-

Tanzania opposition leader defiant as he appears for treason trial

Tanzania opposition leader defiant as he appears for treason trial

-

Israel strikes Gaza after 'basic' food aid pledge

-

Markets drop after US loses last triple-A credit rating

Markets drop after US loses last triple-A credit rating

-

Ryanair annual profit drops 16% as fares fall

-

Five things to know about Scarlett Johansson

Five things to know about Scarlett Johansson

-

Polar bear biopsies to shed light on Arctic pollutants

-

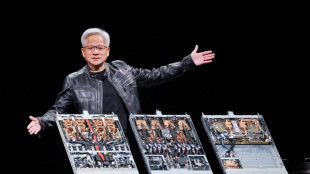

Nvidia unveils plan for Taiwan's first 'AI supercomputer'

Nvidia unveils plan for Taiwan's first 'AI supercomputer'

-

Kiss to coach Australia-New Zealand combined XV against Lions

-

'Leave our marshes alone': Iraqis fear oil drilling would destroy fabled wetlands

'Leave our marshes alone': Iraqis fear oil drilling would destroy fabled wetlands

-

Asian markets drop after US loses last triple-A credit rating

-

China factory output beats forecasts, weathering tariffs

China factory output beats forecasts, weathering tariffs

-

$TRUMP dinner blurs lines between profit and politics

-

Syrians chase equestrian glory in sport once dominated by Assads

Syrians chase equestrian glory in sport once dominated by Assads

-

Trump to hold call with Putin in push for Ukraine ceasefire

-

Trump to hold call with Putin in push for Ukraine ceasfire

Trump to hold call with Putin in push for Ukraine ceasfire

-

Starmer to host first UK-EU summit since Brexit

-

More misery for Messi and Miami with Florida derby defeat

More misery for Messi and Miami with Florida derby defeat

-

Rahm ready to 'get over it' and 'move on' after PGA failure

-

Kingdom Arena Riyadh

Kingdom Arena Riyadh

-

No.1 Scheffler outduels Rahm at PGA to capture third major title

-

Top-ranked Scheffler wins PGA Championship for third major title

Top-ranked Scheffler wins PGA Championship for third major title

-

Thunder storm past Nuggets to set up Wolves clash

-

Israel to allow food into Gaza after two month blockade

Israel to allow food into Gaza after two month blockade

-

Paris airport chaos to enter second day after air traffic breakdown

-

Pro-EU mayor, nationalist historian set for Polish presidential runoff

Pro-EU mayor, nationalist historian set for Polish presidential runoff

-

Rome champion Alcaraz expects French Open threat from 'insane' Sinner

-

France to unveil €37 bn in foreign investment at Versailles summit: presidency

France to unveil €37 bn in foreign investment at Versailles summit: presidency

-

Napoli close in on Serie A title despite Parma stalemate

-

Israel to allow food into round operations' after two month blockade

Israel to allow food into round operations' after two month blockade

-

Joe Biden diagnosed with aggressive prostate cancer

-

No.1 Scheffler and Rahm deadlocked in back-nine PGA fight

No.1 Scheffler and Rahm deadlocked in back-nine PGA fight

-

Joe Biden: Democratic fighter, now battling cancer

-

WNBA probing 'hateful' comments in Clark-Reese game

WNBA probing 'hateful' comments in Clark-Reese game

-

Pro-EU centrist wins tense Romania presidential vote rerun

-

Wes Anderson and his A-list cast dazzle at Cannes

Wes Anderson and his A-list cast dazzle at Cannes

-

Sinner says Rome final loss 'good lesson' for French Open

-

Global chip giants converge on Taiwan for Computex

Global chip giants converge on Taiwan for Computex

-

Pro-EU mayor narrowly ahead in Polish election: exit poll

-

Israel announces 'extensive ground operations' in ramped-up Gaza campaign

Israel announces 'extensive ground operations' in ramped-up Gaza campaign

-

Brazilian Ribeiro strikes twice as Sundowns finish with victory

-

Villarreal beat Barca to secure Champions League place

Villarreal beat Barca to secure Champions League place

-

Nuno dedicates Forest win to Awoniyi after horror injury

-

Arteta vows to end Arsenal trophy drought

Arteta vows to end Arsenal trophy drought

-

IPL action resumes with Gujarat, Punjab and Bengaluru into playoffs

-

Chelsea coach glad of Williams and Ohanian's support after Women's FA Cup triumph

Chelsea coach glad of Williams and Ohanian's support after Women's FA Cup triumph

-

FBI identifies California bomb suspect as 'nihilistic' 25-year-old

-

No.1 Scheffler leads by three as PGA final-round drama begins

No.1 Scheffler leads by three as PGA final-round drama begins

-

Iran says to keep enriching uranium, even with a deal

-

Phillies reliever Alvarado suspended for positive test

Phillies reliever Alvarado suspended for positive test

-

Sudharsan and Gill power Gujarat into IPL playoffs

Asian markets drop after US loses last triple-A credit rating

Asian stocks fell with the dollar Monday after Moody's removed the United States' last gold standard sovereign bond rating, citing the growing debt pile that it warned could balloon further.

