraine ceasfire

-

Starmer to host first UK-EU summit since Brexit

-

More misery for Messi and Miami with Florida derby defeat

More misery for Messi and Miami with Florida derby defeat

-

Rahm ready to 'get over it' and 'move on' after PGA failure

National Energy Services Reunited Corp. Announces its Intention to Commence an Exchange Offer and Consent Solicitation

HOUSTON, TX / ACCESS Newswire / May 19, 2025 / National Energy Services Reunited Corp. ("NESR" or the "Company") (Nasdaq:NESR)(Nasdaq:NESRW), an international, industry-leading provider of integrated energy services in the Middle East and North Africa ("MENA") region, today announced that it intends to commence (i) an exchange offer (the "Offer") relating to its outstanding warrants to purchase ordinary shares of the Company, no par value (the "Ordinary Shares"), which warrants trade on the Nasdaq Capital Market under the symbol "NESRW" (the "Warrants"), and (ii) a consent solicitation (the "Consent Solicitation") relating to its outstanding Warrants.

The Company intends to offer, to all holders of the Warrants, the opportunity to receive 0.10 Ordinary Shares in exchange for each outstanding Warrant tendered by the holder and exchanged pursuant to the Offer. Concurrently with the Offer, the Company also intends to solicit consents from holders of the Warrants to amend the warrant agreement that governs the Warrants (the "Warrant Amendment") to permit the Company to require that each Warrant that is outstanding upon the closing of the Offer be converted at a ratio of 0.09 Ordinary Shares for each Warrant not tendered in the Offer. If approved, the Warrant Amendment would permit the Company to eliminate all of the Warrants that remain outstanding after the Offer is consummated. Pursuant to a tender and support agreement, holders of a majority of the outstanding Warrants have agreed to tender their Warrants in the Offer and consent to the Warrant Amendment in the Consent Solicitation.

Important Additional Information

This press release is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any of the Warrants. The anticipated exchange offer and consent solicitation described in this press release has not yet commenced, and while the Company intends to commence the exchange offer and consent solicitation as soon as reasonably practicable upon the filing of definitive documentation with the SEC relating to the exchange offer and consent solicitation, and complete the exchange offer and consent solicitation, there can be no assurance that the Company will commence or complete the exchange offer and consent solicitation on the terms described in this press release, or at all. The exchange offer and consent solicitation will be made only through the Schedule TO and registration statement on Form S-4 that will include a prospectus/offer to exchange filed by the Company with the Securities and Exchange Commission (the "SEC"), and the complete terms and conditions of the exchange offer and consent solicitation will be set forth therein. The full details of the exchange offer and consent solicitation, including complete instructions on how to exchange Warrants, will be included in such definitive documentation, which will become available to warrant holders upon commencement of the exchange offer.

Cautionary Statement Regarding Forward Looking Statements

Statements contained in this press release that are not historical fact may be forward-looking within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. Such forward-looking statements may relate to, among other things, the Company's expectations regarding the contemplated exchange offer and consent solicitation. Such forward-looking statements do not constitute guarantees of future performance and are subject to a variety of risks and uncertainties, including that NESR will be able to commence the contemplated exchange offer and consent solicitation. Additional factors that could cause actual results to differ materially from those projected or suggested in any forward-looking statements are contained in our filings with the SEC, including those factors discussed under the caption "Risk Factors" in such filings.

You are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. The Company disclaims any obligation to update any forward-looking statements to reflect any new information or future events or circumstances or otherwise, except as required by law. You should read this communication in conjunction with other documents which the Company may file or furnish from time to time with the SEC.

About NESR

Founded in 2017, NESR is one of the largest national oilfield services providers in the MENA and Asia Pacific regions. With over 6,000 employees, representing more than 60 nationalities in 16 countries, the Company helps its customers unlock the full potential of their reservoirs by providing Production Services such as Hydraulic Fracturing, Cementing, Coiled Tubing, Filtration, Completions, Stimulation, Pumping and Nitrogen Services. The Company also helps its customers to access their reservoirs in a smarter and faster manner by providing Drilling and Evaluation Services such as Drilling Downhole Tools, Directional Drilling, Fishing Tools, Testing Services, Wireline, Slickline, Drilling Fluids and Rig Services.

For inquiries regarding NESR, or for investor queries, please contact:

Blake Gendron

National Energy Services Reunited Corp.

832-925-3777

[email protected]

SOURCE: National Energy Services Reunited Corp.

View the original press release on ACCESS Newswire

Th.Berger--AMWN