-

One dead, 50,000 stranded in eastern Australia floods

One dead, 50,000 stranded in eastern Australia floods

-

Vonn and Shiffrin glad to race Olympics on familiar terrain

-

Trump says mulling privatizing Fannie Mae and Freddie Mac

Trump says mulling privatizing Fannie Mae and Freddie Mac

-

With or without Postecoglou, Spurs can 'break the cycle'

-

Shai Gilgeous-Alexander wins NBA Most Valuable Player award

Shai Gilgeous-Alexander wins NBA Most Valuable Player award

-

Consumer groups want airlines to pay for baggage fees 'distress'

-

Amorim says will quit with no payoff if Man Utd want new boss

Amorim says will quit with no payoff if Man Utd want new boss

-

Deference and disputes: how leaders get on with Trump

-

Postecoglou hungry to build on Spurs' Europa League triumph despite exit talk

Postecoglou hungry to build on Spurs' Europa League triumph despite exit talk

-

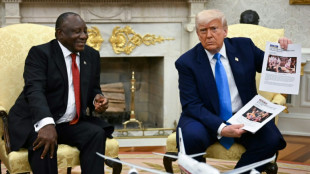

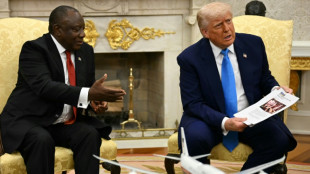

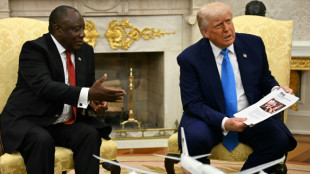

The Ambush Office: Trump's Oval becomes test of nerve for world leaders

-

'Dream comes true' for Spurs captain Son

'Dream comes true' for Spurs captain Son

-

Amorim says will go with no payoff if Man Utd no longer want him

-

Postecoglou wants to build on Spurs' Europa League triumph despite exit talk

Postecoglou wants to build on Spurs' Europa League triumph despite exit talk

-

Man Utd must make changes after 'unacceptable' season, says Shaw

-

Man Utd face harsh truths after losing must-win Europa League final

Man Utd face harsh truths after losing must-win Europa League final

-

Apple design legend Jony Ive joins OpenAI

-

Outrage at Israeli shots as diplomats tour West Bank

Outrage at Israeli shots as diplomats tour West Bank

-

G7 finance chiefs hold talks under strain of Trump tariffs

-

Spurs edge Man Utd to win Europa League and end trophy drought

Spurs edge Man Utd to win Europa League and end trophy drought

-

Irish rapper charged over Hezbollah flag at London concert: police

-

Metz held by Reims in Ligue 1 play-off first leg

Metz held by Reims in Ligue 1 play-off first leg

-

Outrage after Israelis fire 'warning shots' as diplomats tour West Bank

-

Mexican cartel turf war forces evacuation of exotic animals

Mexican cartel turf war forces evacuation of exotic animals

-

LGBTQ Thai ghost story wins prize in Cannes

-

Netanyahu says ready for Gaza 'temporary ceasefire'

Netanyahu says ready for Gaza 'temporary ceasefire'