The move dealt a blow to markets, which had enjoyed a healthy run-up last week after Washington and China hammered out a deal to temporarily slash tit-for-tat tariffs, dialling down the tensions in a painful trade war between the superpowers.

After the rout sparked by US President Donald Trump's Liberation Day tariffs bazooka, investors have in recent weeks raced back to buy up beaten-down stocks as the White House tempered its hardball tariff approach and then announced the agreement with China.

But selling pressure returned Monday after Moody's cut its rating on US debt to Aa1 from Aaa, noting "the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns".

It added that it expected federal deficits to widen to almost nine percent of economic output by 2035, up from 6.4 percent last year, "driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation".

Analysts said the cut in the gold standard rating -- which follows S&P in 2011 and Fitch in 2023 -- could indicate investors will want higher yields on Treasuries, pushing up the cost of government debt.

Still, Treasury Secretary Scott Bessent dismissed the announcement, saying it was "a lagging indicator" and blaming Trump's predecessor Joe Biden.

"We didn't get here in the past 100 days," he told CNN. "It's the Biden administration and the spending that we have seen over the past four years that we inherited, 6.7 percent deficit-to-GDP, the highest when we weren't in a recession, not in a war."

And White House communications director Steven Cheung hit out at Moody's Analytics on X, singling out its chief economist Mark Zandi.

"Nobody takes his 'analysis' seriously. He has been proven wrong time and time again," Cheung posted.

The news added to a frustrating time for the US president after Congress failed to pass his "big, beautiful bill" to extend tax cuts passed in his first term and impose new restrictions on welfare programmes.

Independent congressional analysts say the package would add more than $4.8 trillion to the federal deficit over the coming decade.

The bill came up short in a key vote owing to opposition from several Republican fiscal hawks.

Republican congressman French Hill, who chairs the House Financial Services Committee, said the downgrade "is a strong reminder that our nation's fiscal house is not in order".

House Speaker Mike Johnson told "Fox News Sunday" that he plans for a floor vote on the package by the end of the week.

Equities in Hong Kong and Shanghai fell as below-forecast Chinese retail sales figures reinforced the view that the world's number two economy continues to struggle even after officials unveiled fresh stimulus measures. However, factory output picked up more than expected.

Tokyo, Sydney, Seoul, Singapore, Wellington, Taipei and Jakarta all fell, while US futures were also well down.

The dollar was also down against its peers.

Gold recovered some recent losses owing to its safe haven appeal, rising to $3,225 per ounce.

Still, National Australia Bank's Ray Attrill said: "Moody's actions will have zero impact on any investor's ability or willingness to continue holding US Treasuries -- that would likely require downgrades of four or five more notches."

And SPI Asset Management's Stephen Innes said investors would be more interested in upcoming data that would provide a better idea about the state of the world's top economy.

"Moody's may have dropped the mic, but for equity traders, the real test this week will be Main Street," he wrote in a note.

"We're heading into a make-or-break retail earnings slate -- Target, Home Depot, Lowe's, TJX, Ralph Lauren all report -- and this is where tariff theory collides with checkout-line reality.

"Yes, the S&P has clawed back 18 percent since the 'Liberation Day' tariff blitz, but the consumer has been the market's unsung hero. Now they're about to be audited."

He said the "downgrade is more psychological than mechanical".

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 37,617.63(break)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 23,211.29

Shanghai - Composite: DOWN 0.2 percent at 3,361.55

Euro/dollar: UP at $1.1180 from $1.1154 on Friday

Pound/dollar: UP at $1.3300 from $1.3278

Dollar/yen: DOWN at 145.09 yen from 145.92 yen

Euro/pound: UP at 84.05 from 83.97 pence

West Texas Intermediate: DOWN 0.1 percent at $62.41 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $65.27 per barrel

New York - Dow: UP 0.8 percent at 42,654.74 (close)

London - FTSE 100: UP 0.6 percent at 8,684.56 (close)

Th.Berger--AMWN