-

Thunder rally to beat Pacers, level NBA Finals at 2-12

Thunder rally to beat Pacers, level NBA Finals at 2-12

-

The city doth protest too much? Hamlet gets LA curfew exemption

-

Five things to look out for as Club World Cup kicks off

Five things to look out for as Club World Cup kicks off

-

After conquering Europe, PSG now have sights set on Club World Cup glory

-

Sao Paulo's pumas under attack as 'stone jungle' threatens rainforest

Sao Paulo's pumas under attack as 'stone jungle' threatens rainforest

-

Scott's 'old-man par golf' has him in the hunt at US Open

-

Guerrilla dissident group claims wave of Colombian attacks

Guerrilla dissident group claims wave of Colombian attacks

-

Burns fires 65 to grab US Open lead as big names stumble

-

Boutier, Ciganda among four-way tie for lead at Meijer LPGA Classic

Boutier, Ciganda among four-way tie for lead at Meijer LPGA Classic

-

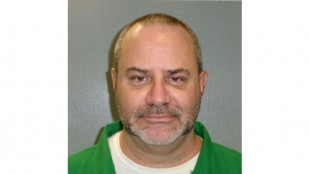

Convicted murderer put to death in fourth US execution this week

-

Russell fastest for Mercedes ahead of Norris in second practice

Russell fastest for Mercedes ahead of Norris in second practice

-

Vasseur launches scathing attack on Italian media reports

-

Bayonne crush Clermont to set up Toulouse showdown in Top 14 semis

Bayonne crush Clermont to set up Toulouse showdown in Top 14 semis

-

Marines deploy in LA ahead of mass anti-Trump protests

-

Former NFL star Brown wanted for attempted murder: police

Former NFL star Brown wanted for attempted murder: police

-

Sir David Beckham: Global icon achieves ultimate goal

-

Arise Sir David! Football legend Beckham knighted

Arise Sir David! Football legend Beckham knighted

-

Kanye West shows up to support Combs at sex trafficking trial

-

Google turns internet queries into conversations

Google turns internet queries into conversations

-

US adversaries fuel disinformation about LA protests

-

Son of late shah urges Iranians to break with Islamic republic

Son of late shah urges Iranians to break with Islamic republic

-

Lawrence grabs US Open lead with birdie binge as Burns fires 65

-

Prince says Bavuma set for 'defining moment' as South Africa eye WTC final triumph

Prince says Bavuma set for 'defining moment' as South Africa eye WTC final triumph