-

'Recovered' Assange promotes Cannes documentary

-

Man City's Foden 'frustrated' by season of struggles

Man City's Foden 'frustrated' by season of struggles

-

Trump ambushes S. African president over 'genocide' accusation

-

Team Penske fire leaders after Indy 500 scandal

Team Penske fire leaders after Indy 500 scandal

-

Suryakumar helps Mumbai crush Delhi to clinch playoff berth

-

Djokovic eases to first win of clay-court season in Geneva

Djokovic eases to first win of clay-court season in Geneva

-

Flick extends Barcelona deal to 2027 after title triumph

-

Springsteen releases surprise EP, including scathing Trump criticism

Springsteen releases surprise EP, including scathing Trump criticism

-

US accepts Boeing jet from Qatar for use as Air Force One

-

Trump ambushes South African president with 'genocide' accusation

Trump ambushes South African president with 'genocide' accusation

-

G7 finance chiefs begin talks under strain of Trump tariffs

-

Bitcoin hits record high amid optimism over US legislation

Bitcoin hits record high amid optimism over US legislation

-

'Tush push' survives as NFL ban fails to pass - reports

-

NFL LA Games decision is flag football's 'Dream Team' moment: president

NFL LA Games decision is flag football's 'Dream Team' moment: president

-

Dollar, US bonds under pressure as Trump pushes tax bill

-

London to host Laver Cup in 2026

London to host Laver Cup in 2026

-

LGBTQ Thai ghost story turns political in Cannes

-

Carapaz wins stage 11 of Giro with Del Toro in lead

Carapaz wins stage 11 of Giro with Del Toro in lead

-

S.Africa's Ramaphosa woos Trump, Musk after tensions

-

Teeth hurt? It could be because of a 500-million-year-old fish

Teeth hurt? It could be because of a 500-million-year-old fish

-

Third time lucky? South Africa presents revised budget

-

Dollar, US bonds under pressure amid global tensions and Trump tax bill

Dollar, US bonds under pressure amid global tensions and Trump tax bill

-

French prosecutors urge 10-year terms for key accused in Kardashian theft

-

Israeli 'warning' fire at diplomats sparks outcry amid Gaza pressure

Israeli 'warning' fire at diplomats sparks outcry amid Gaza pressure

-

Lyon hotshot Cherki called up by France for Nations League

Dollar, US bonds under pressure as Trump pushes tax bill

A bond sell-off and declining dollar signalled investor unease Wednesday as Washington lawmakers contemplated a tax-cut bill that could push up the US deficit.

Wall Street was trading lower, while European share markets were mixed at their close. The US dip extended losses from Tuesday, which had ended a six-day rally.

Much US attention on Wednesday was focused on a push by Republicans to pass US President Donald Trump's "big, beautiful bill" to cut taxes. They are aiming for a vote in the House of Representatives later this week.

The US bill has "helped to push tariff and trade war concerns off the front pages", David Morrison, senior market analyst at Trade Nation, said.

While New York stock market losses were restrained -- and the tech-heavy Nasdaq was trading higher -- analysts worried that the US bond market, already weakened by a credit-rating downgrade by Moody's, could deepen a months-long slump.

"A bond market crisis is exactly the sort of event that could send stocks tumbling and volatility surging," said Kathleen Brooks, research director at XTB.

"It's also harder to recover from compared to the man-made tariff crisis," she added.

US and Japanese finance ministers were likely to touch on their currency policies at a G7 meeting going on in Canada, he said.

Bitcoin on Wednesday hit a new record high, of $109,499.90, as investors eyed new US legislation on cryptocurrency with optimism.

In Europe, London's FTSE closed slightly up, despite inflation data coming in higher than expected, which analysts said could slow the pace of interest rate cuts by the Bank of England.

Germany's DAX also ended in positive territory. But the CAC in Paris ended lower.

An initial surge in crude prices spurred by a CNN report that Israel was planning a strike on Iranian nuclear sites reversed direction after a surprise announcement by the US Energy Information Administration that the country's oil stocks had risen last week.

There was also speculation the report had been a leak designed to put pressure on Iran in its negotiations with Washington on rolling back its nuclear programme.

Worries over the impact of Trump's tariffs -- and what will happen when a suspension of the more extreme ones expires -- were still reflected in the markets.

But Mexico said on Wednesday it had obtained a cut in the duties levelled at its auto imports into the United States.

Economy Minister Marcelo Ebrard said Washington had agreed to levy 15 percent instead of 25 percent.

- Key figures at around 1530 GMT -

New York - S&P 500: DOWN 0.2 percent at 5,927.06 points

New York - Dow: DOWN 0.8 percent at 42,338.80

New York - Nasdaq Composite: UP 0.3 percent at 19,195.58

London - FTSE 100: UP 0.1 percent at 8,786.46 (close)

Paris - CAC 40: DOWN 0.4 percent at 7,910.49 (close)

Frankfurt - DAX: UP 0.4 percent at 24,122.40 (close)

Tokyo - Nikkei 225: DOWN 0.6 percent at 37,298.98 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 23,827.78 (close)

Shanghai - Composite: UP 0.2 percent at 3,387.57 (close)

New York - Dow: DOWN 0.3 percent at 42,677.24 (close)

Bitcoin: UP, new record at $109,499.80

Euro/dollar: UP at $1.1336 from $1.1284 on Tuesday

Pound/dollar: UP at $1.3440 from $1.3391

Dollar/yen: DOWN at 143.67 yen from 144.47 yen

Euro/pound: UP at 84.36 pence from 84.26 pence

Brent North Sea Crude: DOWN 0.6 percent at $64.98 per barrel

West Texas Intermediate: DOWN 0.6 percent at $61.66 per barrel

Y.Kobayashi--AMWN