-

Nagayama and Scutto win gold at world judo champs

-

Miami missing Alba for Club World Cup opener

Miami missing Alba for Club World Cup opener

-

No.1 Scheffler, four-over, says don't count him out at US Open

-

Wrongly deported Salvadoran migrant pleads not guilty to smuggling charges

Wrongly deported Salvadoran migrant pleads not guilty to smuggling charges

-

Verstappen on top in opening Canadian GP practice after Leclerc crashes

-

Supporters of deported Venezuelans denied visit to Salvadoran jail

Supporters of deported Venezuelans denied visit to Salvadoran jail

-

Macron urges renewed nuclear dialogue after Israel's Iran strikes

-

Brilliant Markram takes South Africa to brink of WTC final glory

Brilliant Markram takes South Africa to brink of WTC final glory

-

Burns fires stunning 65 to grab share of US Open lead

-

Second officer arrested over Kenya custody death

Second officer arrested over Kenya custody death

-

Joy and grief for lone India crash survivor's family

-

Deadly school shooting fuels debate on Austria's gun laws

Deadly school shooting fuels debate on Austria's gun laws

-

Marines ordered by Trump to LA start deploying

-

Markram takes South Africa to brink of WTC final glory against Australia

Markram takes South Africa to brink of WTC final glory against Australia

-

Nations advance ocean protection, vow to defend seabed

-

Israel attack on Iran tests Trump promise not to be dragged into war

Israel attack on Iran tests Trump promise not to be dragged into war

-

Cunha determined to change fortunes of 'dream team' Man Utd

-

Zverev to play Shelton in Stuttgart semis

Zverev to play Shelton in Stuttgart semis

-

Bath 'don't feel burden' of history in Premiership final

-

At least 2,680 killed in Haiti unrest so far this year: UN

At least 2,680 killed in Haiti unrest so far this year: UN

-

Israeli attack exposed Iran's military vulnerabilities: analysts

-

Middle East crisis opens 'major schism' in Trump coalition

Middle East crisis opens 'major schism' in Trump coalition

-

Trump tells Iran to make deal or face 'more brutal' attacks

-

Spain economy minister urges fair, balanced EU-US tariff deal

Spain economy minister urges fair, balanced EU-US tariff deal

-

No political jokes in Springfield, says Simpsons creator Groening

-

Pizza delivery monitor alerts to secret Israel attack

Pizza delivery monitor alerts to secret Israel attack

-

Two UK men jailed for 'brazen' gold toilet heist

Clough Closed-end Funds Announce Renewal of Share Repurchase Programs

DENVER, CO / ACCESS Newswire / June 13, 2025 / The Boards of Trustees (the "Boards") of the following closed-end funds (the "Funds") advised by Clough Capital Partners L.P. (the "Adviser" or "Clough Capital") announced that each Fund has renewed its share repurchase program under which it may purchase up to 5% of its outstanding common shares in open market transactions through June 30, 2026:

Clough Global Equity Fund (NYSE MKT:GLQ)

Clough Global Opportunities Fund (NYSE MKT:GLO)

Clough Global Dividend & Income Fund (NYSE MKT:GLV)

The share repurchase programs were originally approved in June 2023 and have been renewed annually thereafter. These programs are designed to enhance shareholder value by permitting the Funds to purchase their shares when trading at a discount to their net asset value per share. Since the June 2023 commencement of the share repurchase programs through May 30, 2025, GLV, GLQ and GLO have repurchased 299,900, 386,500 and 779,500 shares, respectively

The amount and timing of repurchases will be at the discretion of the Adviser, subject to market conditions and investment considerations. There is no assurance that the Funds will purchase shares at any particular discount levels or in any particular amounts. Any repurchases made under these programs will be made on a national securities exchange at the prevailing market price, subject to exchange requirements and volume, timing and other limitations under federal securities laws. The Funds' repurchase activity will be disclosed in the annual and semi-annual reports to shareholders. The Boards will monitor the share repurchase programs on an ongoing basis, considering a range of strategic options to enhance shareholder value in the long-term.

Certain statements made on behalf of the Funds may be considered forward-looking statements. The Funds' actual results may differ significantly from those anticipated in any forward-looking statements due to numerous factors, including but not limited to a decline in value in the general markets or the Funds' investments specifically. Neither the Funds nor the Adviser undertake any responsibility to update publicly or revise any forward-looking statement.

Clough Capital Partners L.P.

Clough Capital, investment adviser to the Funds, is a global multi-strategy alternative asset management firm founded in 1999 that manages over $1.3 billion in assets as of March 31, 2025. Clough Capital employs fundamental research to invest in public and private markets, across various asset classes and manage an array of strategies for its clients. More information is available at www.cloughcapital.com.

An investor should consider the investment objectives, risks, charges and expenses carefully before investing in a Fund. To obtain a Fund's prospectus, annual report or semi-annual report, which contains this and other information visit www.cloughcefs.com or call (855) 425-6844. Read them carefully before investing.

This press release is not a solicitation to buy or sell fund shares. Each Fund is a closed-end fund, which does not continuously issue shares for sale as open-end mutual funds do. Since the initial public offerings, each Fund now trades in the secondary market. Investors wishing to buy or sell shares need to place orders through an intermediary or broker. The share price of a closed-end fund is based on the market's value and often trade at a discount to their net asset value, which can increase an investor's risk of loss. All investments are subject to risk, including the risk of loss.

Inquiries: (855) 425-6844 or [email protected].

SOURCE: Clough Global Closed-End Funds

View the original press release on ACCESS Newswire

L.Durand--AMWN